filmov

tv

Financial Time Series Analysis using Wavelets

Показать описание

1. QX Data Science Event | 10.05.2019 | QX Manor in Frankfurt am Main

Description:

Presentation by Markus Vogl at the 1. QX Data Science Event about Financial Time Series Analysis using Wavelets.

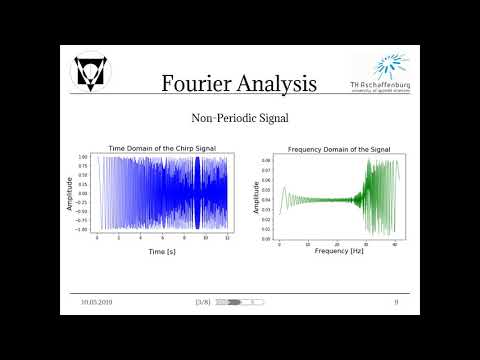

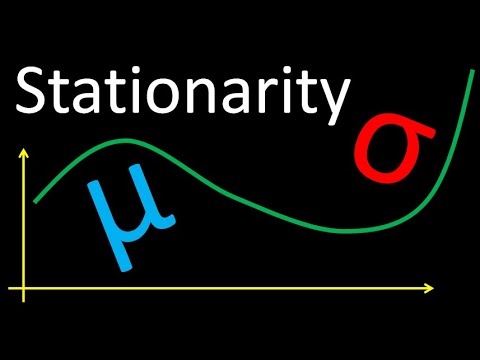

Contains Explanations of Financial Time Series Properties (e.g. Markov, Martingale, Stationarity & Gaussianity versus Fractality & Momentum), Signal Theory (e.g. Fourier Analysis, Short Time Fourier Analysis & Continuous as well as Discrete Wavelet Transformations).

Concludes with outlook into research on Wavelet Neural Networks, Fractals & Chaos Theory.

Partners, Event-Team & Presentor:

#lecture #university #timeseriesanalysis #timeseries #statistics #python #pythonprogramming #pythontutorial #data #datascientist #finance #stockmarket #quantitativefinance #marketanalysis #wavelet #signal #signalanalysis #fourier_series #fouriertransform #wavelengths #waveletneuralnetwork #WNN #wnn

Description:

Presentation by Markus Vogl at the 1. QX Data Science Event about Financial Time Series Analysis using Wavelets.

Contains Explanations of Financial Time Series Properties (e.g. Markov, Martingale, Stationarity & Gaussianity versus Fractality & Momentum), Signal Theory (e.g. Fourier Analysis, Short Time Fourier Analysis & Continuous as well as Discrete Wavelet Transformations).

Concludes with outlook into research on Wavelet Neural Networks, Fractals & Chaos Theory.

Partners, Event-Team & Presentor:

#lecture #university #timeseriesanalysis #timeseries #statistics #python #pythonprogramming #pythontutorial #data #datascientist #finance #stockmarket #quantitativefinance #marketanalysis #wavelet #signal #signalanalysis #fourier_series #fouriertransform #wavelengths #waveletneuralnetwork #WNN #wnn

What is Time Series Analysis?

Course Syllabus | Financial Time Series Analysis | Quantra Course

Introducing Time Series Analysis and forecasting

Financial Time Series Analysis using Wavelets

How to Trade Using Time Series | Financial Time Series Analysis for Trading | Quantra Course

Financial Analysis with Time Series Visualization

Financial Time Series Analysis using Wavelets & Neural Networks

Time Series Forecasting with XGBoost - Use python and machine learning to predict energy consumption

Market on Close - June 27, 2025

Forecasting with the FB Prophet Model

8. Time Series Analysis I

What are ARCH & GARCH Models

Time Series Vs Non Time Series Problems- Why Time Series Forecasting Is Difficult?

Time Series Talk : Moving Average Model

Time Series Talk : Stationarity

How to Encode Financial Market Data for Machine Learning Time Series

Forecasting Financial Time Series using Attention based Models

Detrending and deseasonalizing data with fourier series

Dr Egor Kraev - Easy Bayesian regularization for fitting financial time series and curves

Forecasting in Excel: MUST-KNOW for Any Analyst

11 Stylized Facts of Financial Time Series

Financial Data Forecaster Time Series Forecasting on Stock Prices and Index

What is Time Series Data | Python for Trading | Quantra Free Course

Time Series Analysis SIMPLE Exam Technique | ACCA PM / F5 | Question Sauce

Комментарии

0:07:29

0:07:29

0:04:01

0:04:01

0:03:00

0:03:00

0:31:38

0:31:38

0:05:03

0:05:03

0:01:21

0:01:21

0:14:19

0:14:19

0:23:09

0:23:09

0:50:38

0:50:38

0:20:42

0:20:42

1:16:19

1:16:19

0:05:10

0:05:10

0:11:09

0:11:09

0:07:10

0:07:10

0:10:02

0:10:02

0:15:02

0:15:02

0:09:17

0:09:17

0:12:16

0:12:16

0:35:29

0:35:29

0:09:35

0:09:35

0:10:20

0:10:20

0:31:36

0:31:36

0:03:34

0:03:34

0:18:50

0:18:50