filmov

tv

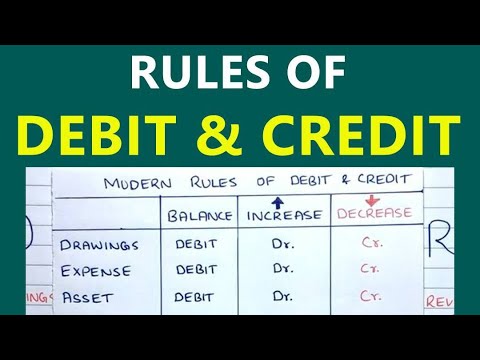

Lesson 4:: Rules of Debit and Credit

Показать описание

Rules of Debit and Credit

Caption: The rules of debit and credit are fundamental principles of double-entry accounting. Assets are debited to increase them and credited to decrease them, while liabilities are debited to decrease them and credited to increase them. Equity is debited to decrease it and credited to increase it. Revenues are debited to decrease them and credited to increase them, while expenses are debited to increase them and credited to decrease them. These rules help maintain the balance in the accounting equation and ensure accurate financial statements.

Keywords: Rules of debit and credit, Double-entry accounting, Assets, Liabilities, Equity, Revenues, Expenses, Debit, Credit, Financial transactions, Accounting equation, Balance sheet, Financial statements

Consignment Accounting: Part 1

Consignment Accounting: Part 2

Consignment Accounting: Part 3

JOINT VENTURE: PART 1

Types of Accounts and Accounting Process

Accounting Equation Part 1

Accounting Principles

Rules of Debit and Credit

Accounting Equation-Part 2

JOURNAL

Ledger and Trial balance

Final Account Adjustments

Trading A/c, P & L A/c and Balance Sheet

Depreciation Accounting

Difference Between Trial Balance and Balance Sheet: Trial Balance vs Balance Sheet

JOINT VENTURE: PART 2

HOW TO SOLVE FINAL ACCOUNT QUESTIONS FAST

HIRE PURCHASE: PART 1

HIRE PURCHASE: PART 2

BRANCH ACCOUNTING: PART 1

BRANCH ACCOUNTING: PART 2

BRANCH ACCOUNTING: PART 3

INVENTORY VALUATION

Funds Flow Statement Part 1

Funds Flow Statement Part 2 Adjustments

Garner Vs Murray Rule: Insolvency of Partner(s)

Insolvency of All the Partners

FINANCIAL ACCOUNTING SYLLABUS OVERVIEW B.COM | B.COM (Hns)

Periodic Vs Perpetual System of Inventory

Bills of Exchange Part 1

Bills of Exchange Part 2

Accounting Notes and MCQs

Financial Accounting Syllabus B.Com Hns

Income Tax live class Series 1

B.Com 1st Semester Syllabus II B.Com First Year Syllabus DU II B.Com Syllabus

Caption: The rules of debit and credit are fundamental principles of double-entry accounting. Assets are debited to increase them and credited to decrease them, while liabilities are debited to decrease them and credited to increase them. Equity is debited to decrease it and credited to increase it. Revenues are debited to decrease them and credited to increase them, while expenses are debited to increase them and credited to decrease them. These rules help maintain the balance in the accounting equation and ensure accurate financial statements.

Keywords: Rules of debit and credit, Double-entry accounting, Assets, Liabilities, Equity, Revenues, Expenses, Debit, Credit, Financial transactions, Accounting equation, Balance sheet, Financial statements

Consignment Accounting: Part 1

Consignment Accounting: Part 2

Consignment Accounting: Part 3

JOINT VENTURE: PART 1

Types of Accounts and Accounting Process

Accounting Equation Part 1

Accounting Principles

Rules of Debit and Credit

Accounting Equation-Part 2

JOURNAL

Ledger and Trial balance

Final Account Adjustments

Trading A/c, P & L A/c and Balance Sheet

Depreciation Accounting

Difference Between Trial Balance and Balance Sheet: Trial Balance vs Balance Sheet

JOINT VENTURE: PART 2

HOW TO SOLVE FINAL ACCOUNT QUESTIONS FAST

HIRE PURCHASE: PART 1

HIRE PURCHASE: PART 2

BRANCH ACCOUNTING: PART 1

BRANCH ACCOUNTING: PART 2

BRANCH ACCOUNTING: PART 3

INVENTORY VALUATION

Funds Flow Statement Part 1

Funds Flow Statement Part 2 Adjustments

Garner Vs Murray Rule: Insolvency of Partner(s)

Insolvency of All the Partners

FINANCIAL ACCOUNTING SYLLABUS OVERVIEW B.COM | B.COM (Hns)

Periodic Vs Perpetual System of Inventory

Bills of Exchange Part 1

Bills of Exchange Part 2

Accounting Notes and MCQs

Financial Accounting Syllabus B.Com Hns

Income Tax live class Series 1

B.Com 1st Semester Syllabus II B.Com First Year Syllabus DU II B.Com Syllabus

Комментарии

0:22:54

0:22:54

0:04:14

0:04:14

0:08:32

0:08:32

0:05:44

0:05:44

0:00:56

0:00:56

0:09:29

0:09:29

0:30:57

0:30:57

0:04:44

0:04:44

0:07:44

0:07:44

0:09:41

0:09:41

0:25:44

0:25:44

0:05:20

0:05:20

0:28:43

0:28:43

0:00:16

0:00:16

0:26:35

0:26:35

0:09:51

0:09:51

0:13:41

0:13:41

0:12:47

0:12:47

0:33:04

0:33:04

0:42:08

0:42:08

0:22:25

0:22:25

0:27:32

0:27:32

0:39:04

0:39:04

0:04:03

0:04:03