filmov

tv

Explained | What Is Peer-To-Peer (P2P) Lending & How It Works

Показать описание

Peer-to-Peer lending is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary in the deal. In this video, we tell you P2P lending works and help you decode its pros and cons

Follow us:

Follow us:

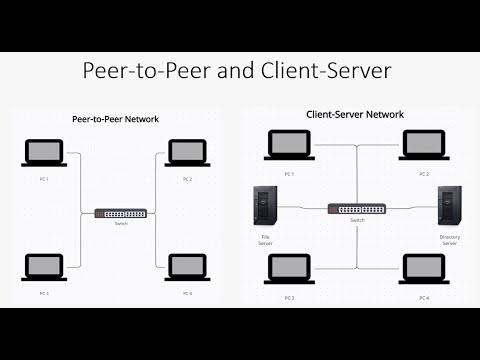

Peer-to-peer and Client-server Network | P2P & client server network

What is a Peer to Peer Network? Blockchain P2P Networks Explained

What Is Peer-To-Peer (P2P)?

How Peer to Peer (P2P) Network works | System Design Interview Basics

Explained | What Is Peer-To-Peer (P2P) Lending & How It Works

Client Server and Peer to Peer Networks

What is a P2P network I NordVPN

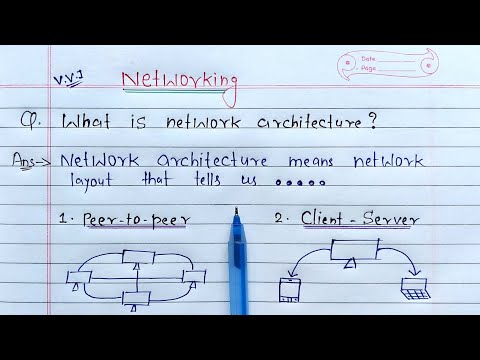

What is Network Architecture? full Explanation | Peer to Peer and Client-Server architecture

🔴 Bitcoin Live Price and Real-Time Liquidations 🟠

What is P2P or Peer to Peer Architecture Explained #shorts

Peer-to-Peer Lending (AKA P2P Loans or Crowdlending) Explained in One Minute

1.3.1 Client Server vs Peer to Peer - Revise GCSE Computer Science

Network Application, Client-Server & Peer-to-Peer P2P Architecture, Socket, Transport layer serv...

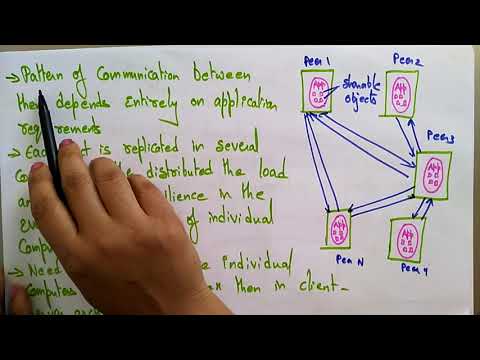

Peer-to-peer (P2P) Networks - Basic Algorithms

Peer-to-Peer Networking - Network+ Tutorial

Client-Server and Peer-to-Peer Models

Architectural model | Peer to Peer | distributed systems | Lec-9 | Bhanu Priya

Peer-to-Peer Lending in Europe via Monestro Explained in One Minute

Peer to Peer Communications

How Does Peer-to-Peer Lending Work? | Harvard VPAL

Peer To Peer Network | P2P | Explained in Hindi | ZebPay Academy

What exactly is peer to peer money transfer?

Peer to Peer in Keela Explained

WARNING: Why Peer To Peer Lending is a BAD INVESTMENT

Комментарии

0:02:16

0:02:16

0:02:20

0:02:20

0:02:48

0:02:48

0:11:13

0:11:13

0:04:07

0:04:07

0:06:57

0:06:57

0:01:23

0:01:23

0:14:09

0:14:09

11:53:27

11:53:27

0:00:50

0:00:50

0:01:42

0:01:42

0:06:53

0:06:53

0:13:27

0:13:27

0:25:06

0:25:06

0:00:56

0:00:56

0:07:46

0:07:46

0:04:38

0:04:38

0:01:59

0:01:59

0:03:29

0:03:29

0:03:45

0:03:45

0:02:19

0:02:19

0:05:39

0:05:39

0:02:41

0:02:41

0:13:01

0:13:01