filmov

tv

Sources of Business Finance Explained | Bank Loans, Trade Credit, Share Capital, Overdrafts & More

Показать описание

Watch this video if you want to understand the different sources of finance available to businesses.

All businesses require finance to survive initially and thrive over the long term.

Yet with such a wide variety of options to choose from, selecting the most suitable source of finance can be a confusing process.

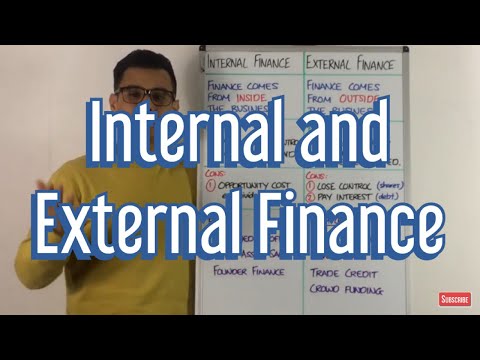

Businesses can acquire finance from either internal or external sources across both short and long term options.

However, choosing the best option for the business is crucial for its future cash flows whilst limiting the additional costs payable over the long term.

This video explains the common sources of finance available to businesses including the advantages and disadvantages of each.

The video covers the following sources of finance: Overdrafts, Bank Loans, Owners Capital, Trade Credit, Retained Profit, Share Capital, Venture Capital, and Crowdfunding.

Follow us on the socials below to see even more Business Studies content:

#BusinessStudies #GCSEBusinessStudies #ALevelBusinessStudies

All businesses require finance to survive initially and thrive over the long term.

Yet with such a wide variety of options to choose from, selecting the most suitable source of finance can be a confusing process.

Businesses can acquire finance from either internal or external sources across both short and long term options.

However, choosing the best option for the business is crucial for its future cash flows whilst limiting the additional costs payable over the long term.

This video explains the common sources of finance available to businesses including the advantages and disadvantages of each.

The video covers the following sources of finance: Overdrafts, Bank Loans, Owners Capital, Trade Credit, Retained Profit, Share Capital, Venture Capital, and Crowdfunding.

Follow us on the socials below to see even more Business Studies content:

#BusinessStudies #GCSEBusinessStudies #ALevelBusinessStudies

Комментарии

0:17:12

0:17:12

0:12:30

0:12:30

0:10:25

0:10:25

0:12:11

0:12:11

0:22:54

0:22:54

0:11:32

0:11:32

0:40:39

0:40:39

0:11:51

0:11:51

0:00:50

0:00:50

0:22:56

0:22:56

0:21:29

0:21:29

0:16:42

0:16:42

0:04:42

0:04:42

0:02:51

0:02:51

2:23:53

2:23:53

0:08:14

0:08:14

1:07:47

1:07:47

0:23:10

0:23:10

0:09:45

0:09:45

0:01:29

0:01:29

0:12:58

0:12:58

0:08:19

0:08:19

0:04:55

0:04:55

0:07:08

0:07:08