filmov

tv

Gene Munster on what's next for Tesla stock

Показать описание

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

Gene Munster on what's next for Tesla stock

Tesla Experts Share Q3 Stock Forecast — HUGE Robotaxi News!

Deepwater's Gene Munster on what iPhone 16 will mean for Apple

Meta has more innovation momentum than Apple, says Deepwater's Gene Munster

Tesla and EV World #6. Gene Munster Predicts Three New Tesla Vehicles

Now Is The PERFECT Time, Gene Munster Says This AI Supercycle Will Skyrocket This STOCK To NEW HIGHS

Gene Munster on Tech's Current Performance

Gene Munster: 'This Stock Will Double In The Next 2 Years'

Adoption of Microsoft’s copilot is nascent and growing quickly: Gene Munster

'The 2nd AI Wave Has Just Begun' Gene Munster Says Now Is The Perfect Time To Get Rich, Ge...

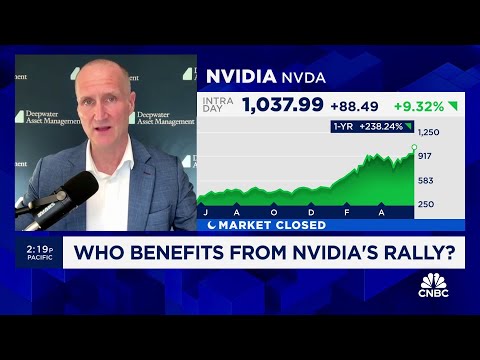

Market views Nvidia's incremental raises as 'less impressive', says Deepwater's ...

Gene Munster details what investors need to seen next from Apple

Gene Munster: The Worst Still To Come For Tesla? | CNBC

Gene Munster on his outlook for Facebook

Deepwater's Gene Munster on why Apple, Meta and Google are the 'Three AI Amigos'

Gene Munster: I believe Apple's best days are yet to come

Apple is probably the safest place to be when it comes to navigating the next 6 months: Gene Munster

Gene Munster on Tesla's 'Surprising' Sales Miss

Deepwater's Gene Munster on why Google will win the AI arms race

Apple's AI features will create groundswell of demand, says Deepwater's Gene Munster

GENE MUNSTER: Why bringing Apple’s production to the US is impossible

Why Gene Munster is 'uncomfortable' with Rivian's valuation

Nvidia's growth story will continue, says Deepwater's Gene Munster

Deepwater's Gene Munster on Apple Event 2023

Комментарии

0:06:10

0:06:10

0:26:44

0:26:44

0:04:15

0:04:15

0:06:23

0:06:23

0:00:46

0:00:46

0:10:07

0:10:07

0:11:53

0:11:53

0:08:19

0:08:19

0:05:15

0:05:15

0:09:00

0:09:00

0:05:44

0:05:44

0:09:09

0:09:09

0:05:32

0:05:32

0:03:35

0:03:35

0:02:39

0:02:39

0:02:06

0:02:06

0:04:02

0:04:02

0:05:55

0:05:55

0:07:29

0:07:29

0:04:59

0:04:59

0:01:27

0:01:27

0:05:44

0:05:44

0:04:55

0:04:55

0:04:10

0:04:10