filmov

tv

Wirecard scandal: How fraudsters built a financial giant | DW News

Показать описание

To the outside world, Wirecard was a successful DAX group. But in reality, it was riddled with fraud. Behind a clean facade, criminals were at work. Former CEO Markus Braun is currently in custody. Ex-Asia board member Jan Marsalek is a fugitive.

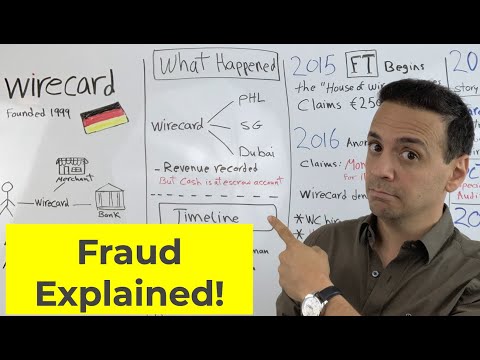

Wirecard was once an electronics payments service provider and even operated a bank in Germany. But it turns out some sales were completely made up. The balance sheet showed a 1-point-9 Bbillion euro hole. Since then, public prosecutors began investigating the company on commercial fraud and document falsification charges.

There had been rumors for years. Media outlets repeatedly reported inconsistencies.. But, each year the EY auditing firm gave Wirecare a seal of approval. The German Financial regulator Bafin didnt investigate the allegations either. Journalists who reported on fraudulent dealings at Wirecard received complaints.

Since October, a parliamentary investigative committee has been scrutinizing the role of the authorities in this scandal. But one thing is certain: Germany's financial supervisors are ready for reforms.

Follow DW on social media:

#Wirecard #Germany #FinTech

Wirecard was once an electronics payments service provider and even operated a bank in Germany. But it turns out some sales were completely made up. The balance sheet showed a 1-point-9 Bbillion euro hole. Since then, public prosecutors began investigating the company on commercial fraud and document falsification charges.

There had been rumors for years. Media outlets repeatedly reported inconsistencies.. But, each year the EY auditing firm gave Wirecare a seal of approval. The German Financial regulator Bafin didnt investigate the allegations either. Journalists who reported on fraudulent dealings at Wirecard received complaints.

Since October, a parliamentary investigative committee has been scrutinizing the role of the authorities in this scandal. But one thing is certain: Germany's financial supervisors are ready for reforms.

Follow DW on social media:

#Wirecard #Germany #FinTech

Комментарии

0:06:10

0:06:10

0:17:05

0:17:05

0:15:31

0:15:31

0:13:24

0:13:24

0:07:00

0:07:00

0:08:20

0:08:20

0:10:24

0:10:24

0:07:53

0:07:53

0:44:27

0:44:27

0:02:51

0:02:51

0:05:53

0:05:53

0:00:35

0:00:35

0:00:38

0:00:38

0:13:09

0:13:09

0:17:23

0:17:23

0:25:32

0:25:32

0:11:41

0:11:41

0:05:54

0:05:54

0:08:46

0:08:46

0:06:02

0:06:02

0:10:39

0:10:39

0:02:59

0:02:59

0:13:22

0:13:22

0:02:43

0:02:43