filmov

tv

40-year record high inflation is main driver behind rising insurance costs: APCIA CEO David Sampson

Показать описание

David Sampson, American Property Casualty Insurance Association president and CEO, joins 'Squawk Box' to discuss the surging auto and home insurance costs, what's driving the rising insurance rates,

UK inflation hits 40-year record, highest in G7

40-year record high inflation is main driver behind rising insurance costs: APCIA CEO David Sampson

US inflation hits nearly 40-year record high

Granite Staters say 40-year record high inflation impacting day-to-day life

U.S. inflation hits new 40-year high, consumer prices surge 7.9%

Inflation At 40 YEAR RECORD HIGH After Rising 7%. Feds To Raise Interest, IGNORE Supply Chain Woes

U.S. inflation hits 40-year high of 8.6% in May

U.S. inflation hits new 40-year record in June

U.S. inflation hits 40-year high

Inflation hits 40-year record high of 9.1 percent

U.S. inflation rate the highest in 40 years

U.S. Inflation Hits Fresh 40-Year High of 7.9%

U.S. Inflation Hits 40-Year High

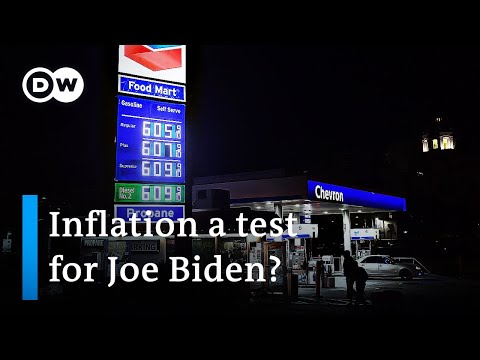

US inflation soars to highest point in 40 years | DW News

Inflation hit 9.1% in June, highest rate in more than 40 years

Prices surge as inflation hits 40-year high l WNT

US inflation hit a new 40-year high last month of 8.6%

U.S. inflation reaches 40-year high

Inflation hits highest point in nearly 40 years l WNT

Inflation Hits A Nearly 40-Year High, Impacting Businesses Across The Nation

US seeing highest inflation rate in 40 years | ABC7 Chicago

Inflation hit a fresh 40-year record in March

US inflation peaks at almost 40-year high

US inflation slowed last month from 40-year high

Комментарии

0:01:14

0:01:14

0:08:16

0:08:16

0:02:42

0:02:42

0:01:31

0:01:31

0:06:34

0:06:34

0:13:43

0:13:43

0:01:32

0:01:32

0:03:12

0:03:12

0:01:14

0:01:14

0:01:13

0:01:13

0:01:56

0:01:56

0:00:19

0:00:19

0:05:03

0:05:03

0:02:52

0:02:52

0:02:44

0:02:44

0:02:35

0:02:35

0:02:04

0:02:04

0:06:19

0:06:19

0:03:51

0:03:51

0:02:59

0:02:59

0:01:51

0:01:51

0:01:49

0:01:49

0:02:30

0:02:30

0:02:35

0:02:35