filmov

tv

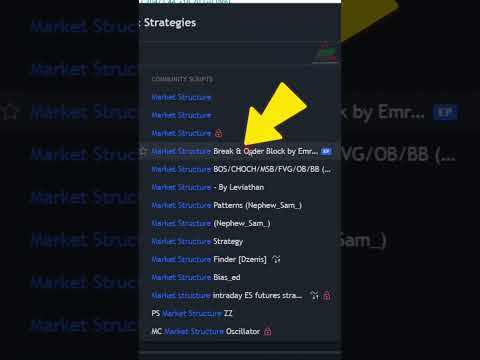

This Indicator Predicts Market Tops With Incredible Accuracy (Consistent Over Many Years)

Показать описание

#optionsstrategy #optionstrading #daytrading

This Indicator Predicts The Future

This Indicator Predicts Market Tops With Incredible Accuracy (Consistent Over Many Years)

This indicator will help you predict market moves in Tradingview #shorts #forex #forextrading

How This ONE Indicator Predicts Market Pivots BEFORE They Happen!

ONLY TradingView Indicators to Use in 2025! [TOP 2 MOST POWERFUL]

This Indicator is Over Powered!

SECRET Tradingview Indicator that FINDS MARKET TOPS and BOTTOMS [Buy Sell Indicator Tradingview]

This indicator can predict the future! #shorts #tradingview #tradingindicators #crypto

intraday trading with best simply indicator #cryptotrading #besttradingindicator #cryptostrategy

This tradingview Indicator predicts 100% accurate reversals

This Trading Indicator Predicts Future Moves - Simple Forex Trading Strategy 🔮📈

This TradingView Indicator Finds Reversals | V4 Divergence Trading Strategy

Indicators Are Nonsense

The Only Indicator You’ll Ever Need

Review: 'This TradingView Indicator Predicts The EXACT Future'

This indicator PREDICTS FUTURE Volume📊🔮

5 NEW Indicators That Predict the EXACT Future

2 - Secret Hack UT Bot Indicator 95% Accuracy #shorts #intradaytrading #optionstrading

This TradingView Indicator Predicts The EXACT Future

Best indicator to predict a recession! #larrywilliams # #tradingstrategy #futurestrading

This Tradingview indicator wins 99% trades!

3 Most Effective Indicators on TradingView

The VWAP Angle Indicator: Always catch market TOPS and BOTTOMS

How to make 10000$ in 1 hour #trading #shorts #crypto #trading #indicator #bitcoin #btc #makemoney

Комментарии

0:05:24

0:05:24

0:10:49

0:10:49

0:00:25

0:00:25

0:03:47

0:03:47

0:08:51

0:08:51

0:00:33

0:00:33

0:14:27

0:14:27

0:00:47

0:00:47

0:00:19

0:00:19

0:07:45

0:07:45

0:09:25

0:09:25

0:07:07

0:07:07

0:00:45

0:00:45

0:08:48

0:08:48

0:09:21

0:09:21

0:00:25

0:00:25

0:12:17

0:12:17

0:01:00

0:01:00

0:09:18

0:09:18

0:00:47

0:00:47

0:04:40

0:04:40

0:00:55

0:00:55

0:10:44

0:10:44

0:00:28

0:00:28