filmov

tv

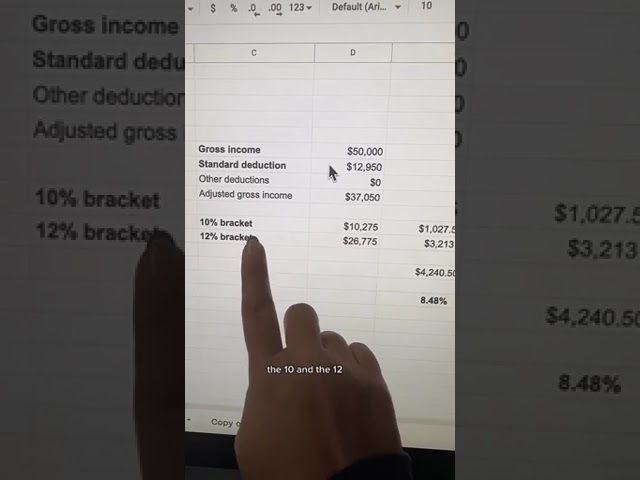

HOW FEDERAL INCOME TAX WORKS?

Показать описание

Did it surprise you to learn that you’re not just taxed at a single flat rate?

Don’t be embarrassed if it did! This stuff is not explained to us and let’s face it, the IRS isn’t making the Tax Code an actual page-turner.

Here are some common questions I got when I shared this over on the clock app. Oh, and these numbers are all based on 2022 since we’re in the midst of tax season now. These numbers all change for 2023.

✔️Theres an income tax calculator in my free guide linked in my bio.

𝗪𝗵𝗮𝘁 𝗶𝘀 𝗮 𝘀𝘁𝗮𝗻𝗱𝗮𝗿𝗱 𝗱𝗲𝗱𝘂𝗰𝘁𝗶𝗼𝗻? This is money that’s NOT taxed because of different exemptions or discounts you’re entitled to. The IRS wanted to simplify taxes so people wouldn’t have to itemize their deductions (listing them out one by one).

It only makes sense to itemize if doing so will get you a bigger deduction which is rare. About 90% of people use the standard deduction.

𝗔𝗿𝗲𝗻’𝘁 𝘁𝗵𝗲𝗿𝗲 𝗼𝘁𝗵𝗲𝗿 𝘁𝗮𝘅𝗲𝘀 𝗶𝗻 𝗮𝗱𝗱𝗶𝘁𝗶𝗼𝗻 𝘁𝗼 𝘁𝗵𝗲 𝗳𝗲𝗱𝗲𝗿𝗮𝗹 𝗶𝗻𝗰𝗼𝗺𝗲 𝘁𝗮𝘅? You bet there are! There are FICA and state and local taxes to name just a few. I focused on the federal income tax to demonstrate how progressive (gradual) taxes work compared to a flat tax.

𝗗𝗼 𝗜 𝗻𝗲𝗲𝗱 𝘁𝗼 𝗸𝗻𝗼𝘄 𝗵𝗼𝘄 𝘁𝗼 𝗰𝗮𝗹𝗰𝘂𝗹𝗮𝘁𝗲 𝘁𝗵𝗶𝘀 𝗺𝘆𝘀𝗲𝗹𝗳? HELL NO. I’m only showing it to you so you can have a little better understanding so you can communicate with your tax preparer better. They’re not going to take the time to explain this stuff to you.

𝗜𝘀 𝘁𝗵𝗲𝗿𝗲 𝗮𝗻𝘆 𝘄𝗮𝘆 𝗜 𝗰𝗮𝗻 𝗹𝗼𝘄𝗲𝗿 𝗺𝘆 𝗶𝗻𝗰𝗼𝗺𝗲 𝘁𝗮𝘅? YES! There are deductions you can take advantage of that are called “above-the-line deductions” and guess which one is my favorite? The one for investing in pre-tax accounts! Every dollar you invest in a Traditional 401k or Traditional IRA lowers your tax liability for that year.

So not only will investing help you GROW your wealth, it will help you KEEP more of your money so you can have more tax flexibility when you’re planning your retirement.

Don’t be embarrassed if it did! This stuff is not explained to us and let’s face it, the IRS isn’t making the Tax Code an actual page-turner.

Here are some common questions I got when I shared this over on the clock app. Oh, and these numbers are all based on 2022 since we’re in the midst of tax season now. These numbers all change for 2023.

✔️Theres an income tax calculator in my free guide linked in my bio.

𝗪𝗵𝗮𝘁 𝗶𝘀 𝗮 𝘀𝘁𝗮𝗻𝗱𝗮𝗿𝗱 𝗱𝗲𝗱𝘂𝗰𝘁𝗶𝗼𝗻? This is money that’s NOT taxed because of different exemptions or discounts you’re entitled to. The IRS wanted to simplify taxes so people wouldn’t have to itemize their deductions (listing them out one by one).

It only makes sense to itemize if doing so will get you a bigger deduction which is rare. About 90% of people use the standard deduction.

𝗔𝗿𝗲𝗻’𝘁 𝘁𝗵𝗲𝗿𝗲 𝗼𝘁𝗵𝗲𝗿 𝘁𝗮𝘅𝗲𝘀 𝗶𝗻 𝗮𝗱𝗱𝗶𝘁𝗶𝗼𝗻 𝘁𝗼 𝘁𝗵𝗲 𝗳𝗲𝗱𝗲𝗿𝗮𝗹 𝗶𝗻𝗰𝗼𝗺𝗲 𝘁𝗮𝘅? You bet there are! There are FICA and state and local taxes to name just a few. I focused on the federal income tax to demonstrate how progressive (gradual) taxes work compared to a flat tax.

𝗗𝗼 𝗜 𝗻𝗲𝗲𝗱 𝘁𝗼 𝗸𝗻𝗼𝘄 𝗵𝗼𝘄 𝘁𝗼 𝗰𝗮𝗹𝗰𝘂𝗹𝗮𝘁𝗲 𝘁𝗵𝗶𝘀 𝗺𝘆𝘀𝗲𝗹𝗳? HELL NO. I’m only showing it to you so you can have a little better understanding so you can communicate with your tax preparer better. They’re not going to take the time to explain this stuff to you.

𝗜𝘀 𝘁𝗵𝗲𝗿𝗲 𝗮𝗻𝘆 𝘄𝗮𝘆 𝗜 𝗰𝗮𝗻 𝗹𝗼𝘄𝗲𝗿 𝗺𝘆 𝗶𝗻𝗰𝗼𝗺𝗲 𝘁𝗮𝘅? YES! There are deductions you can take advantage of that are called “above-the-line deductions” and guess which one is my favorite? The one for investing in pre-tax accounts! Every dollar you invest in a Traditional 401k or Traditional IRA lowers your tax liability for that year.

So not only will investing help you GROW your wealth, it will help you KEEP more of your money so you can have more tax flexibility when you’re planning your retirement.

Комментарии

0:00:59

0:00:59

0:02:48

0:02:48

0:04:06

0:04:06

0:18:05

0:18:05

0:04:29

0:04:29

0:25:05

0:25:05

0:15:52

0:15:52

0:06:56

0:06:56

0:03:50

0:03:50

0:00:18

0:00:18

0:02:38

0:02:38

0:01:11

0:01:11

0:01:33

0:01:33

0:05:28

0:05:28

0:15:13

0:15:13

0:01:34

0:01:34

0:08:36

0:08:36

0:21:52

0:21:52

0:01:24

0:01:24

0:10:51

0:10:51

0:04:38

0:04:38

0:07:18

0:07:18

0:12:29

0:12:29

0:12:10

0:12:10