filmov

tv

Tax 8949 and D

Показать описание

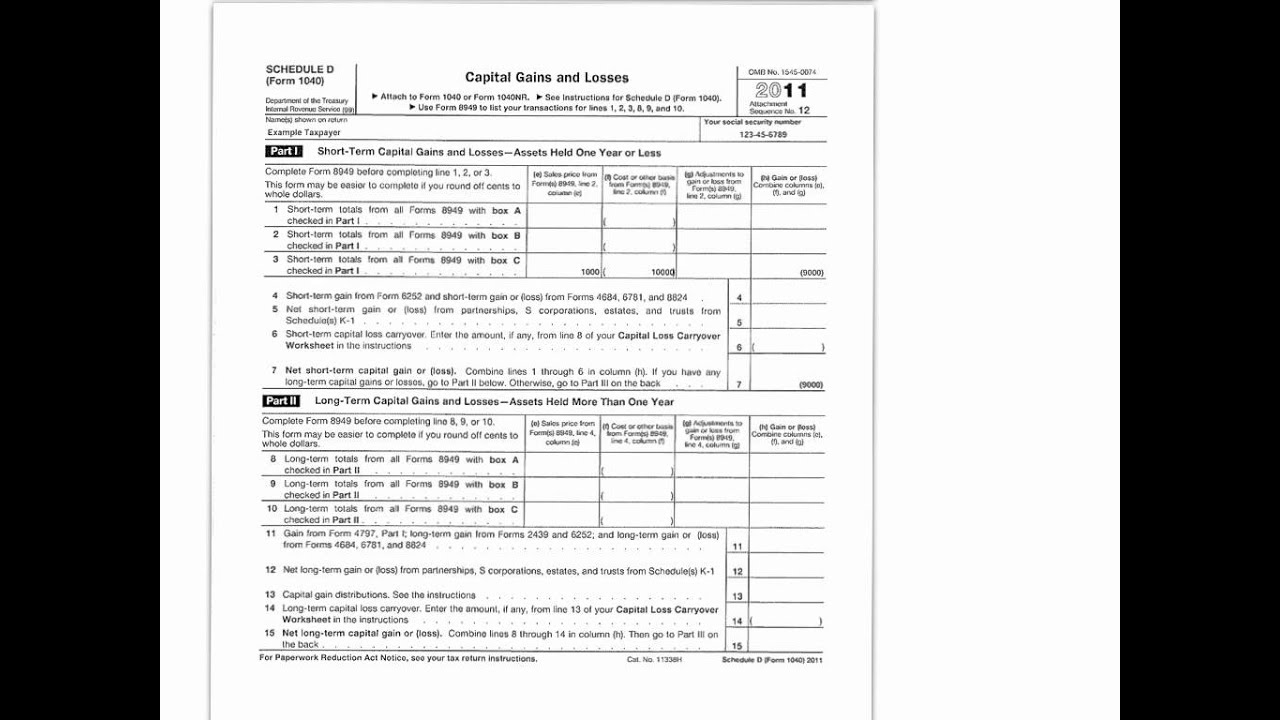

Video describes the completion form 8949 and schedule D.

Reporting Capital Gains on IRS Form 8949 and Schedule D

IRS Form 8949 walkthrough (Sales and Other Dispositions of Capital Assets)

When to Use IRS Form 8949 for Stock Sales - TurboTax Tax Tip Video

Tax 8949 and D

How to Use IRS Form 8949 for Reporting Capital Gains and Losses?

Crypto taxes 8949, Cryptocurrency tax 8949. IRS Form 8949 and Schedule D, Crypto gains, and losses.

How To Report Crypto On Form 8949 For Taxes | CoinLedger

IRS Schedule D Walkthrough (Capital Gains and Losses)

How to Fill Out Schedule D

How to interpret a brokerage statement (and put the information from it on your tax return)

IRS Form 8949 Reporting for Qualified Opportunity Zones with Form 8997

Crypto taxes Schedule D and 8949, Cryptocurrency Form 8949 and Schedule D, Crypto gains and losses.

Capital Gains - Putting it all Together on a Schedule D

How To Report Crypto On Form 8949

Episode 18 - Master Capital Gains Tax: Schedule D & Form 8949 Explained for Beginners

Report Stock Sales on Taxes Easily! 📈 (How To Report Capital Gains) 💰

Form 1099-S on Form 1040 for 2022 - Principal Residence Exclusion

What are 'Wash Sales?'

Crypto taxes, 8949, 1099b, 1040, Schedule D, 1099misc, schedule 1, Cryptocurrency Tax forms

How to Report Crypto Currency on Your Tax Return (Form 1040)

IRS Form 8949 Line-by-Line Instructions 2024: How to Report Stocks on Your Tax Return 🔶 TAXES S2•E59...

Schedule D Explained - IRS Form 1040 - Capital Gains and Losses

How to Report Cryptocurrency on IRS Form 8949 - CryptoTrader.Tax

How to Enter 1099-B Capital Gains & Losses into Tax Software

Комментарии

0:05:22

0:05:22

0:22:25

0:22:25

0:02:35

0:02:35

0:04:09

0:04:09

0:03:04

0:03:04

0:01:00

0:01:00

0:04:47

0:04:47

0:32:16

0:32:16

0:09:36

0:09:36

0:06:28

0:06:28

0:06:22

0:06:22

0:00:59

0:00:59

0:07:13

0:07:13

0:01:56

0:01:56

0:25:10

0:25:10

0:22:37

0:22:37

0:11:19

0:11:19

0:05:15

0:05:15

0:00:59

0:00:59

0:08:02

0:08:02

0:21:27

0:21:27

0:08:13

0:08:13

0:03:25

0:03:25

0:04:08

0:04:08