filmov

tv

PROFIT from Merger | (w/ English CC) | IDFC Merger & Tata Merger

Показать описание

** Understanding Arbitrage **

Arbitrage in the stock market means buying a stock at a lower price in one place and selling it for a higher price in another place. Traders do this to take advantage of price differences and make a profit. It's like finding a good deal on something and then selling it for a higher price to make money. However, finding these opportunities can be challenging because markets are usually efficient and quickly adjust prices to eliminate potential arbitrage opportunities.

** About Tata Steel Merger **

- The Board of Directors of Tata Steel Limited has approved the proposed amalgamation of 7 subsidiaries into Tata Steel Limited.

- The subsidiaries include Tata Steel Long Products Limited, The Tinplate Company of India Limited, Tata Metaliks Limited, The Indian Steel & Wire Products Limited, Tata Steel Mining Limited, and S & T Mining Company Limited, TRF Limited

- The proposed amalgamations aim to enhance management efficiency, strategic focus, and agility across businesses.

- The amalgamations will drive synergies through raw material security, centralized procurement, reduced logistics costs, and better facility utilization.

- Each amalgamation will be value-accretive for shareholders.

Here are the swap ratios for the proposed amalgamations:

- For every 10 shares of Tata Steel Long Products Limited, 67 shares of Tata Steel Limited.

- For every 10 shares of The Tinplate Company of India Limited, 33 shares of Tata Steel Limited.

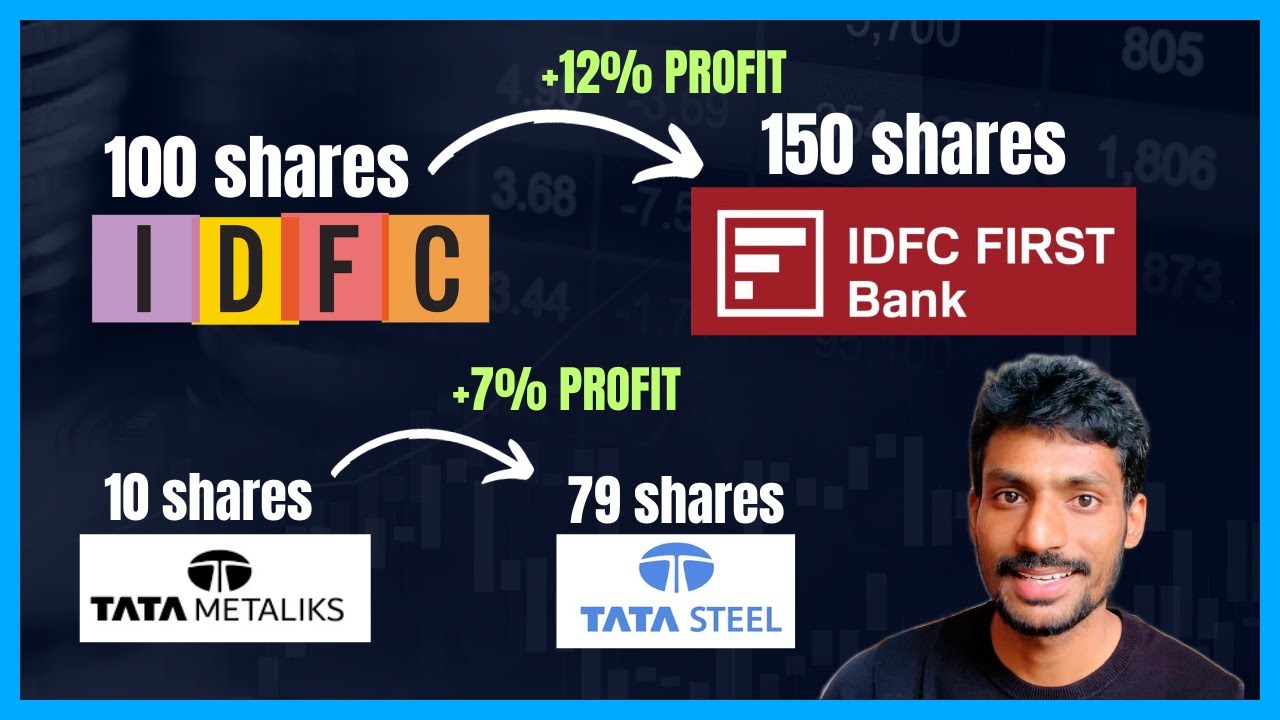

- For every 10 shares of Tata Metaliks Limited, 79 shares of Tata Steel Limited.

- For every 10 shares of TRF Limited, 17 shares of Tata Steel Limited.

** IDFC Ltd. - IDFC First Bank Merger **

- The Share Exchange Ratio for the amalgamation of IDFC Limited with IDFC FIRST Bank is 155 equity shares of IDFC FIRST Bank for every 100 equity shares of IDFC Limited.

- 264.64 crore shares of IDFC FIRST Bank held by IDFC Ltd will be extinguished, and 248 crore new shares of IDFC FIRST Bank will be issued to IDFC Ltd shareholders based on their holdings.

- The merger will increase the standalone book value per share of IDFC FIRST Bank by 4.9%.

- The merger will provide value unlocking for IDFC Limited shareholders who will directly hold shares in IDFC FIRST Bank.

- The merger will simplify the corporate structure of IDFC FHCL, IDFC Limited, and IDFC FIRST Bank, streamlining accounting and regulatory compliances.

- The merger will create an institution with diversified shareholders, similar to other successful Indian private sector banks.

----------

Join this channel's Learners membership to get access to perks:

----------

New Account opening links for leading brokers in India :

Here are the account opening links for some of the leading brokers in India if you're interested in opening a new broker account.

----------

----------

How to use Google Sheets for tracking stocks?

----------

#usefulInformationBoosan

Useful Information Boosan, Personal Finance Tamil, Productivity, Self improvment

Boosan

Arbitrage in the stock market means buying a stock at a lower price in one place and selling it for a higher price in another place. Traders do this to take advantage of price differences and make a profit. It's like finding a good deal on something and then selling it for a higher price to make money. However, finding these opportunities can be challenging because markets are usually efficient and quickly adjust prices to eliminate potential arbitrage opportunities.

** About Tata Steel Merger **

- The Board of Directors of Tata Steel Limited has approved the proposed amalgamation of 7 subsidiaries into Tata Steel Limited.

- The subsidiaries include Tata Steel Long Products Limited, The Tinplate Company of India Limited, Tata Metaliks Limited, The Indian Steel & Wire Products Limited, Tata Steel Mining Limited, and S & T Mining Company Limited, TRF Limited

- The proposed amalgamations aim to enhance management efficiency, strategic focus, and agility across businesses.

- The amalgamations will drive synergies through raw material security, centralized procurement, reduced logistics costs, and better facility utilization.

- Each amalgamation will be value-accretive for shareholders.

Here are the swap ratios for the proposed amalgamations:

- For every 10 shares of Tata Steel Long Products Limited, 67 shares of Tata Steel Limited.

- For every 10 shares of The Tinplate Company of India Limited, 33 shares of Tata Steel Limited.

- For every 10 shares of Tata Metaliks Limited, 79 shares of Tata Steel Limited.

- For every 10 shares of TRF Limited, 17 shares of Tata Steel Limited.

** IDFC Ltd. - IDFC First Bank Merger **

- The Share Exchange Ratio for the amalgamation of IDFC Limited with IDFC FIRST Bank is 155 equity shares of IDFC FIRST Bank for every 100 equity shares of IDFC Limited.

- 264.64 crore shares of IDFC FIRST Bank held by IDFC Ltd will be extinguished, and 248 crore new shares of IDFC FIRST Bank will be issued to IDFC Ltd shareholders based on their holdings.

- The merger will increase the standalone book value per share of IDFC FIRST Bank by 4.9%.

- The merger will provide value unlocking for IDFC Limited shareholders who will directly hold shares in IDFC FIRST Bank.

- The merger will simplify the corporate structure of IDFC FHCL, IDFC Limited, and IDFC FIRST Bank, streamlining accounting and regulatory compliances.

- The merger will create an institution with diversified shareholders, similar to other successful Indian private sector banks.

----------

Join this channel's Learners membership to get access to perks:

----------

New Account opening links for leading brokers in India :

Here are the account opening links for some of the leading brokers in India if you're interested in opening a new broker account.

----------

----------

How to use Google Sheets for tracking stocks?

----------

#usefulInformationBoosan

Useful Information Boosan, Personal Finance Tamil, Productivity, Self improvment

Boosan

Комментарии

0:06:22

0:06:22

0:00:57

0:00:57

0:04:44

0:04:44

0:10:08

0:10:08

0:00:52

0:00:52

0:00:36

0:00:36

0:42:52

0:42:52

0:36:58

0:36:58

0:28:44

0:28:44

0:12:18

0:12:18

0:11:06

0:11:06

0:05:09

0:05:09

0:00:55

0:00:55

0:08:24

0:08:24

0:02:10

0:02:10

0:00:17

0:00:17

0:10:41

0:10:41

0:03:49

0:03:49

0:00:19

0:00:19

0:05:22

0:05:22

0:33:28

0:33:28

0:00:38

0:00:38

0:00:59

0:00:59

0:00:23

0:00:23