filmov

tv

Mortgage Prepayment Risk for Banks

Показать описание

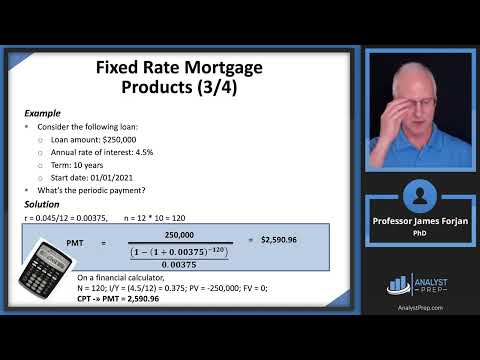

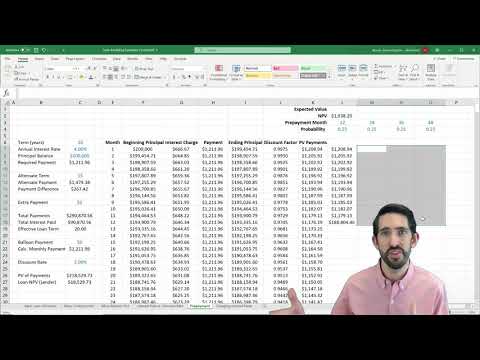

Changes in interest rates create problems for banks due to mismatches of fixed-rate and floating-rate instruments, as well as differences in time to maturity, rate-setting frequency, and indexes. But changes in interest rates also lead to prepayment risk.

Prepayment risk occurs when a borrower repays the principal sooner than required. Prepayment is a problem because the bank gets stuck re-lending the money at a less favorable interest rate.

Prepayments occur through:

• Curtailment (the borrower pays an additional principal amount along with their scheduled mortgage payment; this reduces the balance of the loan)

• Housing turnover (the borrower sells the property and pays off the loan)

• Refinancing (the borrower gets a new loan and pays off the first loan)

The most important factor affecting prepayment is the refinancing rate. However, prepayment is also affected by:

• Borrower characteristics (e.g., credit score)

• Geographic location

• Mortgage seasoning

• Seasonality

• The burnout effect

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Prepayment risk occurs when a borrower repays the principal sooner than required. Prepayment is a problem because the bank gets stuck re-lending the money at a less favorable interest rate.

Prepayments occur through:

• Curtailment (the borrower pays an additional principal amount along with their scheduled mortgage payment; this reduces the balance of the loan)

• Housing turnover (the borrower sells the property and pays off the loan)

• Refinancing (the borrower gets a new loan and pays off the first loan)

The most important factor affecting prepayment is the refinancing rate. However, prepayment is also affected by:

• Borrower characteristics (e.g., credit score)

• Geographic location

• Mortgage seasoning

• Seasonality

• The burnout effect

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:04:51

0:04:51

0:02:25

0:02:25

0:04:10

0:04:10

0:01:25

0:01:25

0:02:22

0:02:22

0:00:58

0:00:58

0:01:11

0:01:11

0:02:47

0:02:47

0:03:02

0:03:02

0:06:32

0:06:32

0:03:12

0:03:12

0:47:51

0:47:51

0:51:41

0:51:41

0:07:48

0:07:48

0:08:39

0:08:39

0:02:04

0:02:04

0:04:54

0:04:54

0:05:25

0:05:25

0:53:15

0:53:15

0:08:58

0:08:58

0:02:36

0:02:36

0:11:06

0:11:06

0:08:54

0:08:54

0:04:20

0:04:20