filmov

tv

Make Easy Money Before Work Everyday ($250/day)

Показать описание

--------------

--------------

📈Charting Platforms

--------------

--------------

My official socials:

*DISCLAIMER* I am not a financial advisor and anything that I say on this YouTube channel should not be seen as financial advice. I am only sharing my biased opinion based off of speculation and my personal experience. You should always understand that with investing there is always risk. You should always do your own research before making any investment.

#DayTrading #scalping #scalpingstrategy

--------------

📈Charting Platforms

--------------

--------------

My official socials:

*DISCLAIMER* I am not a financial advisor and anything that I say on this YouTube channel should not be seen as financial advice. I am only sharing my biased opinion based off of speculation and my personal experience. You should always understand that with investing there is always risk. You should always do your own research before making any investment.

#DayTrading #scalping #scalpingstrategy

Make Easy Money Before Work Everyday ($250/day)

Do This Before Work Everyday to Make Easy Money ($250/Day)

Do This Before Work Everyday to Make Easy Money ($300/Day)

How To Make $500 In 24hrs EASY MAKE MONEY ONLINE SIDE HUSTLE!

Easy way to make $$$ without much money #shorts

how to make money FAST as a TEEN! *age 12,13,14,15,16,17,18*

6 Easy Online Side Hustles that require NO MONEY to start in 2024 💸 realistic for the average person...

How To Make EASY MONEY $600 a day From Your Phone! FOR FREE!!!

Fast Profit System - a free system that makes money fast #shorts #makemoney #workfromhome

15 Websites To Do Easy Work From Home (Make Money Online in 2024)

how to make money FAST as a TEEN! *age 12,13,14,15,16*

Make Money Online Fast: Zero To $499/Day Using ChatGPT – No Experience OR Followers Needed

12 Easy Ways to Make Money for Teens

Make MONEY From DAY 1 With This EASY Side Hustle (Tested)

Fastest Order Selector on Earth!? (DO NOT Attempt) #work #easymoney #pallets

3 EASY Online Jobs for Beginners to Make MONEY Online

Easy Money in Spring - Stardew Valley

How to make money FAST as a teenager without a job *13,14,15,16,17,18,19*

7 Simple Ways to Make Money as Student🔥| Make Online Money by this Hack |Prashant Kirad

The BEST Ways to Make MILLIONS Right Now in GTA 5 Online! (MAKE MILLIONS FAST!)

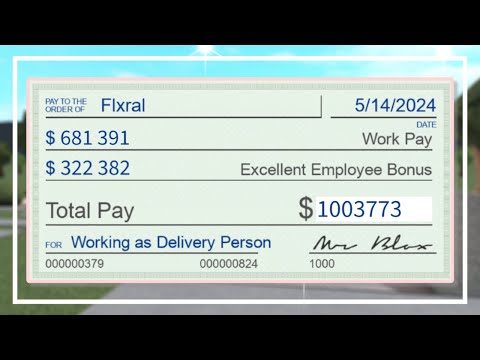

How To Make Money Fast With The New Bloxburg Job System (Roblox)

FREE & EASY: 19 Websites To Make Money Online For Beginners In 2024 - Up to US$600 Per Task

3 EASY Ways to Make Money For Students | Ishan Sharma #shorts

Easy Way To Make Money With ChatGPT For Beginners In 2024! ($156/Day)

Комментарии

0:22:54

0:22:54

0:13:21

0:13:21

0:14:26

0:14:26

0:00:59

0:00:59

0:00:59

0:00:59

0:11:06

0:11:06

0:09:24

0:09:24

0:11:18

0:11:18

0:00:15

0:00:15

0:13:22

0:13:22

0:15:41

0:15:41

0:24:02

0:24:02

0:10:01

0:10:01

0:23:13

0:23:13

0:00:16

0:00:16

0:04:40

0:04:40

0:09:25

0:09:25

0:17:21

0:17:21

0:14:30

0:14:30

0:08:23

0:08:23

0:07:00

0:07:00

0:18:20

0:18:20

0:00:40

0:00:40

0:13:05

0:13:05