filmov

tv

At What Point Should I Consider Making Roth Conversions

Показать описание

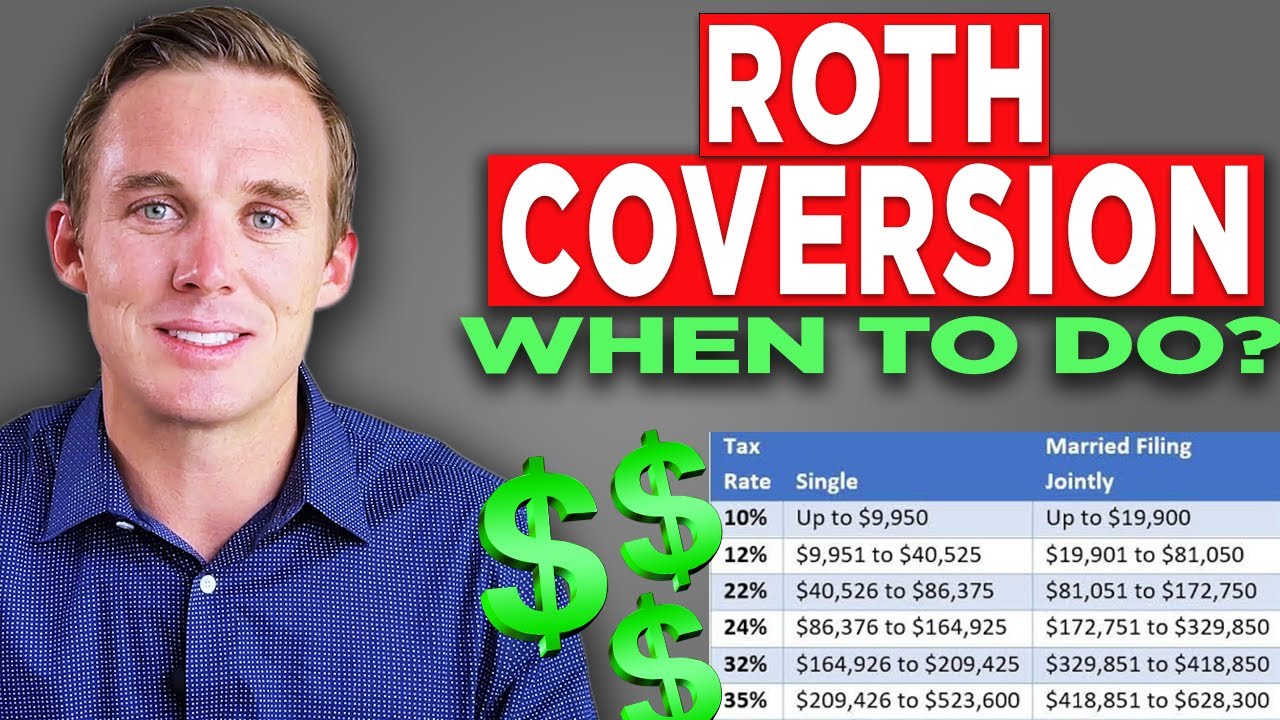

Roth Conversions can be a great tax strategy to implement, but when should you do it? When is it best for your individual situation?

Timestamps:

00:00 - Intro

0:56 - IRA v. Roth IRA

1:48 - What is a Roth Conversion?

2:16 - When Should I Do a Roth Conversion?

3:12 - 3 Times To Do a Roth Conversion

4:34 - Roth Conversion Example

5:51 - 2020 Stock Market Example

6:28 - Save Money On Taxes!

6:54 - Subscribe!

_ _

For more resources and content, check us out here!

Timestamps:

00:00 - Intro

0:56 - IRA v. Roth IRA

1:48 - What is a Roth Conversion?

2:16 - When Should I Do a Roth Conversion?

3:12 - 3 Times To Do a Roth Conversion

4:34 - Roth Conversion Example

5:51 - 2020 Stock Market Example

6:28 - Save Money On Taxes!

6:54 - Subscribe!

_ _

For more resources and content, check us out here!

At What Point Should I Take Profits from Stock Picks? (Up 80%)

John Piper - At what point should I share the gospel with my neighbor?

At What Point Should I Leave My Marriage? | Paul Friedman

Straight Talk: At What Point Should Women Do the Work? || STEVE HARVEY

Polls shows where Harris and Trump stand in swing states weeks before the election

Ask The Doctor with Dr. Steve Duffy - At what point should I have my reflux evaluated by a doctor?

#AskNCM: At what point should I fire an underperforming employee?

At What Point Should I Take the Tax Hit on Unrealized Gains?

At what point should I be concerned? 😳

At What Point Should We Stop Chasing Money?

At What Point Should You Leave a Church? - Phil Johnson

Why Should African Americans Vote For Trump-Vance?: JD Vance Asked Point Blank In Detroit

At what point should you talk to your physician about Palliative Care?

At This Point, Should You Flee the US?

At what point should you look at getting a business partner?

Ask Sallie Krawcheck: At what point in my career should I ask for a raise?

At what point should I hire a divorce lawyer?

Dragon Ball Sparking! Zero - How to Transform and Fuse

At What Point Should I Contact A Doula-Premier Doulas of Atlanta

At what point should I seek medical advice for high lymphocytes?

At this point, what should I do?

At this point you should get a safe instead of an ita bag🧋 #kawaii #kawaiifashion

At what point should I replace my iPhone?

At what point should I promote someone to team leader?

Комментарии

0:07:51

0:07:51

0:03:18

0:03:18

0:09:33

0:09:33

0:04:00

0:04:00

0:10:49

0:10:49

0:00:48

0:00:48

0:02:04

0:02:04

0:30:16

0:30:16

0:01:00

0:01:00

0:14:48

0:14:48

0:03:13

0:03:13

0:03:09

0:03:09

0:00:34

0:00:34

0:00:53

0:00:53

0:00:55

0:00:55

0:00:45

0:00:45

0:03:23

0:03:23

0:03:13

0:03:13

0:00:48

0:00:48

0:00:43

0:00:43

0:00:06

0:00:06

0:00:19

0:00:19

0:00:30

0:00:30

0:02:55

0:02:55