filmov

tv

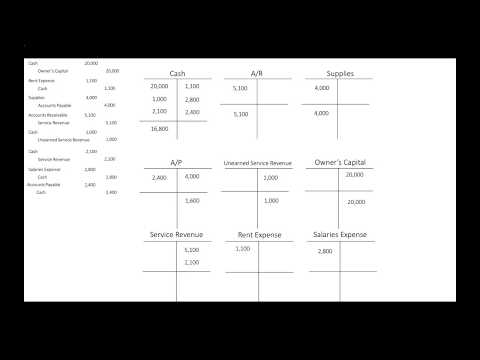

Chapter 1-4 Review

Показать описание

Review over Chapters 1-4 for ACC 111 at Scottsdale Community College.

Review covers:

- Journal entries

- T-accounts

- Trial Balance, Adjusted Trial Balance, Post-Closing Trial Balance

- Financial Statements

- Adjusting Entries

- Closing Entries

Transactions:

July 1 Artie invests $30,000 in the business, Artichokes LLC.

July 1 Signed an office space rental agreement, paying $6,000 for six months.

July 3 Purchased $15,000 of equipment, paying $5,000 in cash and the remainder on account.

July 6 Buy $500 of supplies on account.

July 10 Receive $10,000 payment from a customer for future services.

July 12 Artie withdraws $1,000 cash for personal use.

July 14 Perform services worth $3,000 and bill the customer for the amount.

July 18 Paid employees a total of $2,000.

July 21 Receive payment in full from customer billed on July 14.

July 28 Pay creditors $2,000 for amount owed.

July 30 Perform services for a customer. Earned $12,000 in revenue, received $8,000 in cash and the remainder is on account.

Other data:

1. $150 of supplies were used in July.

2. Employees are owed $1,800 and will be paid on August 2.

3. The equipment has depreciated $125 this month.

4. $8,000 of the unearned revenue remains unearned.

5. One month of the six-month rental agreement has expired.

#accounting #exam #review

Review covers:

- Journal entries

- T-accounts

- Trial Balance, Adjusted Trial Balance, Post-Closing Trial Balance

- Financial Statements

- Adjusting Entries

- Closing Entries

Transactions:

July 1 Artie invests $30,000 in the business, Artichokes LLC.

July 1 Signed an office space rental agreement, paying $6,000 for six months.

July 3 Purchased $15,000 of equipment, paying $5,000 in cash and the remainder on account.

July 6 Buy $500 of supplies on account.

July 10 Receive $10,000 payment from a customer for future services.

July 12 Artie withdraws $1,000 cash for personal use.

July 14 Perform services worth $3,000 and bill the customer for the amount.

July 18 Paid employees a total of $2,000.

July 21 Receive payment in full from customer billed on July 14.

July 28 Pay creditors $2,000 for amount owed.

July 30 Perform services for a customer. Earned $12,000 in revenue, received $8,000 in cash and the remainder is on account.

Other data:

1. $150 of supplies were used in July.

2. Employees are owed $1,800 and will be paid on August 2.

3. The equipment has depreciated $125 this month.

4. $8,000 of the unearned revenue remains unearned.

5. One month of the six-month rental agreement has expired.

#accounting #exam #review

Комментарии

0:42:19

0:42:19

0:09:46

0:09:46

0:57:01

0:57:01

0:13:17

0:13:17

0:23:24

0:23:24

0:00:27

0:00:27

0:17:19

0:17:19

0:11:20

0:11:20

0:56:54

0:56:54

0:15:08

0:15:08

0:03:07

0:03:07

0:02:53

0:02:53

1:29:51

1:29:51

0:03:19

0:03:19

0:13:06

0:13:06

0:20:05

0:20:05

0:13:40

0:13:40

0:04:44

0:04:44

0:11:37

0:11:37

0:10:43

0:10:43

0:20:36

0:20:36

0:13:09

0:13:09

0:00:57

0:00:57

0:02:36

0:02:36