filmov

tv

What CLOSING a Credit Card Did to My Credit Score...

Показать описание

Members are able to see results, fast! Usually within 30 days.

Try it now for just $1 with this special link, no sponsor code needed!

“The content in this video is accurate as of the posting date. Some of the offers may no longer be available.”

Advertiser Disclosure: This site is part of an affiliate sales network and receives

compensation may impact how and where links appear on this site. This site does not

include all financial companies or all available financial offers.

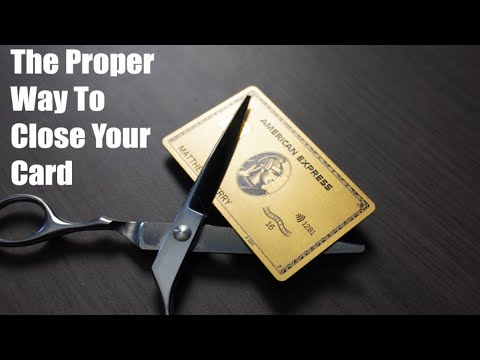

How To Close A Credit Card The Right Way

What CLOSING a Credit Card Did to My Credit Score...

Should I Close a Paid Credit Card Or Leave It Open?

Close Out ALL Of Your Credit Cards - Dave Ramsey Rant

What closing your card means on your credit score

Why you should CANCEL your old credit cards

Closing A Credit Card: When It Makes Financial Sense | NerdWallet

How Does Closing A Credit Card Impact Your Credit Score?

Will Paying Off Credit Cards Hurt Credit Score? - CreditGuide360.com

Worst Credit Cards for CREDIT REPAIR! Close it Or Keep It Open?

TOP Beginner Credit Card Mistakes to AVOID

What Happens When You CANCEL Your Credit Card?

Is closing a credit card Good or Bad?

Credit Cards For Beginners || How to Properly Close a Credit Card?

How Does Closing A Credit Card Impact Your Credit

Closing a Credit Card

Why you should be careful when canceling credit cards

Statement closing date vs. balance due date on your credit card bill! #creditcard #money #debt

Does Closing A Credit Card Affect Your Credit Score?

Don’t close your credit cards!

Should You Ever Close Credit Cards

Hidden Costs of Closing a Credit Card: A Deep Dive into Credit Scores

WHEN To Pay Your Credit Card Bill (Increase Your Score)

When To Close A Credit Card (And How To Do It) | NerdWallet

Комментарии

0:12:04

0:12:04

0:10:13

0:10:13

0:03:21

0:03:21

0:01:47

0:01:47

0:01:34

0:01:34

0:11:12

0:11:12

0:11:57

0:11:57

0:00:56

0:00:56

0:02:58

0:02:58

0:13:15

0:13:15

0:14:21

0:14:21

0:00:16

0:00:16

0:02:52

0:02:52

0:07:36

0:07:36

0:06:10

0:06:10

0:00:19

0:00:19

0:04:43

0:04:43

0:00:58

0:00:58

0:01:27

0:01:27

0:00:59

0:00:59

0:07:15

0:07:15

0:00:29

0:00:29

0:00:30

0:00:30

0:04:37

0:04:37