filmov

tv

TDS Rates on Sale of Property by NRI's (Non-Resident Indians) Explained by Arosh John

Показать описание

(Updated post Budget 2024) TDS Rate on Sale of Property by NRIs | Explained in 5 mins

Tds Rates fy 2023-24 | #tds #incometax #incometax

TDS Section and Rates | TDS Rate Chart for FY 2024-25 | TDS Slab 24-25 | TDS Rate on Salary FD Rent

How NRIs Can Lower TDS Rate on Sale of Property? | NRI Money with Alok

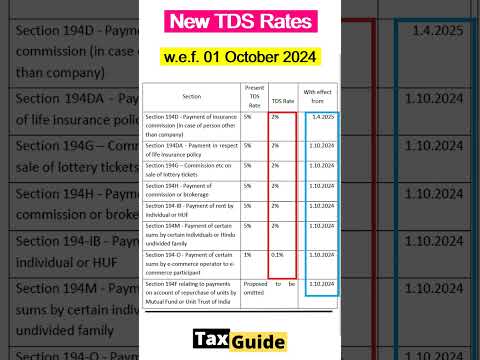

New TDS Rate Chart from 1 October 2024, NEW TDS/TCS Rates F.Y. 2024-25,TDS changes from 1 October 24

LTCG and TDS rate in case of sale of an immovable property by an NRI seller after Union budget 24

TDS | New TDS rate changes from 2025 | TDS on Contractor | 194C | Section 194C

TDS on Sale of Property in India by NRI | 2024 | NRI Money with Alok

TDS ky hai ,TDS why important, #TDS #IncreaseSales #Incometaxindia #TDSfilling #TDS #TaxWisdom

TDS Rate chart fy 2024-25 | TDS Rate chart ay 2025-26 | TDS Rate | TDS limit | TDS Chart 2024-25

TDS Rates on Sale of Property by NRI's (Non-Resident Indians) Explained by Arosh John

TDS on Purchase and Sale | TDS on Purchase vs TCS on Sale | Section 194Q |206C(1H) | Tax on Purchase

New TDS rates changes from 1 October 2024 #shorts_video

Q No.1:- What is TDS rate on sale of NRI properties? | FAQ Series | NRI- Tax on property sale

REVISED TDS RATE 01-10-24 | NEW TDS RATE EFFECTIVE FROM 01-10-24 | NEW TDS RATE CHART F.Y. 24-25

TDS rates changes from 01 October 2024 | New TDS rates from 01-10-2024 | TDS rate changed #shorts

New Tds Rates for Nri on sale of property after 23rd july-2024 | How to calculate Capital Gain ?|

New TDS Rate on Rent u/s 194I & 194IB from 1 October 2024 | TDS on Rent | New TDS Rates

TDS on Purchase of Goods | Section 194Q | Who is to deduct TDS on Purchase | TDS on purchase

New TDS Rate on Commission from 1 October 2024 | TDS u/s 194D | TDS u/s 194G | TDS u/s 194H

TDS on Sale , Purchase of House Property above Rs 50 lakh| CA PRITISH BURTON

Complete Property sale guide for NRIs 2024 | Lower TDS Certificate

TDS ON PURCHASE (194Q) 🆚 TDS ON SALES 206C(1H) | #gst #gstvnews #icai #icsi #gstr1 #tcs #tds #viral...

TDS on Interest otherthan Interest on securities FY 2022-23 #income tax # tds #concept in #shorts

Комментарии

0:05:06

0:05:06

0:00:12

0:00:12

0:05:45

0:05:45

0:07:07

0:07:07

0:14:38

0:14:38

0:05:25

0:05:25

0:19:20

0:19:20

0:07:54

0:07:54

0:00:41

0:00:41

0:10:01

0:10:01

0:01:01

0:01:01

0:07:18

0:07:18

0:00:11

0:00:11

0:03:14

0:03:14

0:06:23

0:06:23

0:00:36

0:00:36

0:08:37

0:08:37

0:09:43

0:09:43

0:08:44

0:08:44

0:07:23

0:07:23

0:05:44

0:05:44

0:19:50

0:19:50

0:00:15

0:00:15

0:00:08

0:00:08