filmov

tv

Piercing the Corporate Veil: An Informative Discussion on Asset Protection in LLCs 🏦⚖️

Показать описание

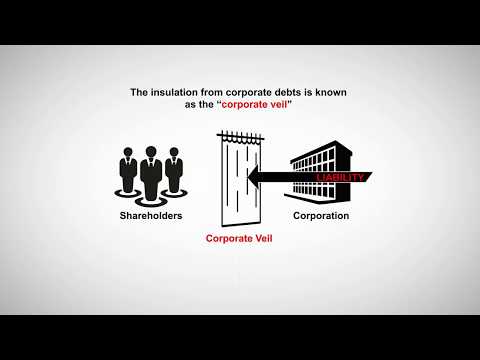

In this eye-opening video, we dive deep into the world of asset protection within the realm of single and multi-member LLCs. Discover how the corporate veil can be pierced in different states, putting your hard-earned assets at risk. We'll discuss the crucial differences between states like Florida, Wyoming, and Nevada when it comes to protecting your assets in an LLC, and the importance of understanding these distinctions for your financial well-being.

Learn about the potential pitfalls of commingling personal and business assets, and how this can lead to courts piercing the corporate veil, giving them access to your LLC's funds. Find out why having a multi-member LLC might be your best option in certain states, and how single member LLCs can be easier to manage in others. We'll also share valuable tips on how to avoid treating your LLC like a "personal piggy bank" and maintain the integrity of your asset protection strategy.

Whether you're a seasoned entrepreneur or just starting out, this video is essential for anyone looking to protect their assets in an LLC. Don't leave your hard-earned assets vulnerable to legal threats – watch now and make sure you're doing everything you can to safeguard your financial future.

If you have any questions about our platform and services, drop it in the comments below.

Legal Disclaimer: The content on this YouTube channel is for informational purposes only and does not constitute legal or tax advice. We strive for accuracy, but laws and regulations are subject to change, and we cannot guarantee the relevance or accuracy of the content. Consult a qualified attorney or tax advisor for advice tailored to your specific circumstances.

Keywords: digital nomad, LLC formation, non-US citizens, tax tips, WY LLC, DE LLC, real estate investor

0:06:17

0:06:17

0:04:05

0:04:05

0:02:10

0:02:10

0:03:58

0:03:58

0:11:37

0:11:37

1:04:15

1:04:15

0:08:30

0:08:30

0:01:03

0:01:03

0:05:16

0:05:16

0:01:33

0:01:33

0:08:22

0:08:22

0:03:01

0:03:01

0:10:28

0:10:28

0:02:44

0:02:44

0:02:47

0:02:47

0:04:08

0:04:08

0:08:12

0:08:12

0:01:29

0:01:29

0:09:09

0:09:09

1:06:25

1:06:25

0:10:31

0:10:31

0:03:33

0:03:33

0:01:01

0:01:01

0:21:35

0:21:35