filmov

tv

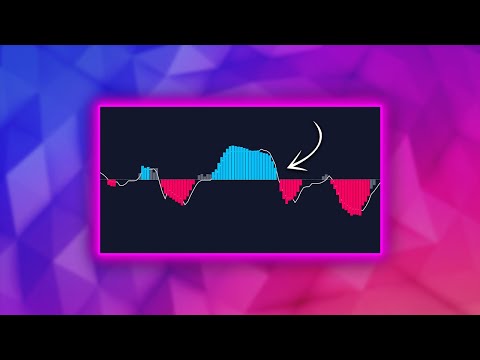

How to Day Trade A Short Squeeze!

Показать описание

How to Day Trade a Short Squeeze like we encountered on Friday! Breaking down this massive move on $DCIX and examining the emotional effects that traders have on the overall price of the stock. You can clearly see by looking at the Chart from Friday how the stock snowballed into a monster by middle of the day. Looking forward to Monday I'm expecting some type of spike in continuation of the move from Friday. Volume and price action at open will be key to watch! Tune in 9AM here on Youtube to see whats going on.

If you enjoyed this video please Subscribe to the channel for more videos coming soon! Just click link below!

FREE DAY TRADING FACEBOOK GROUP

Follow Along on Social Media

I am not a investment professional. Please do not make investment choices off of the ideas you see in these videos without the proper knowledge and research. Day Trading can be very volatile! You need to understand the basics and the risk involved first!

If you enjoyed this video please Subscribe to the channel for more videos coming soon! Just click link below!

FREE DAY TRADING FACEBOOK GROUP

Follow Along on Social Media

I am not a investment professional. Please do not make investment choices off of the ideas you see in these videos without the proper knowledge and research. Day Trading can be very volatile! You need to understand the basics and the risk involved first!

How To Start Trading Stocks As A Complete Beginner

How to WIN at Day Trading as a BEGINNER in 2024 (Step by Step Guide)

How To Find Stocks To Day Trade

How I Would Learn To Day Trade (If I Could Start Over)

The Simplest Day Trading Strategy for Beginners (with ZERO experience)

Day Trading Explained For Beginners!

HOW TO DAY TRADE FOR A LIVING SUMMARY (BY ANDREW AZIZ)

BEST Scalping Trading Strategy For Beginners (How To Scalp Forex, Stocks, and Crypto)

How To Start DAY TRADING - Becoming A Trader IN 30 DAYS

How I Would Learn Day Trading (If I Could Start Over)

How to Become a Professional Day Trader Explained in 5 minutes

I Tried Day Trading with No Experience

The Only Day Trading Video You Should Watch... (Full Course: Beginner To Advanced)

How I Learned To Trade In 2 Days

Day Trader Day in the Life

[LIVE] Day Trading | How I Made $460 in 5 Minutes (from start to finish...)

Trading 101: What is a Day Trader?

How To Grow A Small Stock Account

How to Day Trade for Beginners (FULL TUTORIAL)

How to Day Trade BREAKING NEWS with a Scalping Strategy (Step-by-Step Guide)

How Much Money Do You Need to Start Day Trading?

I Tested This Trading Strategy & It Made 310%

The Truth About Day Trading (Guaranteed To Fail)

How to Day Trade: The Plain Truth by Ross Cameron (Full Audiobook)

Комментарии

0:05:19

0:05:19

1:04:29

1:04:29

0:09:09

0:09:09

0:08:09

0:08:09

0:18:26

0:18:26

0:13:21

0:13:21

0:12:00

0:12:00

0:07:22

0:07:22

0:19:06

0:19:06

0:11:17

0:11:17

0:05:05

0:05:05

0:08:01

0:08:01

0:31:30

0:31:30

0:05:24

0:05:24

0:00:52

0:00:52

![[LIVE] Day Trading](https://i.ytimg.com/vi/SrQiOg0TV20/hqdefault.jpg) 0:13:31

0:13:31

0:08:43

0:08:43

0:08:45

0:08:45

1:58:47

1:58:47

0:59:52

0:59:52

0:04:22

0:04:22

0:01:00

0:01:00

0:08:14

0:08:14

4:31:21

4:31:21