filmov

tv

Macroeconomics Lecture 4 Financial Markets

Показать описание

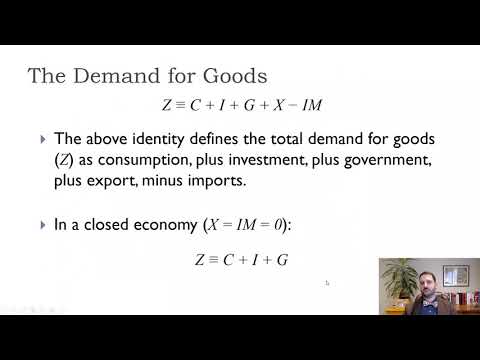

Lecture 4 in the Macroeconomics course at Cardiff University. This lecture gives a recap of the equilibrium in the goods market and covers the equilibrium in the money market. The short-run equilibrium output is driven by aggregate demand (AD), which is determined by the level of autonomous spending and the size of the multiplier. The closer the propensity to consume the larger the multiplier. The equilibrium in the money market depends on the interaction between the demand for money and money supply. We treat the money supply as an exogenous variable (given by the central bank). The demand for money depends on nominal income (positively related) and interest rate (negatively related). To plot the equilibrium in the money market (with money on the horizontal axis and interest rate on the vertical axis), a vertical line to represent money supply (given or exogenous - means independent of the interest rate), and a downward sloping curve to represent the relationship between the demand from money and the interest rate. The intersection point between the money supply curve and the demand for money curve shows the equilibrium in the money market. An increase in the nominal income will shift the demand for money curve to the right leading to a higher equilibrium interest rate. The central bank can change the level of the money supply by entering the bonds market as a seller or buyer, which would affect the equilibrium interest rate.

Комментарии

0:52:15

0:52:15

0:15:28

0:15:28

0:27:56

0:27:56

0:22:35

0:22:35

0:14:28

0:14:28

0:29:58

0:29:58

0:05:32

0:05:32

7:57:27

7:57:27

0:05:57

0:05:57

0:16:08

0:16:08

0:05:07

0:05:07

0:27:29

0:27:29

1:41:19

1:41:19

0:14:43

0:14:43

0:13:15

0:13:15

0:57:03

0:57:03

0:00:53

0:00:53

0:32:41

0:32:41

0:08:15

0:08:15

0:00:40

0:00:40

0:00:54

0:00:54

1:07:43

1:07:43

0:00:16

0:00:16