filmov

tv

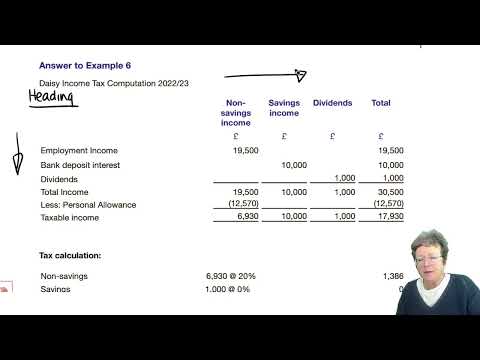

Income tax computation (part 3) - ACCA Taxation (FA 2022) TX-UK lectures

Показать описание

Income tax computation (part 3) - ACCA Taxation (FA 2022) TX-UK lectures

Chapter 2 – Income tax computation (part 3) - ACCA TX-UK Taxation (FA 2023) lectures

Income tax computation – Savings Income continued (part 3) - ACCA Taxation (TX-UK) FA2018

Income Tax Accounting (IFRS) | Calculating Deferred Tax Expense - Part 3 of 4

ACCA F6-Taxation (UK)- Chapter 2 - Basic Income tax Computation (Part 3)

Income Tax Accounting (IFRS) | Calculating Current Income Tax Expense - Part 2 of 4

IAS 12 - INCOME TAX (PART 1)

Capital Gain Part-3 | Income Tax 2022-23

Intermediate Paper-3A:ITL | Topic: Computation of total income and tax...| Session 2 | 21 Nov, 2024

Income Tax Lecture-3 Computation Of total Income & Tax Liability | Income Tax Bcom /BBA 2022-23

Income tax computation (part 4) - ACCA Taxation (FA 2022) TX-UK lectures

Charitable Remainder Trusts 3: Calculating Deductions

Schedule D Filing and Form 8949 - TaxSlayer Pro Income Tax Preparation Course (Module 5, Part 3)

ACCA F6-Taxation (UK)- Chapter 3 - Investment Income (Part 3 Comp)

Part-3 Income from Business and Profession | Depreciation Section 32

income from house property | part 3 Annual Value | Income Tax 2022-23

Capital Allowances (part 3) - ACCA Taxation (FA 2022) TX-UK lectures

Capital Gains Tax Explained 2021 (In Under 3 Minutes)

ACCA F6-Taxation (UK)- Chapter 5 - Employment Income (Part 3)

Income from Salary - House Rent Allowance in Kannada PART 3 By Srinath Sir

How much does a TAX ANALYST make?

How much Tax should u pay as per New Regime?

27. 'Proforma of Calculation of Income From Business' - From Income tax Subject

Income Tax Return Married Couple Germany - Part 3 | Unterhaltserklärung

Комментарии

0:17:39

0:17:39

0:12:46

0:12:46

0:49:42

0:49:42

0:17:56

0:17:56

0:37:08

0:37:08

0:12:15

0:12:15

0:29:38

0:29:38

0:19:05

0:19:05

2:30:13

2:30:13

0:11:12

0:11:12

0:24:48

0:24:48

0:27:14

0:27:14

0:25:53

0:25:53

0:40:00

0:40:00

0:10:56

0:10:56

0:25:37

0:25:37

0:16:01

0:16:01

0:02:23

0:02:23

1:01:08

1:01:08

0:17:44

0:17:44

0:00:40

0:00:40

0:00:45

0:00:45

0:11:03

0:11:03

0:12:36

0:12:36