filmov

tv

Whole Life Insurance vs Indexed Universal Life which is better

Показать описание

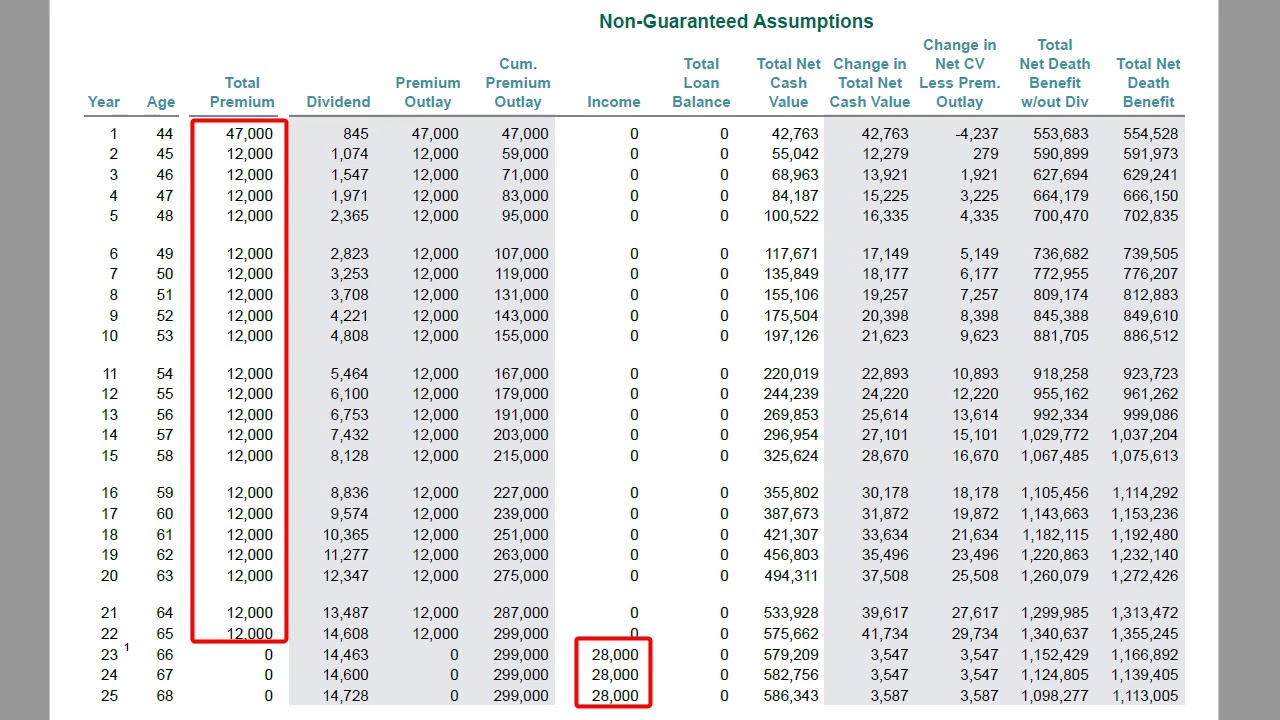

When it comes to comparing whole life vs Indexed Universal Life many people get it wrong! The products are designed to do completely different things. Whole life insurance is best suited for a bond or CD alternative. Whole life is expensive! It is the most expensive form of insurance you can buy, outside of some variable policies.

Indexed Universal life is best suited for max cash and income. It takes on a bit more risk than the whole life policy but aims to generate a higher rate of return.

By comparing the indexed universal life insurance policy to a whole life policy using simply the fixed crediting rate, we get a clearer picture of why the IUL has the higher upside and has the potential for much higher cash accumulation and incomes.

OR

Whole Life Insurance vs Indexed Universal Life which is better

Whole Life Vs. Indexed Universal Life

Whole Life vs. Indexed Life Insurance

Indexed Universal Life vs Whole Life | The Main Difference

What Is Universal Life Vs. Whole Life?

Whole Life vs Indexed Universal Life: The Ultimate Insurance Comparison

Whole Life vs Indexed Life Comparison

The Whole Life Insurance Scam - What Salesmen Won't Tell You

How to Sell $30,000+ as a Life Insurance Agent

Indexed Universal Life IUL Vs. Whole Life - The Facts!

Why Whole Life Insurance is Better than IUL

Indexed Universal Life vs Whole Life

Whole Life Insurance vs. Indexed Universal Life Insurance: Is Whole Life Really Better?

Index Universal Life vs SP 500 #investing

Whole Life Insurance vs Indexed Universal Life | Cost of Insurance

I was wrong about Whole Life Insurance...

Indexed Universal Life Insurance vs Whole Life vs Term: Don't Marry the wrong life insurance po...

Whole Life Insurance Vs Indexed Universal Life

Indexed Universal Life Insurance (IUL), Explained

The Big Difference between IUL and Whole life Insurance

Indexed UL vs Whole Life Insurance | FULL ILLUSTRATION COMPARISONS

Indexed Universal Life Insurance vs Whole Life Insurance | IUL vs Whole Life

Whole Life vs Indexed Universal Life | Which Is Better For You?

What is Indexed Whole Life Insurance

Комментарии

0:09:32

0:09:32

0:08:31

0:08:31

0:16:42

0:16:42

0:14:16

0:14:16

0:12:24

0:12:24

0:21:01

0:21:01

0:22:29

0:22:29

0:11:23

0:11:23

0:05:10

0:05:10

0:36:10

0:36:10

0:21:15

0:21:15

0:05:12

0:05:12

0:44:03

0:44:03

0:01:00

0:01:00

0:19:58

0:19:58

0:21:56

0:21:56

0:03:59

0:03:59

0:05:58

0:05:58

0:05:09

0:05:09

0:20:16

0:20:16

1:41:07

1:41:07

0:20:00

0:20:00

0:18:41

0:18:41

0:03:41

0:03:41