filmov

tv

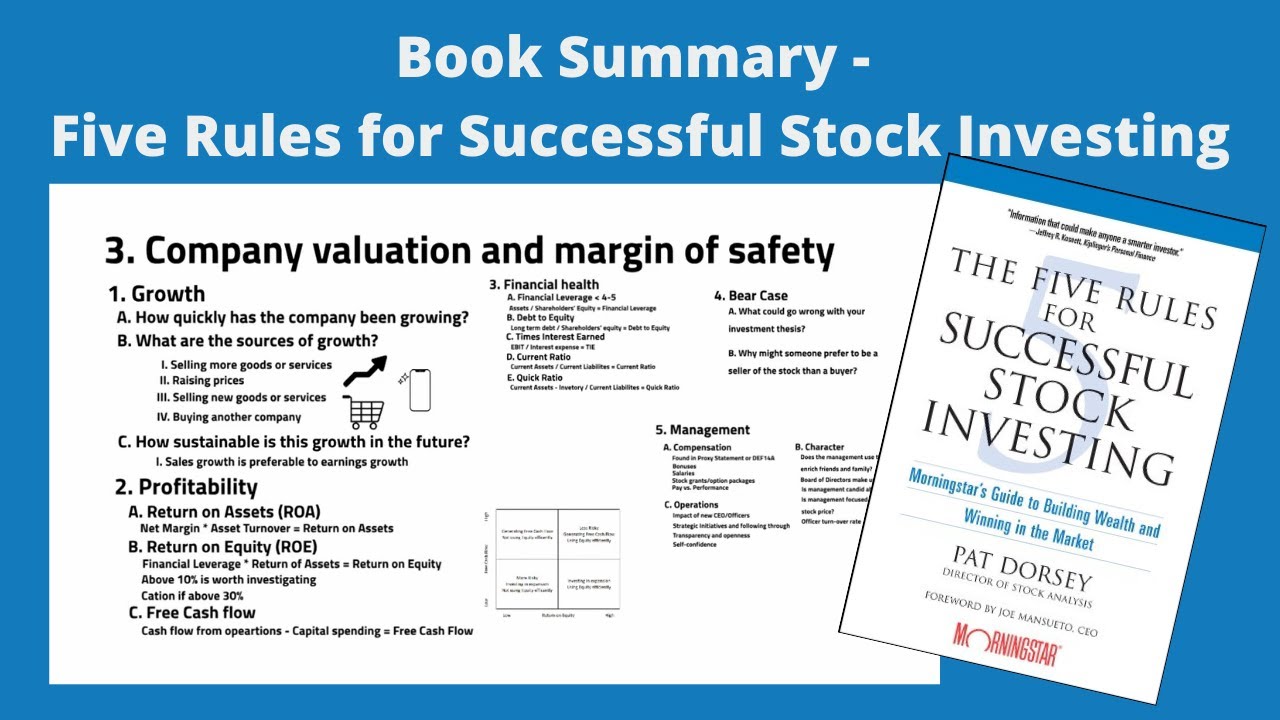

The Five Rules for Successful Stock Investing by Pat Dorsey - Book Summary

Показать описание

My summary of the book The Five Rules for successful stock investing by Pat Dorsey. The book is a great introduction to company valuation and long term "value investing".

I've based many investment decisions on the advice given in the book. The simplified 5 rules are:

1. Doing your homework - 0:58

2. Finding companies with strong competitive advantages or economic moats - 1:36

a. Evaluate profitability (free cash flow, net margins, return on equity, return on assets) - 2:55

b. Economic moats - 4:36

c. Competitive advantage period - 5:15

d. Industry analysis - 5:27

3. Having a margin of safety and company valuation - 6:12

a. Growth - 6:35

b. Profitability - 7:47

c. Financial health - 10:10

d. Bear case - 11:37

e. Management - 12:12

Ratios - 14:35

Intrinsic Value of a company - 17:46

4. Holding for the long term

5. Knowing when to sell

Shortcuts - 18:39

The book gives advice on how to do a fundamental analysis, looking at profitability, growth, leverage, economic moats. It also gives guides on how to calculate and use ratios and valuate the intrinsic value of a company.

Chapters:

00:00 Introduction

00:58 Doing your homework

01:36 Competitive Advantage and Moats

06:12 Margin of Safety and Company Valuation

14:35 Ratios

17:46 Intrinsic Value

18:39 Shortcuts

I've based many investment decisions on the advice given in the book. The simplified 5 rules are:

1. Doing your homework - 0:58

2. Finding companies with strong competitive advantages or economic moats - 1:36

a. Evaluate profitability (free cash flow, net margins, return on equity, return on assets) - 2:55

b. Economic moats - 4:36

c. Competitive advantage period - 5:15

d. Industry analysis - 5:27

3. Having a margin of safety and company valuation - 6:12

a. Growth - 6:35

b. Profitability - 7:47

c. Financial health - 10:10

d. Bear case - 11:37

e. Management - 12:12

Ratios - 14:35

Intrinsic Value of a company - 17:46

4. Holding for the long term

5. Knowing when to sell

Shortcuts - 18:39

The book gives advice on how to do a fundamental analysis, looking at profitability, growth, leverage, economic moats. It also gives guides on how to calculate and use ratios and valuate the intrinsic value of a company.

Chapters:

00:00 Introduction

00:58 Doing your homework

01:36 Competitive Advantage and Moats

06:12 Margin of Safety and Company Valuation

14:35 Ratios

17:46 Intrinsic Value

18:39 Shortcuts

Комментарии

1:11:44

1:11:44

0:03:02

0:03:02

0:20:47

0:20:47

0:28:05

0:28:05

0:04:29

0:04:29

0:15:56

0:15:56

0:22:20

0:22:20

0:04:28

0:04:28

0:00:17

0:00:17

0:01:19

0:01:19

0:05:53

0:05:53

0:06:21

0:06:21

0:04:16

0:04:16

11:59:32

11:59:32

0:11:11

0:11:11

0:01:19

0:01:19

0:06:08

0:06:08

0:02:24

0:02:24

0:10:59

0:10:59

0:13:21

0:13:21

0:10:13

0:10:13

0:10:49

0:10:49

0:26:13

0:26:13

0:42:47

0:42:47