filmov

tv

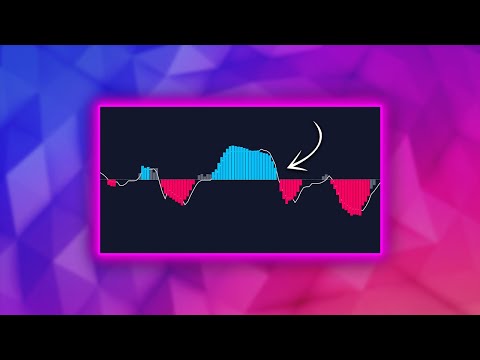

$1 OPTION TRADING STRATEGY - DOUBLE BULL SPREAD (EP. 64)

Показать описание

In today's video I want to talk about a simple options trading strategy on Robinhood that could grow your account when trading options. This options trading strategy has huge profit potential and can be very cheap to implement. This could be a great strategy to use on stocks that you are bullish on. Trading options on Robinhood can be risky, so make sure you understand how buying options and selling options work.

Affiliate Links:

Follow Us On:

20$ TO 120$ IN 1 MINUTE | Best Pocket Option Trading Strategy

100% Never Lose | Best Binary Options Trading Strategy

Very PROFITABLE Trading Strategy with Only 1 Indicator! #shorts

$1 to $8.494 | Binary Options Trading Strategy

$1 to $33.555 | Binary Options Trading Strategy

Options Trading Explained - COMPLETE BEGINNERS GUIDE (Part 1)

$1 OPTION TRADING STRATEGY - DOUBLE BULL SPREAD (EP. 64)

Options Trading For Beginners | Step By Step

1 min trading setup | Option Trading | Scalping Trading #viralshorts #scalping

NEW Pocket Option Strategy made ME +$8,045 on 1 MINUITE STRATEGY Binary Options Trading

50X Your Money With These Cheap Option Trading Strategies

Options Trading: Understanding Option Prices

THIS 1 MINUTE TRADING STRATEGY ACTUALLY WORKS | BINARY OPTIONS & FOREX

SELLING OPTIONS FOR INCOME / $1,500 A WEEK

How to trade 1 minute strategy | Pocket option trading strategy | pocket option 1 minute strategy

1 MINUTE STRATEGY FOR BINARY OPTIONS TRADING | PocketOption

Options Trading for Beginners (WITH DETAILED EXAMPLES)

Killer BINARY OPTIONS 1 MINUTE STRATEGY for ROOKIES 🔴 LIVE TRADING 🔴

I Tested This Trading Strategy & It Made 310%

Turn $1 Into $1000 In 15 Minutes | New Binary Options Trading Strategy 2023 - Pocket Option

I Found A Trading Strategy With a 225% Profit Rate #shorts

MAKING $500 OUT OF 1$ - Best and Safest strategy Binary Options trading / PocketOption or Quotex

Super Easy & Powerful Trading Strategy I Wish I Knew Before Now 😯

TRYING TRADING WITH $1 BALANCE | BINARY OPTIONS TRADING STRATEGY FOR POCKET OPTION | Binary Brokers

Комментарии

0:06:17

0:06:17

0:06:14

0:06:14

0:00:39

0:00:39

0:17:58

0:17:58

0:19:13

0:19:13

0:13:24

0:13:24

0:15:47

0:15:47

0:22:23

0:22:23

0:00:15

0:00:15

0:08:09

0:08:09

0:16:30

0:16:30

0:07:31

0:07:31

0:14:04

0:14:04

0:05:39

0:05:39

0:13:32

0:13:32

0:10:00

0:10:00

0:27:07

0:27:07

0:16:26

0:16:26

0:01:00

0:01:00

0:15:34

0:15:34

0:01:00

0:01:00

0:08:44

0:08:44

0:01:00

0:01:00

0:12:02

0:12:02