filmov

tv

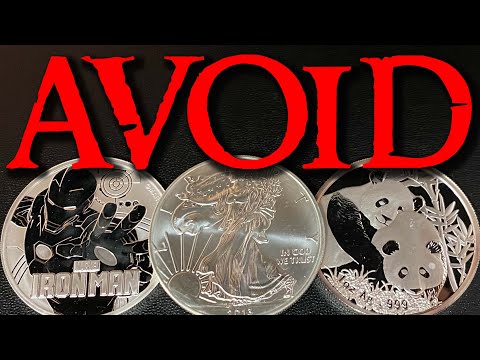

How to Avoid Silver and Gold Taxes: 3 Tips!

Показать описание

How to AVOID Silver and Gold TAXES: 3 TIPS discusses methods in which I and other bullion dealers avoid paying taxes on their silver and gold purchases. This video really applies to people who live in states where sales taxes are placed on gold and silver purchases. Many feel it is absurd to tax money, especially silver and gold bullion coins. Again, this video applies to purchases of silver and gold taxes which are placed on metals when buying. I will do a follow-up video to this discussing the sales of metals and tax implications at a later time.

PRODUCTS I USE FOR MY CHANNEL (Paid Links):

🪙Sigma Metalytics: GET $30 OFF ANY purchase using DISCOUNT CODE “EMPIRE”:

💌Mailing Address:

Empire PM

68 White St.

Ste. 7, PMB 132

Red Bank, NJ 07701

OFFICIAL RULES & DISCLAIMERS FOR GIVEAWAYS (GAW's):

Contests and giveaways on this channel are held in accordance with YouTube Community Guidelines and YouTube Terms of Service. Any entries not following the YouTube Community Guidelines will be disqualified. Contests and Giveaways are void where prohibited. Any and all personal data collected for the contest will solely be used for contest.

1. MUST BE 18 YEARS OF AGE TO PARTICIPATE.

2. No purchase necessary.

3. Void where prohibited.

4. YouTube is not a sponsor nor involved in the giveaway.

5. All of the items given away are gifts from Empire Precious Metals to the winners.

6. I will explain any rules for the Giveaway in the video or during the livestream.

7. To participate, you must be a subscriber and like the video specified. Make sure your subscriptions is set to public.

8. You must be present during the live stream to claim the prize.

9. Any entries not following the YouTube Community Guidelines will be disqualified. Personal data from the giveaway will NOT be used or shared in any way, shape or form.

YouTube’s contest giveaway policies and guidelines:

DISCLAIMER: I am not a financial advisor. I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor. All information found in my videos, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for any actions you take as a result of anything you read here.

#silver #gold #taxes

PRODUCTS I USE FOR MY CHANNEL (Paid Links):

🪙Sigma Metalytics: GET $30 OFF ANY purchase using DISCOUNT CODE “EMPIRE”:

💌Mailing Address:

Empire PM

68 White St.

Ste. 7, PMB 132

Red Bank, NJ 07701

OFFICIAL RULES & DISCLAIMERS FOR GIVEAWAYS (GAW's):

Contests and giveaways on this channel are held in accordance with YouTube Community Guidelines and YouTube Terms of Service. Any entries not following the YouTube Community Guidelines will be disqualified. Contests and Giveaways are void where prohibited. Any and all personal data collected for the contest will solely be used for contest.

1. MUST BE 18 YEARS OF AGE TO PARTICIPATE.

2. No purchase necessary.

3. Void where prohibited.

4. YouTube is not a sponsor nor involved in the giveaway.

5. All of the items given away are gifts from Empire Precious Metals to the winners.

6. I will explain any rules for the Giveaway in the video or during the livestream.

7. To participate, you must be a subscriber and like the video specified. Make sure your subscriptions is set to public.

8. You must be present during the live stream to claim the prize.

9. Any entries not following the YouTube Community Guidelines will be disqualified. Personal data from the giveaway will NOT be used or shared in any way, shape or form.

YouTube’s contest giveaway policies and guidelines:

DISCLAIMER: I am not a financial advisor. I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor. All information found in my videos, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for any actions you take as a result of anything you read here.

#silver #gold #taxes

Комментарии

0:07:12

0:07:12

0:14:02

0:14:02

0:00:28

0:00:28

0:40:35

0:40:35

0:10:50

0:10:50

0:22:37

0:22:37

0:10:58

0:10:58

0:06:03

0:06:03

0:00:21

0:00:21

0:46:02

0:46:02

0:10:48

0:10:48

0:00:32

0:00:32

0:11:44

0:11:44

0:10:17

0:10:17

0:08:39

0:08:39

0:05:14

0:05:14

0:38:45

0:38:45

0:12:51

0:12:51

0:01:01

0:01:01

0:12:40

0:12:40

0:08:04

0:08:04

0:09:58

0:09:58

0:02:46

0:02:46

0:00:26

0:00:26