filmov

tv

Partnership Tax Liability Allocation Problem 1

Показать описание

Partnership Tax Liability Allocation Problem 1.

Partnership Tax Liability Allocation Problem 1

Partnership Tax Liability Allocation Problem 2

Partnership Tax Liability Allocation Made Easy

Introduction to Partnership Tax Allocations - Substantial Economic Effect

Introduction to Partnership Tax Allocations - Substantial Economic Effect Part 2

Allocation of Non-Recourse Deductions Problem 1

Partnership Tax Allocations - Nonrecourse Deductions Intro Part 1 of 3

Partnership Taxation law lecture #5 - Allocations (substantiality)

Allocating partnership profits to partners - ACCA Taxation TX-UK lectures

Partnership Taxation law lecture #11 - 704c Allocations (Review Problems

Allocations Requiring Substantial Economic Effect Problem 3

Partnership Taxation law lecture #13 - Section 752 (recourse debt

Allocations Requiring Substantial Economic Effect Problem 2

Here's why partnership tax is complicated ⛔

Partnership Allocations - Intro & Substantial Econ Effect

Transactions Between Partnership and Partner Problem 1

Advanced Partnership Formation Problem 2

Partnership Tax Pro Rata Distributions Problem 2

Why your LLC’s Minimum Gain Matters - A Partnership Business Tax Topic

Partnership Taxation: Basis - Lesson 1

Recourse vs Nonrecourse Debt Allocation in Partnerships

Partnership Formation and Operations Problem 2

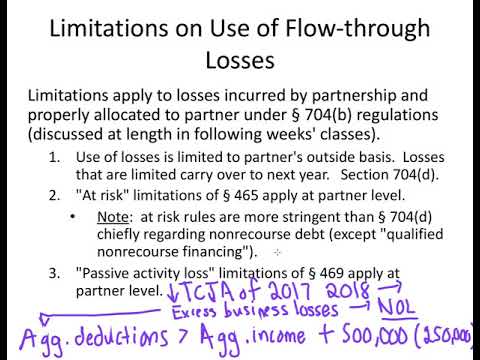

Loss Limitations and Liability Allocation

Allocations Requiring Substantial Economic Effect Problem 1

Комментарии

0:18:24

0:18:24

0:46:18

0:46:18

0:28:31

0:28:31

0:05:13

0:05:13

0:03:38

0:03:38

0:48:27

0:48:27

0:05:40

0:05:40

1:13:38

1:13:38

0:50:51

0:50:51

1:12:34

1:12:34

0:26:35

0:26:35

1:15:30

1:15:30

0:22:02

0:22:02

0:00:48

0:00:48

0:48:33

0:48:33

0:21:43

0:21:43

0:28:03

0:28:03

0:52:00

0:52:00

0:12:10

0:12:10

0:05:04

0:05:04

0:04:30

0:04:30

0:16:02

0:16:02

0:29:01

0:29:01

0:14:10

0:14:10