filmov

tv

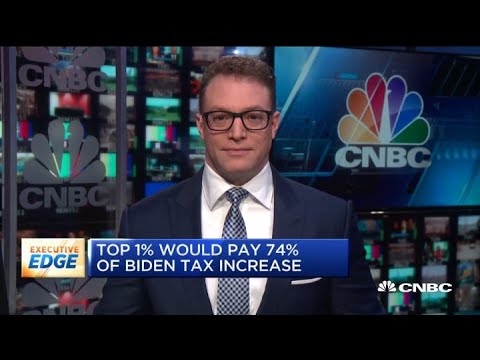

Breaking down Democrats' latest tax plans: Open Markets Institute's Goldstein

Показать описание

The White House issued a framework for a $1.75 trillion social and climate spending bill on Thursday — and would finance more than half of it from tax reforms aimed at wealthy Americans.

The plan would raise revenue by levying a tax surcharge on those making more than $10 million a year, raising taxes for some high-income business owners and strengthening IRS tax enforcement, according to the outline.

The framework was the product of several months of negotiations between moderate and progressive Democrats. Together, proposals targeting wealthy taxpayers would raise about $1 trillion of the nearly $2 trillion of total revenue being raised. (The rest would come from new taxes on corporations and stock buybacks, for example.)

President Joe Biden said the legislation was fully paid for and would help reduce the federal budget deficit.

“I don’t want to punish anyone’s success; I’m a capitalist,” President Biden said in a speech Thursday. “All I’m asking is, pay your fair share.”

Biden reiterated that households earning less than $400,000 a year wouldn’t “pay a penny more” in federal taxes and would likely get a tax cut from the proposal, via elements like the enhanced child tax credit, and reduced costs on child care and health care.

The framework omits specifics beyond high-level detail. But it seems to abandon many tax proposals issued last month by the House Ways and Means Committee, even while the overarching policy goal of targeting the wealthy is the same.

For example, the framework doesn’t raise the current top 37% income tax rate or 20% top rate on investment income (with the exception of multimillionaires subject to the proposed surtax). It also wouldn’t impose new required distributions from big retirement accounts or alter rules around estate taxes and trusts, for example.

“It’s far slimmed down,” said Kyle Pomerleau, a senior fellow at the American Enterprise Institute, a right-leaning think tank. “It forgoes a lot of things they’d proposed in the House bill.”

Of course, the proposal needs near-unanimous backing from Democrats in the House and Senate, given their razor-thin majorities, and it’s unclear whether it has the party’s full support.

Here are some of the major provisions in the Build Back Better framework.

Millionaire and billionaire surtax

The plan would impose a new surcharge on the top 0.02% of Americans, according to the White House.

There would be a 5% surtax on modified adjusted gross income of more than $10 million, and an additional 3% (or, a total 8% surtax) on income of more than $25 million, according to a summary of provisions released Thursday.

The surtax is estimated to raise $230 billion over 10 years. It would kick in after Dec. 31.

“This is one of the main provisions in here that directly taxes the wealthy,” said Garrett Watson, senior policy analyst at the Tax Foundation.

It would affect a much larger number of people than another tax floated by Senate Democrats earlier this week on the wealth of billionaires. That tax would have affected about 700 people. There were 22,112 tax returns reporting income of more than $10 million in 2018, according to most recent IRS data.

Essentially, an 8% surtax would mean the highest earners pay a top 45% federal marginal income tax rate on wages and business income. (They currently pay 37%.)

They’d also pay a top 28% top federal rate on long-term capital gains and dividends, plus the existing 3.8% net investment income tax on high earners. (Taxes on long-term capital gains apply to growth on stocks and other assets sold after one year of ownership. The top tax rate is currently 20%.)

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

Комментарии

0:04:35

0:04:35

0:03:40

0:03:40

0:04:08

0:04:08

0:10:13

0:10:13

0:10:48

0:10:48

0:02:12

0:02:12

0:01:43

0:01:43

0:07:46

0:07:46

0:08:54

0:08:54

0:04:23

0:04:23

0:34:26

0:34:26

0:01:35

0:01:35

0:02:46

0:02:46

0:28:49

0:28:49

0:09:24

0:09:24

0:07:00

0:07:00

0:06:56

0:06:56

0:00:22

0:00:22

0:06:13

0:06:13

0:04:25

0:04:25

0:01:07

0:01:07

0:10:51

0:10:51

0:07:15

0:07:15

0:07:50

0:07:50