filmov

tv

Determine Monthly Deposit Needed Given Future Value of Savings Annuity (Formula)

Показать описание

This video explains how to determine the monthly deposit needed to have a given future value of a saving annuity using a formula.

Determine Monthly Deposit Needed Given Future Value of Savings Annuity (Formula)

Determine Monthly Deposit Needed Given Future Value of Savings Annuity (TI-84 TVM Solver)

How Does Savings Account Interest Work?

Ex: Compounded Interest Formula - Determine Deposit Needed (Present Value)

Compound interest with monthly deposit

Simple Interest: Find a Deposit Needed for a Balance in the Future

Determine the Required Savings to Reach a Financial Goal

Boost Your Savings: The Easiest Bank Interest Calculator to Earn More Money!

Initial Deposit Needed with Deposits to Reach a Financial Goal (TI-84 TVM Solver)

Recurring Deposit In Telugu - Top 10 Banks Offering Highest Interest Rates On RD | Complete Details

Ex 1: Compounded Interest Formula - Quarterly

Cash Deposit in Bank Income Tax Malayalam |CA Subin VR

How to calculate Recurring deposit(RD) in excel - RD calculator - Quarterly & Monthly interest ...

How to grow money through a fixed deposit account

Invest GHS 10,000 in Fixed deposit for 6 months at the rate of 15% - Practical Returns Insight

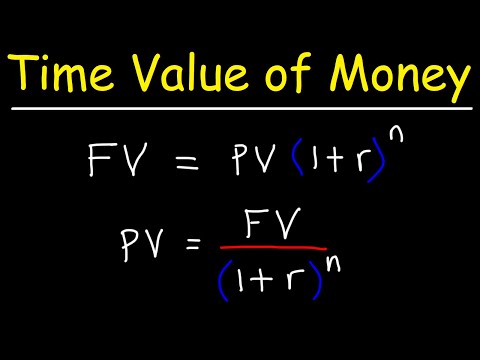

Time Value of Money - Present Value vs Future Value

Fixed Deposit Interest Calculation - FD Interest - FD Maturity Amount and Interest earned - #FD

Fixed Deposit in Telugu - Common Mistakes To Avoid While Investing In Fixed Deposit | FDs | Kowshik

How much to deposit in an account earning 6% compounded monthly to end with $4000 after 15 years?

Compound Interest

How to Calculate the RIGHT Lot Size for Forex Trading 📈

GCSE Maths - How to Calculate Simple Interest #95

HOW TO CALCULATE FIXED DEPOSIT INTEREST | MONTHLY COMPOUNDING & QUARTERLY COMPOUNDING #banking

FD or RD me kya difference hai | Fixed deposit or recurring deposit

Комментарии

0:05:28

0:05:28

0:05:59

0:05:59

0:01:50

0:01:50

0:04:48

0:04:48

0:08:17

0:08:17

0:03:11

0:03:11

0:07:07

0:07:07

0:05:42

0:05:42

0:02:57

0:02:57

0:11:28

0:11:28

0:03:23

0:03:23

0:04:33

0:04:33

0:02:22

0:02:22

0:02:08

0:02:08

0:08:36

0:08:36

0:05:14

0:05:14

0:01:40

0:01:40

0:13:42

0:13:42

0:02:04

0:02:04

0:10:52

0:10:52

0:09:19

0:09:19

0:04:05

0:04:05

0:03:55

0:03:55

0:00:42

0:00:42