filmov

tv

Dubai Offshore Company Formation: Your Guide To Register

Показать описание

A thorough and easy-to-understand guide to registering a Dubai offshore company including all regulations, benefits, limitations and disadvantages

A guide to establishing a Dubai offshore company

What is an offshore entity?

An offshore company may be defined either as:

A legalized company that is incorporated outside of its principal operations’ jurisdiction, or

One incorporated in a small, low-tax jurisdiction (specifically, an offshore financial centre)

The United Arab Emirates (UAE), particularly Dubai, is considered one of the best offshore jurisdictions for a number of reasons. This region differs from other countries like Switzerland, Belize, Seychelles, Cyprus, Panama or the English tax haven, the Isle of Man (UK).

Important information relevant to Dubai offshore company formation is provided throughout this page, including its many benefits, certain limitations, and some disadvantages.

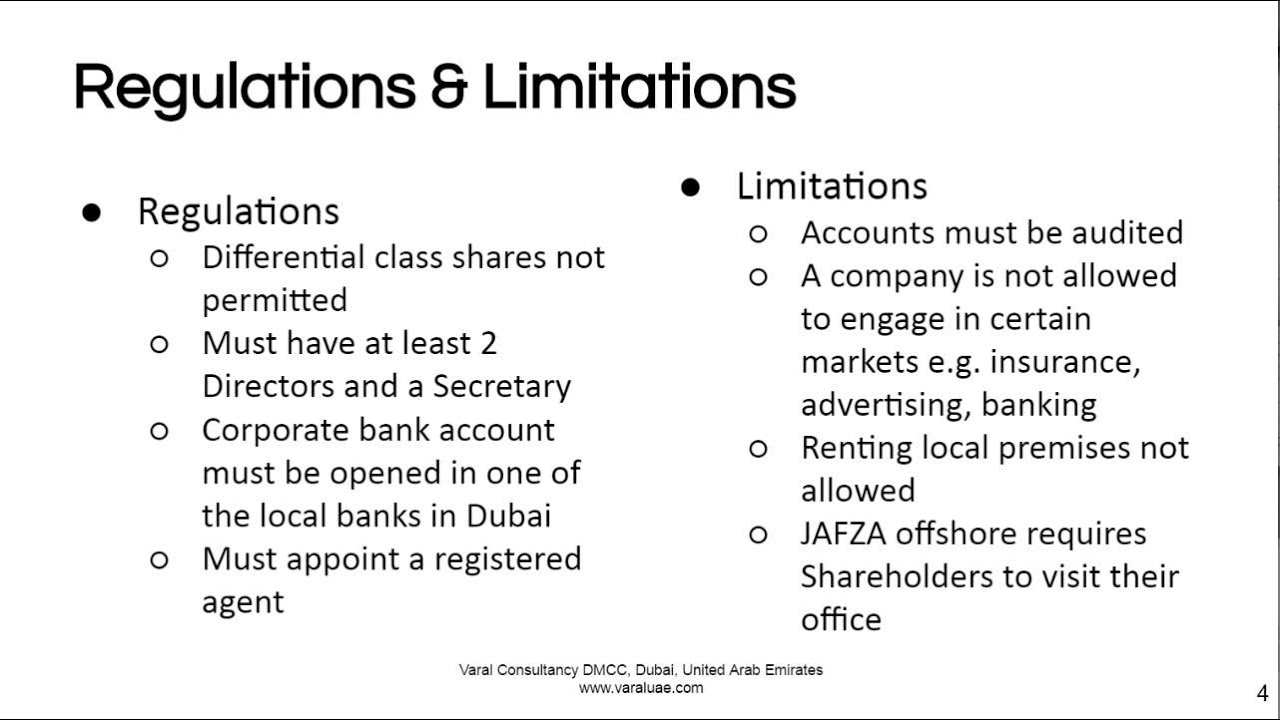

Dubai offshore company formation: Regulations

Regulations have been drawn up to deliver the efficiency and convenience of a Dubai offshore company but, at the same time, maintain esteem with authorities and/ governments in the international financial arena

- All shares are required to be fully settled once earmarked or distributed; differential classes of shares or bearer instruments are not allowed

- An offshore company must have at least two directors and a secretary. The latter may be one of the company’s directors and must be a resident of the UAE

- A corporate bank account must be opened in one of the local banks in Dubai

- The offshore company must appoint its business agents (consultants, auditors, and legal firms) from among those listed in the registry of approved professional agents, which is maintained by the relevant Dubai offshore authorities

Dubai offshore company formation: Beneficial features

The number of benefits to individuals and corporations related to Dubai offshore company formation is numerous.

Here are some of them:

- As in most other offshore jurisdictions, Dubai Offshore provides total tax exemption. The region supports minimum taxation, in some instances

- Certain rules pertaining to “thin capitalization” are not imposed. For clarity: a “thinly capitalized” company is one with a very high gearing – that is, the company’s capital is composed of a much bigger proportion of debt vis-à-vis its equity

- Absolute foreign ownership is allowed. Investors need not call Dubai home

- Simplicity in setting up and maintaining a company, which is evident in its less stringent reporting requirements. The terms and conditions of recordkeeping are very limited which decreases any related fees and costs

0:01:39

0:01:39

0:08:46

0:08:46

0:03:03

0:03:03

0:08:52

0:08:52

0:10:59

0:10:59

0:07:29

0:07:29

0:03:05

0:03:05

0:07:52

0:07:52

0:10:53

0:10:53

0:01:50

0:01:50

0:06:21

0:06:21

0:00:17

0:00:17

0:19:52

0:19:52

0:02:35

0:02:35

0:02:07

0:02:07

0:01:22

0:01:22

0:04:03

0:04:03

0:01:54

0:01:54

0:06:39

0:06:39

0:08:06

0:08:06

0:02:38

0:02:38

0:01:00

0:01:00

0:00:26

0:00:26

0:01:06

0:01:06