filmov

tv

How to Value a Stock! (Stock Valuation Spreadsheet Tutorial)

Показать описание

In this video, I take you step by step on 4 different ways to value a stock, and give you step by step tutorial on how to use my stock valuation spreadsheet. Let me know your thoughts in the comments below!

Social Media (and other fun stuff):

I am not a Financial advisor or licensed professional. Nothing I say or produce on YouTube, or anywhere else, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk. Some of the links in the description may be affiliate links.

How Peter Lynch Values a Stock! (Peter Lynch's Valuation Tutorial)

Stock Multiples: How to Tell When a Stock is Cheap/Expensive

How to Calculate the Intrinsic Value of a Stock in 2023 (Full Example)

Warren Buffett: The Easiest Way To Value Stocks

How I Find My Stocks: Step-By-Step Method

How to Value a Stock! (Stock Valuation Spreadsheet Tutorial)

Warren Buffett: How to Calculate the Instrinsic Value of a Stock

Warren Buffett Explains How To Calculate Intrinsic Value Of A Stock

Is RIOT Stock a Hidden Value Play for Smart Investors?

How I Research Stocks - Step-by-Step Fundamental Analysis

The Steps to Finding the Value of a Stock

How to Calculate the Intrinsic Value of a Stock (Full Example)

How To Calculate Intrinsic Value (AMZN Stock Example + Excel Template)

How to Calculate the Intrinsic Value of a Stock like Benjamin Graham! (Step by Step)

HOW TO FIND THE VALUE OF A STOCK 📈 | How To Value A Company

How to Value a Stock - Picking the Best Valuation Method for Each Company

How to Tell If a Stock Is UNDERVALUED or OVERVALUED

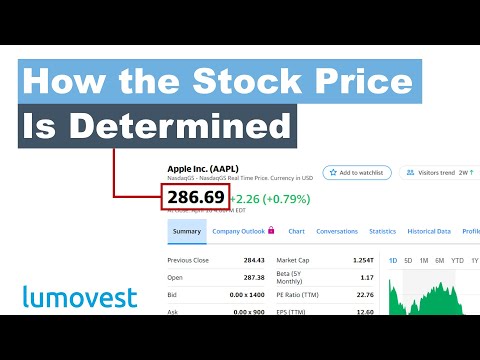

How is the Stock Price Determined? | Stock Market for Beginners (Part 1) | Lumovest

A Beginners Guide to Stock Valuation (Intrinsic Value and Margin of Safety)

Ultimate Stock Valuation Spreadsheet Tutorial! (How to Value a Stock!)

How I Pick My Stocks: Investing For Beginners

Fundamental Analysis: How to Analyze and Value Stocks

How To Calculate the INTRINSIC VALUE of a Stock (Updated)

Warren Buffett: The Simplest Way To Value Any Stock

Комментарии

0:05:53

0:05:53

0:09:47

0:09:47

0:12:07

0:12:07

0:14:19

0:14:19

0:12:31

0:12:31

0:23:05

0:23:05

0:13:35

0:13:35

0:08:56

0:08:56

0:05:42

0:05:42

0:19:18

0:19:18

0:07:49

0:07:49

0:16:47

0:16:47

0:14:43

0:14:43

0:16:21

0:16:21

0:22:29

0:22:29

0:12:51

0:12:51

0:09:56

0:09:56

0:12:29

0:12:29

0:13:33

0:13:33

0:15:53

0:15:53

0:13:33

0:13:33

0:52:54

0:52:54

0:12:45

0:12:45

0:11:59

0:11:59