filmov

tv

Understanding Cointegration for Quant Traders | How to Identify Pairs for Algo Trading

Показать описание

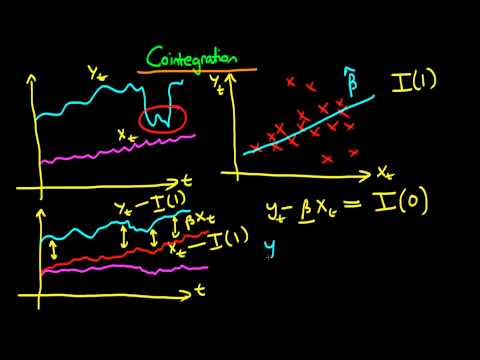

In this video, we dive into the concept of cointegration and its crucial role in quant trading and algorithmic trading strategies. Cointegration helps traders identify pairs of assets whose prices move together over time, creating profitable opportunities for statistical arbitrage.

We'll explain the concept of stationarity and use an intuitive example: a drunk man and his dog, both on random walks but staying close to each other. This illustrates how cointegration works with price series, allowing traders to exploit price divergences for pairs trading.

If the spread between two asset prices is stationary—meaning it fluctuates around a mean—the assets are considered cointegrated. Unlike simple correlation, cointegration identifies deeper price relationships that are critical for successful arbitrage strategies.

What's covered:

-Basics of cointegration in financial markets

-The difference between cointegration and correlation

-How to identify pairs for quant trading

-Application of cointegration in statistical arbitrage strategies

About Quantra:

Quantra is a leading online learning platform that offers bite-sized, interactive courses on algorithmic trading and quantitative trading. Perfect for busy professionals looking to enhance their trading skills with real-world, implementable strategies.

🔔 Subscribe for more trading insights!

#Cointegration #QuantTrading #AlgoTrading #PairsTrading #StatisticalArbitrage #AlgorithmicTrading #QuantTrader #TradingStrategies #QuantraCourses #QuantInsti #QuantFinance #TradingEducation #MarketAnalysis #HFT #QuantitativeAnalysis #FinancialMarkets #StockTrading #ForexTrading #ArbitrageTrading #AutomatedTrading #TradingCourse #StatArb #TradingPairs #AlgoTrader #QuantitativeTrading #QuantAlgo #AlgoTradingStrategy #MarketEfficiency #StatisticalTrading #AlgoTradingCourses #MachineLearningTrading #Backtesting

We'll explain the concept of stationarity and use an intuitive example: a drunk man and his dog, both on random walks but staying close to each other. This illustrates how cointegration works with price series, allowing traders to exploit price divergences for pairs trading.

If the spread between two asset prices is stationary—meaning it fluctuates around a mean—the assets are considered cointegrated. Unlike simple correlation, cointegration identifies deeper price relationships that are critical for successful arbitrage strategies.

What's covered:

-Basics of cointegration in financial markets

-The difference between cointegration and correlation

-How to identify pairs for quant trading

-Application of cointegration in statistical arbitrage strategies

About Quantra:

Quantra is a leading online learning platform that offers bite-sized, interactive courses on algorithmic trading and quantitative trading. Perfect for busy professionals looking to enhance their trading skills with real-world, implementable strategies.

🔔 Subscribe for more trading insights!

#Cointegration #QuantTrading #AlgoTrading #PairsTrading #StatisticalArbitrage #AlgorithmicTrading #QuantTrader #TradingStrategies #QuantraCourses #QuantInsti #QuantFinance #TradingEducation #MarketAnalysis #HFT #QuantitativeAnalysis #FinancialMarkets #StockTrading #ForexTrading #ArbitrageTrading #AutomatedTrading #TradingCourse #StatArb #TradingPairs #AlgoTrader #QuantitativeTrading #QuantAlgo #AlgoTradingStrategy #MarketEfficiency #StatisticalTrading #AlgoTradingCourses #MachineLearningTrading #Backtesting

0:01:55

0:01:55

0:06:11

0:06:11

0:54:51

0:54:51

0:04:56

0:04:56

0:01:36

0:01:36

0:01:50

0:01:50

0:15:00

0:15:00

0:15:00

0:15:00

2:18:45

2:18:45

0:21:23

0:21:23

0:03:21

0:03:21

0:20:27

0:20:27

0:00:44

0:00:44

0:05:17

0:05:17

0:02:48

0:02:48

0:03:30

0:03:30

0:54:08

0:54:08

0:11:31

0:11:31

0:15:36

0:15:36

0:10:36

0:10:36

0:02:28

0:02:28

0:26:05

0:26:05

0:18:30

0:18:30

0:08:43

0:08:43