filmov

tv

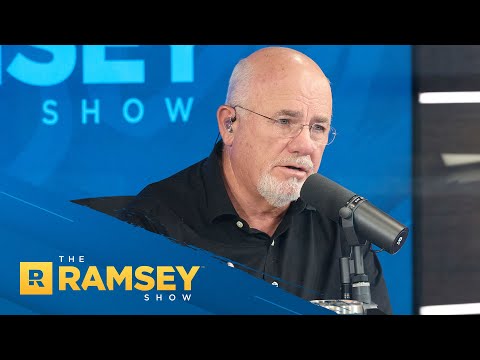

Financial Desperation in 2024: The Surging Cost of Living and Its Toll on Americans

Показать описание

Join this channel to get access to perks:

Discover the grim reality of financial struggle in 2024 as nearly 40% of Americans grapple with meeting their monthly bills, according to recent findings. In this insightful video, we delve into the factors contributing to this crisis, such as escalating living costs and insufficient incomes. Learn how Americans are adapting by changing their spending habits, taking on side jobs, and relying increasingly on credit cards. We'll also discuss the broader economic implications of these survival strategies and what it means for the future of financial stability in the U.S.

📉 Key Points Covered:

Analysis of the current economic conditions leading to widespread financial hardship among Americans.

Insights into how high living costs, stagnant wages, and rising debt are forcing many to rethink their spending and saving strategies.

Exploration of alternative income sources and financial adjustments people are making to cope with the harsh economic climate.

Discussion on the potential long-term effects of these changes on the economy and individual financial health.

🚀 Why Watch?

Understand the severe financial pressures that are shaping consumer behavior in 2024.

Gain insights into the economic strategies Americans are employing to manage the high cost of living.

Learn about the impact of these financial strategies on the overall economy and what it could mean for future economic policies.

💬 Join the Conversation:

Are you experiencing financial challenges due to the current economic climate? What measures have you taken to manage your expenses? Share your strategies and learn from others in the comments below!

👉 Subscribe for more in-depth discussions on economic trends, personal finance advice, and strategic responses to economic challenges.

#FinancialCrisis2024 #CostOfLiving #EconomicStrategies #PersonalFinance #CreditCardDebt

Discover the grim reality of financial struggle in 2024 as nearly 40% of Americans grapple with meeting their monthly bills, according to recent findings. In this insightful video, we delve into the factors contributing to this crisis, such as escalating living costs and insufficient incomes. Learn how Americans are adapting by changing their spending habits, taking on side jobs, and relying increasingly on credit cards. We'll also discuss the broader economic implications of these survival strategies and what it means for the future of financial stability in the U.S.

📉 Key Points Covered:

Analysis of the current economic conditions leading to widespread financial hardship among Americans.

Insights into how high living costs, stagnant wages, and rising debt are forcing many to rethink their spending and saving strategies.

Exploration of alternative income sources and financial adjustments people are making to cope with the harsh economic climate.

Discussion on the potential long-term effects of these changes on the economy and individual financial health.

🚀 Why Watch?

Understand the severe financial pressures that are shaping consumer behavior in 2024.

Gain insights into the economic strategies Americans are employing to manage the high cost of living.

Learn about the impact of these financial strategies on the overall economy and what it could mean for future economic policies.

💬 Join the Conversation:

Are you experiencing financial challenges due to the current economic climate? What measures have you taken to manage your expenses? Share your strategies and learn from others in the comments below!

👉 Subscribe for more in-depth discussions on economic trends, personal finance advice, and strategic responses to economic challenges.

#FinancialCrisis2024 #CostOfLiving #EconomicStrategies #PersonalFinance #CreditCardDebt

Комментарии

0:18:42

0:18:42

0:17:27

0:17:27

0:25:38

0:25:38

0:18:16

0:18:16

0:00:33

0:00:33

0:11:29

0:11:29

0:13:09

0:13:09

0:16:09

0:16:09

0:00:53

0:00:53

0:14:36

0:14:36

0:00:51

0:00:51

0:00:36

0:00:36

0:01:01

0:01:01

0:00:51

0:00:51

0:00:58

0:00:58

0:00:41

0:00:41

0:07:42

0:07:42

0:18:50

0:18:50

0:02:27

0:02:27

0:00:53

0:00:53

2:07:25

2:07:25

0:00:40

0:00:40

0:00:58

0:00:58

0:01:00

0:01:00