filmov

tv

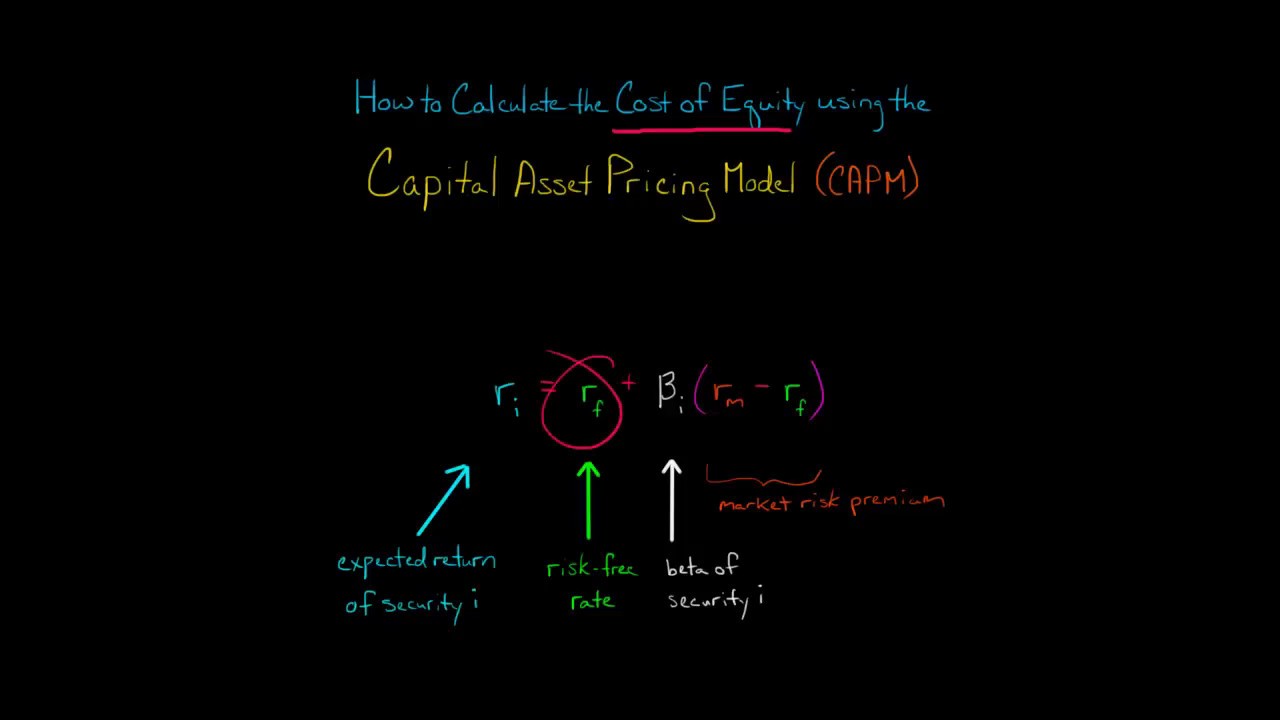

How to Calculate Cost of Equity using CAPM

Показать описание

This video shows how to calculate a company's cost of equity by using the Capital Asset Pricing Model (CAPM).

You can calculate the cost of equity for a company by using the following formula:

Cost of Equity = Risk-free Rate + Beta * (Expected Market Return - Risk-free Rate)

For example, let's say the risk-free rate is 2% and the expected market return is 10%. If a company's beta is 2.5, its cost of equity would be 22%. This cost of equity is the required rate of return that investors would expect to receive based on the company's systematic risk. If the systematic risk were higher (for example, a company with a beta of 3.0), then the cost of equity would be higher (26%) because investors would expect a higher return to compensate for bearing a higher level of systematic risk.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

You can calculate the cost of equity for a company by using the following formula:

Cost of Equity = Risk-free Rate + Beta * (Expected Market Return - Risk-free Rate)

For example, let's say the risk-free rate is 2% and the expected market return is 10%. If a company's beta is 2.5, its cost of equity would be 22%. This cost of equity is the required rate of return that investors would expect to receive based on the company's systematic risk. If the systematic risk were higher (for example, a company with a beta of 3.0), then the cost of equity would be higher (26%) because investors would expect a higher return to compensate for bearing a higher level of systematic risk.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:03:36

0:03:36

0:03:17

0:03:17

0:01:21

0:01:21

0:05:32

0:05:32

0:11:07

0:11:07

0:03:23

0:03:23

0:02:33

0:02:33

0:00:11

0:00:11

0:00:14

0:00:14

0:05:07

0:05:07

0:01:34

0:01:34

0:04:15

0:04:15

0:01:00

0:01:00

0:16:30

0:16:30

0:00:59

0:00:59

0:05:08

0:05:08

0:01:42

0:01:42

0:06:16

0:06:16

0:00:20

0:00:20

0:00:57

0:00:57

0:02:29

0:02:29

0:00:20

0:00:20

0:05:45

0:05:45

0:05:35

0:05:35