filmov

tv

The Loanable Funds Market- Macro Topic 4.7

Показать описание

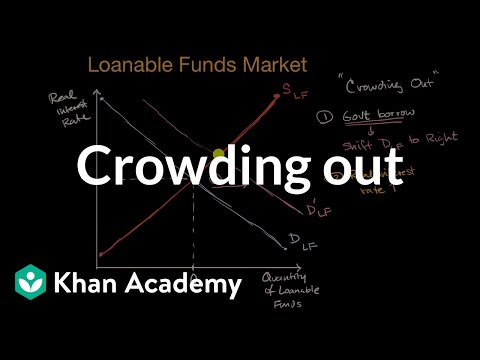

The loanable funds market is made up of borrowers and lenders and it sets the real interest rate. Make sure you can draw changes on the graph and explain the effects of saving and deficit spending, including crowding out. Be sure to like and subscribe. Thanks for watching.

Need more help? Check out my Ultimate Review Packet:

Need more help? Check out my Ultimate Review Packet:

The Loanable Funds Market- Macro Topic 4.7

Loanable funds market | Financial sector | AP Macroeconomics | Khan Academy

Macro 4.7 Loanable Funds Market

The Loanable Funds Market and Crowding Out

Macro: Unit 4.7 -- The Loanable Funds Market

Introduction to the Loanable Funds Market

Money Growth and Inflation- Macro Topic 5.3

Macro 4.18 - Market for Loanable Funds

The Money Market (1 of 2)- Macro Topic 4.5

Review of Macro Graphs: The Loanable Funds Market

AP Macroeconomics- Budget Deficit & Loanable Funds Market

Lecture 8 - The Loanable Funds Market

The Loanable Funds Market: Embracing Complexity

Crowding out | AP Macroeconomics | Khan Academy

Macroeconomics: Loanable Funds Market, Real Interest Rate, Capital Flow, Government Borrowing

Macro 4.7 - Loanable Funds Model - NEW!

13.2 The Market for Loanable Funds

13.3a Introduction to Market for Loanable Funds

AP Macroeconomics: Loanable Funds Market

AP Macroeconomics- Loanable Funds Market and a Government Surplus

The Loanable Funds Market - Finance, Saving, and Investment (2/3) | Principles of Macroeconomics

Saving and Borrowing

Change In Investment Demand and the Loanable Funds Market - Intermediate Macroeconomics

Macro Majesties — The Loanable Funds Market

Комментарии

0:05:15

0:05:15

0:07:32

0:07:32

0:10:59

0:10:59

0:03:08

0:03:08

0:23:45

0:23:45

0:03:33

0:03:33

0:08:09

0:08:09

0:03:49

0:03:49

0:03:25

0:03:25

0:13:24

0:13:24

0:03:36

0:03:36

0:10:00

0:10:00

0:10:56

0:10:56

0:03:55

0:03:55

0:07:37

0:07:37

0:07:56

0:07:56

0:03:39

0:03:39

0:17:27

0:17:27

0:10:50

0:10:50

0:02:39

0:02:39

0:07:50

0:07:50

0:08:20

0:08:20

0:07:17

0:07:17

0:08:58

0:08:58