filmov

tv

How Much Gold Do I Need To Retire? 1oz Per Month?

Показать описание

-----------------------------------------------------------------

GoldSilver is one of the most trusted names in precious metals. Since 2005, we’ve provided investors with both education and world-class bullion dealer services.

We offer a wide selection of bullion products, private vault storage, global shipping, and easy payment choices.

Check out our sister channel Wealthion @Wealthion featuring regular guests such as Jim Rickards, Rick Rule, Stephanie Pomboy, Lance Roberts, John Hathaway, Alisdair McLeod, Simon Hunt, John Rubino, Jim Rogers, Marc Faber and more.

As always, thank you for your support. M.

GoldSilver is one of the most trusted names in precious metals. Since 2005, we’ve provided investors with both education and world-class bullion dealer services.

We offer a wide selection of bullion products, private vault storage, global shipping, and easy payment choices.

Check out our sister channel Wealthion @Wealthion featuring regular guests such as Jim Rickards, Rick Rule, Stephanie Pomboy, Lance Roberts, John Hathaway, Alisdair McLeod, Simon Hunt, John Rubino, Jim Rogers, Marc Faber and more.

As always, thank you for your support. M.

Can You Have TOO MUCH Gold? How Much Gold Should You Have?

How much gold does it take to = $100?

How Much Gold Should You Buy? It’s (Probably) Not What You Think

How much can you make gold panning?

How Much Gold Do You Really Need To Own?

How much gold and silver should you own?

Do You Have Enough? How Much Gold and Silver To Have

Why Does the USA have so Much Gold!?

Gold confiscation Act of 1933

How Much Gold do the Ultra Wealthy Have?

HOW MUCH Silver & Gold to OWN 🤔🤔 (Minimum Guide)

How Much Gold Does USA Have?

How Much Will Coin Shops Pay for your Gold Coins?

How Much Gold Should You Own? At A Minimum

How Much Gold And Silver Do You Need? (Calculation Breakdown)

How much Gold do you get for $100 over time?

How Much Gold Would You Need to Start Over?

How Much Gold or Silver Should I Own, By Age? #silver #gold

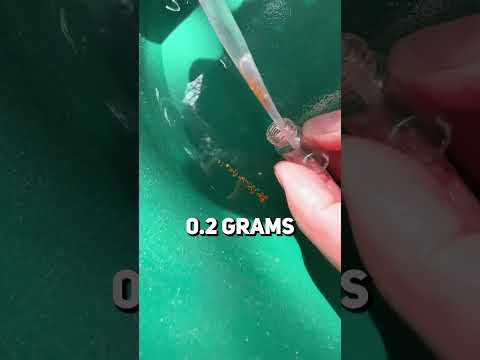

How Much Gold Is In Home Depot Sand?

Is Gold Really Worth The Investment?

How Much Gold Does the Average Person Need?

How Much GOLD In A Yard Of Home Depot Sand?

How Much Gold Did You Get?

How Much Gold has Been Found on Earth?

Комментарии

0:10:40

0:10:40

0:00:21

0:00:21

0:06:54

0:06:54

0:00:20

0:00:20

0:14:18

0:14:18

0:00:27

0:00:27

0:10:58

0:10:58

0:00:31

0:00:31

0:00:53

0:00:53

0:11:51

0:11:51

0:08:02

0:08:02

0:01:00

0:01:00

0:01:00

0:01:00

0:11:28

0:11:28

0:21:45

0:21:45

0:00:19

0:00:19

0:00:58

0:00:58

0:08:56

0:08:56

0:00:30

0:00:30

0:00:58

0:00:58

0:08:40

0:08:40

0:00:39

0:00:39

0:00:08

0:00:08

0:00:22

0:00:22