filmov

tv

How to Claim Tax Deductible Charitable Donations

Показать описание

2020 Guide: Tax Deductible Charitable Donations

Today we’re going to be going over everything you need to know about tax-deductible donations. We’ll be covering what types of donations are eligible, how to claim your deduction if it even makes sense for you to donate for tax purposes... and everything in between.

Note that for guidance or advice specific to your situation, you should consult with your tax or legal professional.

///

Disclaimer: The information provided in this video is for informational purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).

Today we’re going to be going over everything you need to know about tax-deductible donations. We’ll be covering what types of donations are eligible, how to claim your deduction if it even makes sense for you to donate for tax purposes... and everything in between.

Note that for guidance or advice specific to your situation, you should consult with your tax or legal professional.

///

Disclaimer: The information provided in this video is for informational purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).

How to Claim Tax Deductible Charitable Donations

What is a Tax Write-Off and Tax Deduction for Small Businesses?

9 HUGE Tax Write Offs for Individuals (EVERYONE can use these)

SELF-EMPLOYED EXPENSE BASICS – WHAT CAN YOU CLAIM?

How To Claim Tax Deductible Donations With Churches or Charities.

WHAT DOES TAX DEDUCTIBLE ACTUALLY MEAN?

When Is Sponsorship Tax Deductible?

AJ Bell Youinvest - How to claim tax relief

Podcast: Making adjustments on the California return

Tax Deductible Food and Drink Expenses: Pay Less Taxes LEGALLY

Are home improvement expenses tax deductible?

What Educational Expenses Are Tax Deductible? TurboTax Tax Tip Video

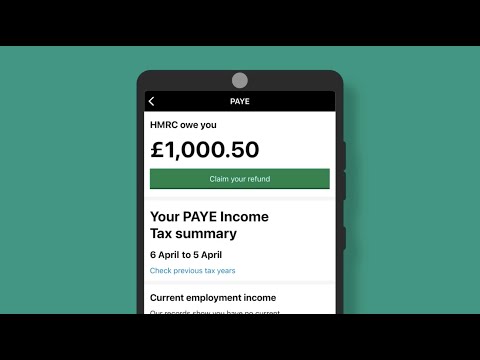

How do I use the HMRC app to claim a tax refund?

Claiming tax relief for common employment expenses

Claiming Tax Relief

How to Lodge Tax Return in Australia Yourself (2024) | Step by Step Guide | Tax Refund 2024

Are Fraud Losses Tax Deductible? (online scam and ponzi schemes)

14 Biggest Tax Write Offs for Small Businesses! [What the Top 1% Write-Off]

Maximise Your Business Travel Budget: Discover Which Expenses are Tax Deductible

Claim Tax Relief as a Doctor in the NHS

How To Claim NHIF Relief When Filing Your 2022 Income Tax Returns

Tax Deductible Expenses in New Zealand

Are medical expenses deductible?

Best Tax Saving Guide | Complete tax planning for salaried persons | LLA

Комментарии

0:07:26

0:07:26

0:12:47

0:12:47

0:17:22

0:17:22

0:09:55

0:09:55

0:02:36

0:02:36

0:03:43

0:03:43

0:02:49

0:02:49

0:04:31

0:04:31

0:04:39

0:04:39

0:02:45

0:02:45

0:00:45

0:00:45

0:01:38

0:01:38

0:01:33

0:01:33

0:09:39

0:09:39

0:01:53

0:01:53

0:06:58

0:06:58

0:03:13

0:03:13

0:18:43

0:18:43

0:05:43

0:05:43

0:05:14

0:05:14

0:01:00

0:01:00

0:02:02

0:02:02

0:00:54

0:00:54

0:18:58

0:18:58