filmov

tv

Living on $1 Million After Taxes in Luxembourg #luxembourg #democrat #republican #salary #taxes

Показать описание

Can I Live Off Interest On A Million Dollars? Shocking Reality #shorts

Living on $1 Million After Taxes in Zurich, Switzerland #switzerland #democrat #republican #salary

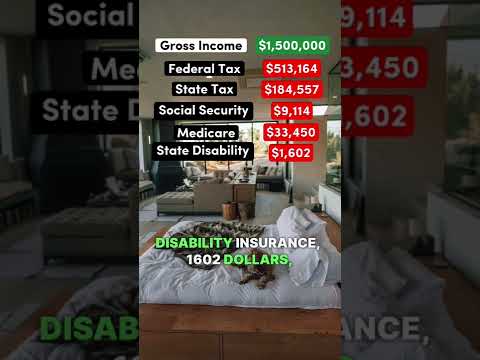

Living on a $1.5 Million Salary After Taxes in California #california #cali #viral

Living on $1 Million After Taxes in the Netherlands #netherlands #democrat #republican #salary

How to Invest $1 Million to Live off Dividends Forever!

Living on $1 Million After Taxes in Quebec, Canada #canada #quebec #democrat #republican #salary

Living on $1 Million After Taxes in Australia #australia #taxes #democrat #republican #salary

Living on $1 Million After Taxes in Hungary #shorts #taxes

Ti Fiya Leve l Ale Septentrional Part 31 #music #live #1million #haitianmusic

Living On $1 Million A Year In Silicon Valley | Millennial Money

How To Live Off One Million Dollars FOR LIFE | How to retire With A Million Dollars

Living on $1 Million After Taxes in Saudi Arabia #saudiarabia #democrat #republican #salary

Living on $1 Million After Taxes in Monaco #monaco #taxes #democrat #republican #salary

Living on $1 Million A Year in Austin Texas

Living on $1 Million After Taxes in Stockholm, Sweden #sweden #taxes #democrat #republican #salary

Living on a $1 Million Salary After Taxes in the Czech Republic #czechrepublic #taxes #salary

Living on $1 Million After Taxes in Luxembourg #luxembourg #democrat #republican #salary #taxes

Living on $1 Million After Taxes in Liechtenstein #liechtenstein #conservative #liberal #salary

1 Million Retirement... 50k Income For Life

Living on $1 Million After Taxes in Ireland #ireland #taxes #democrat #republican #salary

Living On $1.6 Million A Year In Los Angeles | Millennial Money

LIFE AFTER DEATH | SHE DID THIS FOR 1 MILLION

Living on $1 Million After Taxes in Argentina #argentina #democrat #republican #salary

Living On $6.1 Million A Year In Las Vegas | Millennial Money

Комментарии

0:00:58

0:00:58

0:01:01

0:01:01

0:00:52

0:00:52

0:00:30

0:00:30

0:14:49

0:14:49

0:00:42

0:00:42

0:00:30

0:00:30

0:00:32

0:00:32

0:07:32

0:07:32

0:08:40

0:08:40

0:09:06

0:09:06

0:00:18

0:00:18

0:00:18

0:00:18

0:12:09

0:12:09

0:00:38

0:00:38

0:00:30

0:00:30

0:00:39

0:00:39

0:00:40

0:00:40

0:08:04

0:08:04

0:00:35

0:00:35

0:10:11

0:10:11

0:14:33

0:14:33

0:00:32

0:00:32

0:11:57

0:11:57