filmov

tv

What is Professional Tax | Professional Tax Registration | Karnataka | Maharashtra | Tamil Nadu

Показать описание

#ProfessionalTaxRegistration

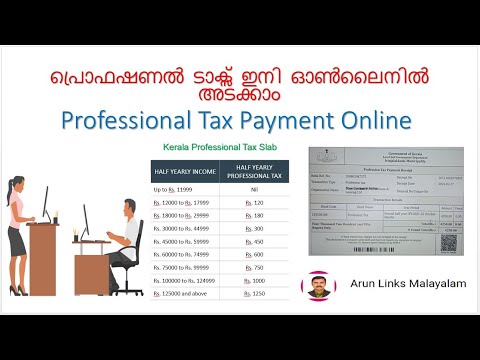

Professional Tax is levied by the state government on profession, trade or employment which is applicable to salaried employees and professionals such as chartered accountants, lawyers, and doctors. The power of levying #ProfessionalTax by the state government is given under article 276 of the Constitution of India.The rate of professional tax depends upon the state in which employee is serving his duties.

To govern the professional tax of the particular state, every state has its laws and regulations. However, all the states do follow a slab system based on the income to levy professional tax.

There Are Two Types Professional Tax Certificates:-

PTEC (Professional Tax Enrolment Certificate):

This is paid by the business entity, owner or a professional i.e. Private/ #PublicLimitedCompany, #SoleProprietor, Director Etc.

PTRC: (Professional Tax Registration Certificate):

Government or Non- Government employer deducts the tax from the employee’s wages and deposit the same to the government.

Documents required for Professional Tax Registration

• Acknowledgement of the online form, along with the print out of the digital form submitted.

• In case, the applicant is #Company- COI, AOA & MOA, and PAN of the company. (Attested by the #Director).

• Identity proof and address proof of all directors along with the passport size photo.

• Bank account details of the Company along with a bank statement and cancelled cheque.

• Proof of Registered Office. However, in the case of rented property-NOC from the owner.

• In case of a company-Board Resolution and In case of #Partnership- the Declaration of consent by the concerned Partner is required.

• Salary and attendance register.

Procedure of Professional Tax Registration

• The applicant can apply online through the #CTDPortal (Commercial taxes department) of specific state.

• The applicant shall file the form along with the requisite document.

• One can also apply offline by submitting the application form along with the requisite documents and prescribed fee to the concerned State Government.

• Once the applicant applied for registration, he/she should submit the physical copy to the concerned tax department.

• On receipt of an application, the tax authority shall scrutinize it for its correctness.

• After scrutinization, if the authority gets satisfied, it shall approve the same and issue the registration certificate to the applicant. In case if the department found a flaw in the application, it can definitely raise a queries that shall be responded on time.

Penalties are imposed in Case of Violation

• A penalty of Rs5/- per day is applicable on late obtaining the registration of the certificate.

• In case of non/late payment of professional tax, the #penalty will be 10% of the amount of tax. An individual is liable to pay Rs 1000 in case of late filing of returns. Also, if the delay is for more than a month, a penalty of Rs 2000 will be imposed.

Phone:- 9121230280

Want to know more about #Corpbiz?

Professional Tax is levied by the state government on profession, trade or employment which is applicable to salaried employees and professionals such as chartered accountants, lawyers, and doctors. The power of levying #ProfessionalTax by the state government is given under article 276 of the Constitution of India.The rate of professional tax depends upon the state in which employee is serving his duties.

To govern the professional tax of the particular state, every state has its laws and regulations. However, all the states do follow a slab system based on the income to levy professional tax.

There Are Two Types Professional Tax Certificates:-

PTEC (Professional Tax Enrolment Certificate):

This is paid by the business entity, owner or a professional i.e. Private/ #PublicLimitedCompany, #SoleProprietor, Director Etc.

PTRC: (Professional Tax Registration Certificate):

Government or Non- Government employer deducts the tax from the employee’s wages and deposit the same to the government.

Documents required for Professional Tax Registration

• Acknowledgement of the online form, along with the print out of the digital form submitted.

• In case, the applicant is #Company- COI, AOA & MOA, and PAN of the company. (Attested by the #Director).

• Identity proof and address proof of all directors along with the passport size photo.

• Bank account details of the Company along with a bank statement and cancelled cheque.

• Proof of Registered Office. However, in the case of rented property-NOC from the owner.

• In case of a company-Board Resolution and In case of #Partnership- the Declaration of consent by the concerned Partner is required.

• Salary and attendance register.

Procedure of Professional Tax Registration

• The applicant can apply online through the #CTDPortal (Commercial taxes department) of specific state.

• The applicant shall file the form along with the requisite document.

• One can also apply offline by submitting the application form along with the requisite documents and prescribed fee to the concerned State Government.

• Once the applicant applied for registration, he/she should submit the physical copy to the concerned tax department.

• On receipt of an application, the tax authority shall scrutinize it for its correctness.

• After scrutinization, if the authority gets satisfied, it shall approve the same and issue the registration certificate to the applicant. In case if the department found a flaw in the application, it can definitely raise a queries that shall be responded on time.

Penalties are imposed in Case of Violation

• A penalty of Rs5/- per day is applicable on late obtaining the registration of the certificate.

• In case of non/late payment of professional tax, the #penalty will be 10% of the amount of tax. An individual is liable to pay Rs 1000 in case of late filing of returns. Also, if the delay is for more than a month, a penalty of Rs 2000 will be imposed.

Phone:- 9121230280

Want to know more about #Corpbiz?

Комментарии

0:10:02

0:10:02

0:09:52

0:09:52

0:08:22

0:08:22

0:04:50

0:04:50

0:12:42

0:12:42

0:06:40

0:06:40

0:04:01

0:04:01

0:01:01

0:01:01

0:01:30

0:01:30

0:04:31

0:04:31

0:02:11

0:02:11

0:16:33

0:16:33

0:07:19

0:07:19

0:07:19

0:07:19

0:05:08

0:05:08

0:05:03

0:05:03

0:06:08

0:06:08

0:09:08

0:09:08

0:07:55

0:07:55

0:03:46

0:03:46

0:01:21

0:01:21

0:11:39

0:11:39

0:04:56

0:04:56

0:03:42

0:03:42