filmov

tv

Company vs Trust Structure EXPLAINED SIMPLY (Australia)

Показать описание

Need cloud accounting software?

Connect with Us:

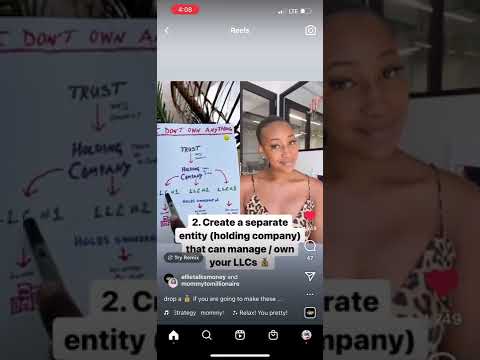

In this video, we compare the pros and cons of a Company Structure and Trust Structure, including some real-world case studies, so that you can make an informed decision on the best structure for your business.

Watch until the end to learn about how we use a Hybrid Structure to help our clients manage their taxes more effectively.

CHAPTERS:

00:00 - Intro

01:14 - Overview of Company Structure

01:39 - Advantages of a Company Structure

02:33 - Disadvantages of a Company Structure

03:05 - Case Study 1: Choosing Sole Trader Over Company

04:21 - Overview of a Trust Structure

06:33 - Advantages of a Trust Structure

07:50 - Disadvantages of a Trust Structure

08:22 - Case Study 2: Choosing Company Over Sole Trader

08:50 - Case Study 3: Choosing Trust Over Company

09:25 - Case Study 4: Hybrid Structure

11:30 - Final Thoughts

—

Thank you for watching this video. I post videos on this channel to provide the latest and most frequently asked business questions. Please take a second to say hi in the comments below. Also, if you enjoy the video and find it valuable, subscribe to the channel, like and share it with anyone who you think might find my channel useful!

—

► Subscribe to my channel here:

—

Davie has over 15 years experience in advising businesses in management accounting and taxation issues. He heads up a passionate team at Box Advisory Group who are dedicated to offering proactive and outstanding service to our clients.

Davie’s extensive experience in providing tax and consulting advice and astute business knowledge has paved the way for success for many businesses.

He is a member of the Chartered Accountants Australian and New Zealand, a member of the Australian Tax Practitioners Board and holds a Bachelor of Commerce degree from the University of New South Wales.

—

Follow Me:

—

Disclaimer:

This video is for informational purposes only and should not be considered financial or legal advice. This video does not take into consideration your personal circumstances. Consult with a qualified financial planner, tax advisor or legal consultant before making any decisions regarding investments.

Комментарии

0:12:31

0:12:31

0:05:32

0:05:32

0:06:46

0:06:46

0:04:03

0:04:03

0:09:06

0:09:06

0:00:37

0:00:37

0:02:28

0:02:28

0:04:47

0:04:47

0:39:31

0:39:31

0:02:20

0:02:20

0:02:24

0:02:24

0:01:30

0:01:30

0:13:10

0:13:10

0:00:46

0:00:46

0:08:26

0:08:26

0:01:11

0:01:11

0:07:44

0:07:44

0:01:00

0:01:00

0:07:39

0:07:39

0:00:41

0:00:41

0:00:58

0:00:58

0:13:23

0:13:23

0:06:10

0:06:10

0:03:22

0:03:22