filmov

tv

Apply Responsibility Accounting to Cost and Profit Centers

Показать описание

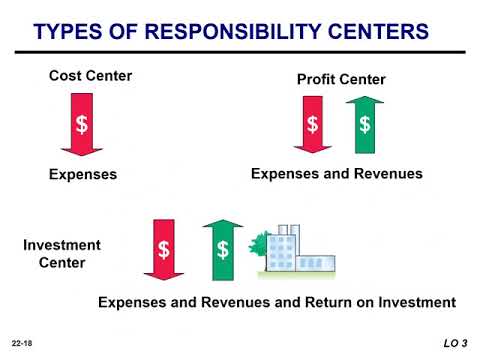

Responsibility accounting involves accumulating and reporting revenues and costs on the basis of the individual manager who has the authority to make the day-to-day decisions about the items. The evaluation of a manager's performance is based on the matters directly under the manager's control. In responsibility accounting, it is necessary to distinguish between controllable and noncontrollable fixed costs and to identify three types of responsibility centers: cost, profit, and investment.

Responsibility reports for cost centers compare actual costs with flexible budget data. The reports show only controllable costs, and no distinction is made between variable and fixed costs. Responsibility reports show contribution margin, controllable fixed costs, and controllable margin for each profit center.

Responsibility reports for cost centers compare actual costs with flexible budget data. The reports show only controllable costs, and no distinction is made between variable and fixed costs. Responsibility reports show contribution margin, controllable fixed costs, and controllable margin for each profit center.

0:13:56

0:13:56

0:01:21

0:01:21

0:03:44

0:03:44

0:02:14

0:02:14

0:31:04

0:31:04

0:08:30

0:08:30

0:05:50

0:05:50

0:15:37

0:15:37

0:28:05

0:28:05

0:04:19

0:04:19

0:15:04

0:15:04

0:37:06

0:37:06

0:10:26

0:10:26

0:04:38

0:04:38

0:00:15

0:00:15

0:24:15

0:24:15

0:07:38

0:07:38

0:14:39

0:14:39

0:00:59

0:00:59

0:00:36

0:00:36

0:00:15

0:00:15

0:05:13

0:05:13

0:53:39

0:53:39

0:07:58

0:07:58