filmov

tv

A Visual Breakdown of Why Investing Is Better Than Paying Off Debt

Показать описание

A Visual Breakdown of Why Investing Is Better Than Paying Off Debt

A Visual Breakdown of Why Investing Is Better Than Paying Off Debt

A visual breakdown of where the Trump rally shooting took place

20th Century Fox - Visual Breakdown - After Effects Recreation 4K

Edit Breakdown: a visual summary of your film

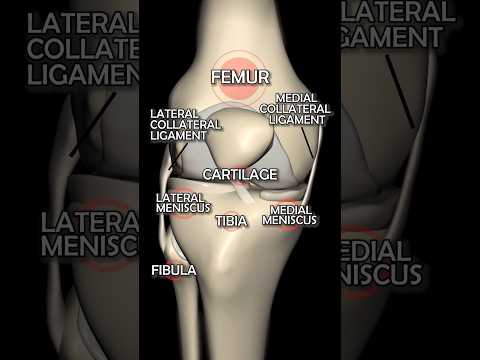

A Visual Breakdown of Knee Joint Anatomy: From Bones to Ligaments

A Visual Breakdown Of LA's Measure M

The Abysmal Eye - Visual breakdown

The Cinematography of The Conjuring 2: A Visual Breakdown

Breakdown - Divide And Konquer (EP)

Eric Prydz HOLO | Visual Breakdown

Dune 2021's 'Sand Screen' Method VFX Breakdown

ILM Behind the Magic: The Visual Effects of Star Wars: The Rise of Skywalker

How Movie VFX Are Made: The 8 Steps of Visual Effects!

How to Outline a Series ✨ A Visual Breakdown 👀

Surface Types: Get a Visual Breakdown of Any Route's Terrain - Paved or Unpaved

Visual FX Breakdown - EXTREME Body Modification

Behind the Magic: The Visual Effects of The Creator

A Visual Guide to the Cuts of Bison: Where Every Cut of Buffalo Comes From | By The Bearded Butchers

Pushpa - The Rise | Allu Arjun, Sukumar | VFX Breakdown | Makuta Visual Effects

Behind the Magic | The Visual Effects of Marvel Studios’ Eternals

The Visual Effects of 'Transformers: Dark of the Moon' Part 2

Piloci (Pilots) - Visual Breakdown 2

Behind the Magic: The Visual Effects of 'Pacific Rim'

Behind the Magic: The Visual Effects of 'Transformers Age of Extinction'

Комментарии

0:09:31

0:09:31

0:00:56

0:00:56

0:03:40

0:03:40

0:18:37

0:18:37

0:00:59

0:00:59

0:07:31

0:07:31

0:05:24

0:05:24

0:24:35

0:24:35

0:20:19

0:20:19

0:08:52

0:08:52

0:06:34

0:06:34

0:04:00

0:04:00

0:08:12

0:08:12

0:21:22

0:21:22

0:02:45

0:02:45

0:00:32

0:00:32

0:07:07

0:07:07

1:04:38

1:04:38

0:03:35

0:03:35

0:05:16

0:05:16

0:03:48

0:03:48

0:00:11

0:00:11

0:03:27

0:03:27

0:03:08

0:03:08