filmov

tv

Sinking Funds for Beginners! How to Set Up Your 2021 Sinking Funds!

Показать описание

Hey loves!

In this video I’m explaining sinking funds for beginners and how to set up yours for 2021. Adding sinking funds to your budget is a great way to save money for anticipated expenses and to make guilt free purchases. I’m also sharing a few sinking funds you should have set up this year!

_________

____________

💸LET'S WORK 1-1!

💸BROWSE MY MOST POPULAR PRODUCTS:

💸BROWSE MY FAVE RESOURCES:

____________

💰Referral/affiliate links! (I earn a small commission)

Get the BusyKid chore app to pay your kiddos!

____________

____________

Disclaimer: I’m not a financial expert, accountant, or anything related. I am not qualified or certified to give financial advice. This channel’s content is not to be construed as personalized advice. However, I am sharing my personal experience and individual opinions. If you are looking for financial advice, please seek the services of professional advisers.

In this video I’m explaining sinking funds for beginners and how to set up yours for 2021. Adding sinking funds to your budget is a great way to save money for anticipated expenses and to make guilt free purchases. I’m also sharing a few sinking funds you should have set up this year!

_________

____________

💸LET'S WORK 1-1!

💸BROWSE MY MOST POPULAR PRODUCTS:

💸BROWSE MY FAVE RESOURCES:

____________

💰Referral/affiliate links! (I earn a small commission)

Get the BusyKid chore app to pay your kiddos!

____________

____________

Disclaimer: I’m not a financial expert, accountant, or anything related. I am not qualified or certified to give financial advice. This channel’s content is not to be construed as personalized advice. However, I am sharing my personal experience and individual opinions. If you are looking for financial advice, please seek the services of professional advisers.

Sinking Funds for Beginners | How to Set Up Sinking Funds | Sinking Funds Explained

WHAT ARE SINKING FUNDS | 6 SINKING FUNDS YOU NEED | HOW TO BUDGET YOUR MONEY

What is a Sinking Fund and How Do You Create One?

Sinking Funds 101: How to get started with Sinking Funds in 2023|FREE PRINTABLE

An Easy Beginner's Guide to Sinking Funds

Sinking Funds Explained | How to Set Up Your 2023 Sinking Funds (Sinking Funds for Beginners)

HOW TO ACHIEVE YOUR FINANCIAL GOALS USING SINKING FUNDS

Sinking Funds EXPLAINED: What They Are, How They Work & Why You Need Them!

STOP OVERTHINKING IT! | STARTING AND USING SAVINGS CHALLENGES | SINKING FUNDS | BUDGET 101

How I Use Sinking Funds in My Budget

Sinking Funds | A Beginners Guide #sinkingfunds #goals

SINKING FUNDS FOR BEGINNERS || Sinking Funds Explained...3 tips to start your 2021 sinking funds

DETAILED 2024 SINKING FUNDS SET UP | PLANNING FOR THE FUTURE

How to Set Up a Sinking Fund | Sinking Funds Explained + Tutorial

The 6 'Sinking Funds' That Make Me Ready For Any Expense

$79 Low Income Cash Stuffing | How to Use Sinking Funds

Sinking Funds for Beginners! How to Set Up Your 2021 Sinking Funds!

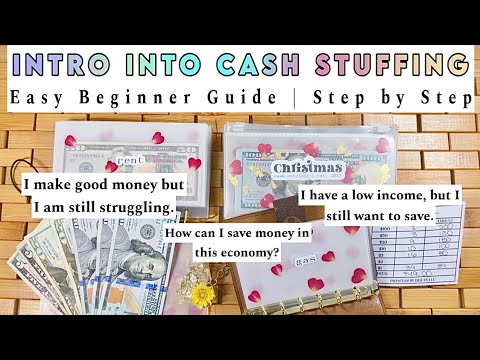

How to Start Cash Stuffing | Cash Envelope System for Beginners | Sinking Funds Explained

Budgeting Method for Beginners/ Sinking Funds | Low Income | SimpleShopz

What are Sinking Funds | FAQ | Baddies and Budgets | Cash Stuffing Beginners

My 2024 Savings Goals | Sinking Funds For Beginners | Sinking Fund Categories | Budget With Me

Sinking Funds for Beginners | Sinking Funds Explained – How to Set Up Your 2020 Sinking Funds

Explaining Our 18 Sinking Funds!

WHAT ARE SINKING FUNDS?? HOW TO SAVE MONEY THROUGH-OUT THE YEAR

Комментарии

0:13:09

0:13:09

0:16:13

0:16:13

0:05:27

0:05:27

0:24:22

0:24:22

0:24:16

0:24:16

0:09:36

0:09:36

0:22:17

0:22:17

0:04:48

0:04:48

0:27:14

0:27:14

0:17:31

0:17:31

0:23:02

0:23:02

0:07:25

0:07:25

0:34:18

0:34:18

0:13:30

0:13:30

0:05:49

0:05:49

0:08:08

0:08:08

0:13:07

0:13:07

0:24:14

0:24:14

0:12:09

0:12:09

0:08:21

0:08:21

0:11:01

0:11:01

0:11:45

0:11:45

0:16:55

0:16:55

0:13:17

0:13:17