filmov

tv

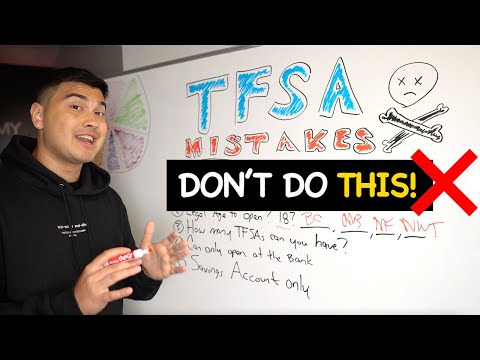

4 TFSA Investing MISTAKES To Avoid | Part 2!

Показать описание

This video covers 4 more investing tips and mistakes relating to investing and the TFSA! This is part 2 of a series of stock market investing videos covering tips and mistakes to avoid! Follow me on Instagram: Griffin Milks

Resources I Use and Recommend:

► Get $50 For FREE with Wealthsimple Trade 🇨🇦💵 (Stock Brokerage):

► Get $50 for FREE with Wealthsimple Invest 🤑 (ETF Brokerage):

► Get $50 in Free Trades with Questrade 🇨🇦 (Stock Brokerage):

Thank you for LIKING this video and SUBSCRIBING to the channel! #Investing #TFSA #CanadianInvesting

🎥 Other Videos on the Channel!:

Disclaimer: This video contains affiliate links, meaning that if you click on a product link I may receive a commission at no additional cost to you. I do not promote products, services or companies I have not personally used or those which I do not recommend. All opinions are my own.

Music:

Resources I Use and Recommend:

► Get $50 For FREE with Wealthsimple Trade 🇨🇦💵 (Stock Brokerage):

► Get $50 for FREE with Wealthsimple Invest 🤑 (ETF Brokerage):

► Get $50 in Free Trades with Questrade 🇨🇦 (Stock Brokerage):

Thank you for LIKING this video and SUBSCRIBING to the channel! #Investing #TFSA #CanadianInvesting

🎥 Other Videos on the Channel!:

Disclaimer: This video contains affiliate links, meaning that if you click on a product link I may receive a commission at no additional cost to you. I do not promote products, services or companies I have not personally used or those which I do not recommend. All opinions are my own.

Music:

4 TFSA Investing MISTAKES To Avoid!

4 TFSA Investing MISTAKES To Avoid | Part 2!

4 TFSA Mistakes to Avoid

17 TFSA Mistakes YOU MUST Avoid (Tax-Free Savings Account)

Top 5 TFSA Investing MISTAKES You MUST Avoid!

Top 10 TFSA Investing Mistakes to Avoid!

8 TFSA Mistakes You Must Avoid

5 TFSA Mistakes to Avoid (And How to Fix Them)

6 MASSIVE Mistakes To Avoid With Your TFSA

Common TFSA (Tax Free Savings Account) mistakes to avoid!

TFSA MISTAKES in Canada to AVOID! // Tax Free Investing Strategy // Canadian Tax Guide Chapter 9

5 Big TFSA Mistakes I Made You Must Avoid!

Don't Make These Common TFSA MISTAKES! // Canadian Finance

What Dave Ramsey Doesn't Like About Investing In ETFs

The TFSA Mistake Most Canadians Make (and how to fix it)

5 TFSA Mistakes YOU MUST Avoid

I made $100,000 avoiding this common ETF investing mistake

#4 TFSA mistake - Market gains and losses impact #shorts

DO NOT Make These TFSA Mistakes In 2022

TFSA Canada: My Biggest Mistakes in my TFSA (Don't Do This)

5 Massive TFSA Mistakes to Avoid in Canada!

75% of Canadians Use Their TFSA Wrong...Do You?

5 Case Studies That Your TFSA Can Go Wrong | TFSA Mistakes

4 Massive TFSA Mistakes To Avoid In Canada 2021 (Tax-Free Savings Account)

Комментарии

0:15:20

0:15:20

0:14:11

0:14:11

0:06:09

0:06:09

0:15:30

0:15:30

0:26:09

0:26:09

0:15:24

0:15:24

0:11:20

0:11:20

0:10:13

0:10:13

0:07:11

0:07:11

0:16:31

0:16:31

0:18:54

0:18:54

0:11:15

0:11:15

0:06:01

0:06:01

0:05:12

0:05:12

0:11:39

0:11:39

0:11:37

0:11:37

0:11:44

0:11:44

0:01:15

0:01:15

0:10:20

0:10:20

0:12:21

0:12:21

0:08:53

0:08:53

0:05:55

0:05:55

0:10:05

0:10:05

0:03:10

0:03:10