filmov

tv

(EViews10):Estimate Johansen Cointegration Test #var #vecm #Johansen #cointegration

Показать описание

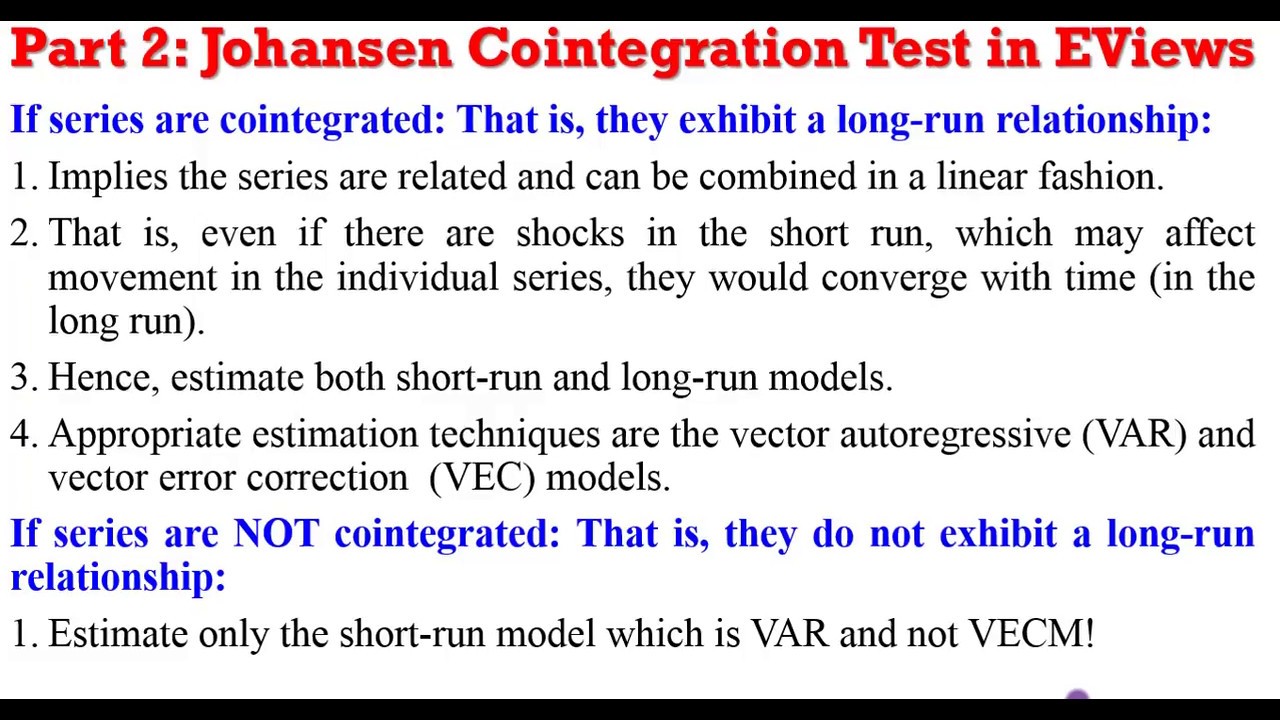

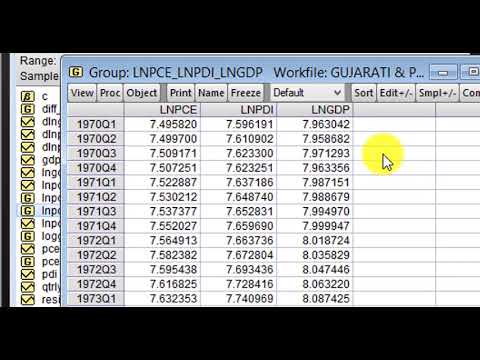

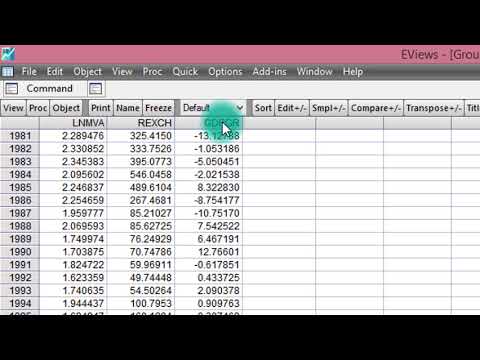

This video shows you how to perform the Johansen cointegration test using EViews10. After performing stationarity test, there are three (3) likely outcomes: the series may turn out to be I(0), I(1) or a combination of both. So what do you do next? This hands-on tutorial shows you what to do in EViews10 when series are I(1), that is, first difference-stationary series.

Follow up with soft-notes and updates from CrunchEconometrix:

Follow up with soft-notes and updates from CrunchEconometrix:

(EViews10):Estimate Johansen Cointegration Test #var #vecm #Johansen #cointegration

(EViews10):Estimate VAR Models(1) #var #vecm #Johansen #normality #serialcorrelation

(EViews10): Estimate and Interpret VECM (1) #var #vecm #causality #lags #Johansen #innovations

(EViews10):Cointegration, Series are I(0)#ardl #ecm #var #vecm #Johansen #boundstest #cointegration

Cointegration test in EVIEWs

Johansen Cointegration in Eviews

(Stata13): How to Perform Johansen Cointegration Test #var #vecm #Johansen #cointegration

(EViews 10) Johansen Test of co-integration Model 1

ARDL Eviews Long Run Short Run ECM Cointegration

EViews: Unit Root Test, Cointegration Test and ARDL-ECM (Estimation and Interpretation)

Johansen Cointegration Test

(EViews10):Estimate Bounds Cointegration Test #ardl #ecm #boundstest #cointegration

Johansen Co-integration Test | Econometrics | EViews | Estimation | Regression Analysis

(EViews10): Estimate and Interpret VECM (2) #var #vecm #causality #lags #Johansen #innovations

(EViews10)Estimate VAR,Forecast Error Variance Decomposition #var #vecm #fevd #Johansen

Cointegration Test in Eviews

JOHANSEN COINTEGRATION TEST | Perform on EVIEWS | Amateur Analyst 101

(EViews10):Discussing Results, VAR Models(2) #var #vecm #Johansen #normality #serialcorrelation

11. Cointegration Analysis using EViews || Dr. Dhaval Maheta

lag selection criteria and cointegration test in Eviews 10

(EViews 10) Johansen Test of co-integration and VECM Model 2

Video 11 - Johansen cointegration test Eviews (part 3)

Unit Root Tests, Cointegration and ECM/VECM in Eviews

Johansen Cointegration test in eviews

Комментарии

0:09:26

0:09:26

0:05:27

0:05:27

0:13:45

0:13:45

0:04:44

0:04:44

0:06:51

0:06:51

0:03:13

0:03:13

0:09:12

0:09:12

0:16:13

0:16:13

0:01:02

0:01:02

0:17:03

0:17:03

0:14:07

0:14:07

0:06:08

0:06:08

0:13:23

0:13:23

0:09:33

0:09:33

0:10:21

0:10:21

0:08:41

0:08:41

0:01:54

0:01:54

0:08:25

0:08:25

0:27:47

0:27:47

0:14:59

0:14:59

0:37:35

0:37:35

0:07:15

0:07:15

0:19:39

0:19:39

0:04:01

0:04:01