filmov

tv

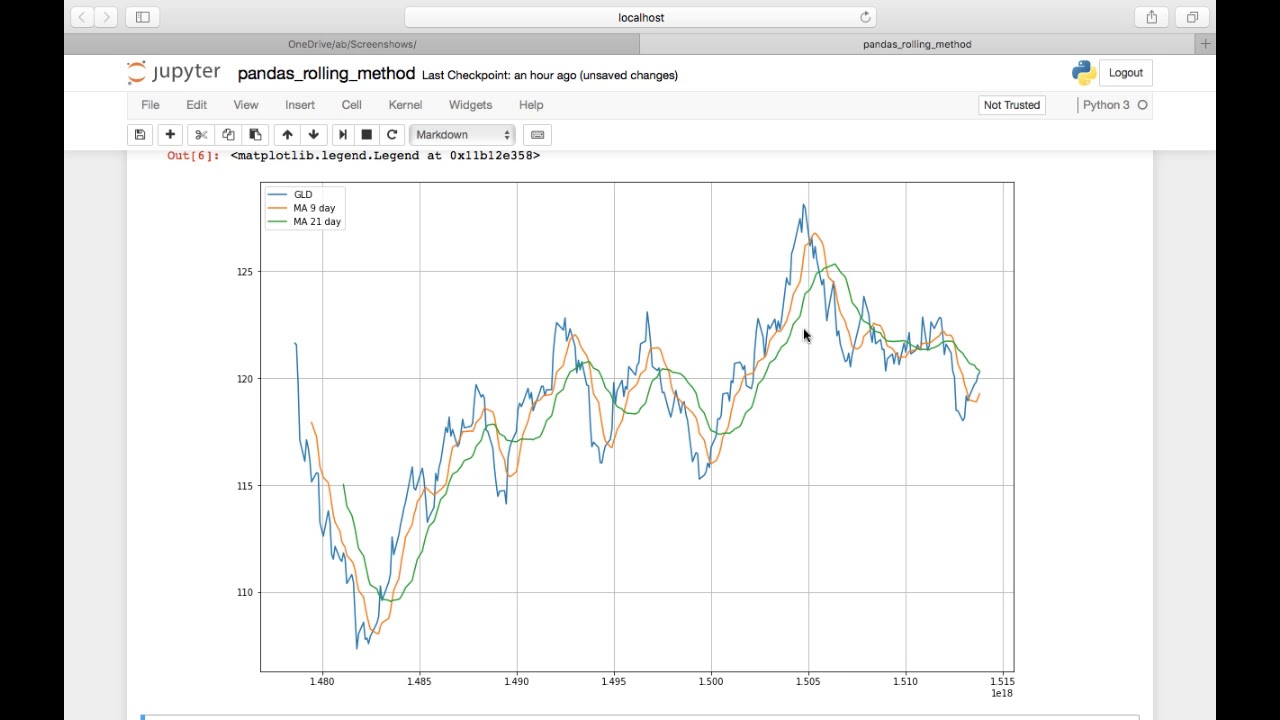

Python Pandas || Moving Averages and Rolling Window Statistics for Stock Prices

Показать описание

#pandas #python #rolling

Please SUBSCRIBE:

fix_yahoo_finance has been renamed yfinance.

This video was made after changes to many APIs including Yahoo and Google prevented the datareader from connecting. This problem was rectified in pandas_datareader 0.80, however. You may still find yfinance to be a useful library - particularly if for some reason you cannot upgrade pandas_datareader.

Quickly download data for any number of stocks and create a correlation matrix using Python pandas and create a scatter matrix. It may take me 10 minutes to explain, but it will only take you 3 to see the power of Python for downloading and exploring data quickly primarily utilizing NumPy and pandas.

Video tutorial demonstrating the using of the pandas rolling method to calculate moving averages and other rolling window aggregations such as standard deviation often used in determining a securities historical volatility.

You can download the notebook used here:

Please SUBSCRIBE:

fix_yahoo_finance has been renamed yfinance.

This video was made after changes to many APIs including Yahoo and Google prevented the datareader from connecting. This problem was rectified in pandas_datareader 0.80, however. You may still find yfinance to be a useful library - particularly if for some reason you cannot upgrade pandas_datareader.

Quickly download data for any number of stocks and create a correlation matrix using Python pandas and create a scatter matrix. It may take me 10 minutes to explain, but it will only take you 3 to see the power of Python for downloading and exploring data quickly primarily utilizing NumPy and pandas.

Video tutorial demonstrating the using of the pandas rolling method to calculate moving averages and other rolling window aggregations such as standard deviation often used in determining a securities historical volatility.

You can download the notebook used here:

Create a Moving Average with Pandas in Python

Moving Average (Rolling Average) in Pandas and Python - Set Window Size, Change Center of Data

Python Pandas || Moving Averages and Rolling Window Statistics for Stock Prices

Moving Average in Python Pandas | Rolling or Moving - Average, Median, Sum etc. in Pandas

Compute Moving Averages of Stock Time Series Using Python and Pandas

Simple Moving Average (SMA) in Python Pandas + Plotting

Python Basics Tutorial How to Find 200 and 50 Day Moving Averages With Pandas Rolling Method

Pandas for Productivity Ep.5: How to calculate moving averages in Pandas

Data analysis with python and Pandas - Calculate Moving average of time series Tutorial 8

Moving Average for Python in 6 mins

Moving Average in python using Pandas (Machine Learning)

Exponential Moving Averages of Stock Time Series in Python and Pandas

How to Calculate Simple Moving Average & Standard Deviation in python

Rolling Average is #PANDAS #datascience #python #dataanalytics

How to do Moving Averages in Python

How to Compute and Plot a 30-Day Moving Average in Pandas

How To Calculate The Exponential Moving Average (EMA) | Python & Pandas

How to calculate MOVING AVERAGE in Pandas DataFrame in Python

back-testing a simple-moving-average-based trading strategy using pandas

How to Use Pandas Rolling - A Simple Illustrated Guide

How to do Moving Average in Python Pandas | Full Course | rolling(), ewm(), expanding() methods

Python and Pandas for Sentiment Analysis and Investing 7 - Dynamic Moving Averages

Pandas with Python 2.7 Part 5 - Column Operations (Math, moving averages)

Learn Exponential Moving Average (EMA) using Python on Google Colab

Комментарии

0:10:32

0:10:32

0:09:35

0:09:35

0:11:23

0:11:23

0:05:43

0:05:43

0:21:37

0:21:37

0:09:49

0:09:49

0:10:34

0:10:34

0:12:47

0:12:47

0:10:10

0:10:10

0:06:59

0:06:59

0:04:18

0:04:18

0:12:51

0:12:51

0:06:01

0:06:01

0:00:56

0:00:56

0:13:42

0:13:42

0:01:32

0:01:32

0:02:44

0:02:44

0:02:13

0:02:13

0:16:23

0:16:23

0:05:29

0:05:29

0:24:38

0:24:38

0:11:21

0:11:21

0:04:51

0:04:51

0:05:48

0:05:48