filmov

tv

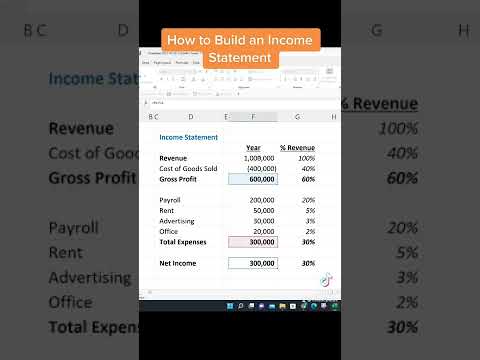

Income Statement (P&L) for Small Services Businesses

Показать описание

Managing the P&L

Your profit and loss statement in your services business can give you important insights into the health of your business. Whether you’re a small solo business or a big global enterprise, managing your P&L is critical.

******************

******************

If you run a business, you need to have a monthly profit and loss statement (P&L).

Big global companies have robust P&Ls. But it’s not just something that benefits big enterprises or companies that produce physical products.

Companies that provide services, whether you’re a big shop or a solo part-time entrepreneur, need a P&L too.

Why do you need a P&L as a small business? It tells you important facts about the health of your business.

And it will help you ensure your business can survive seasonal swings or big economic downturns too.

So what does a P&L for a services business contain? It can be difficult to figure out, since you’re not moving tangible products. But it’s not any less important for your services business.

And what insights does it hold for your overall business?

That’s what John Arnott will cover in this video as part of the Business Mastery series.

You must manage and monitor your business finances – find out how in this video using your P&L.

You’ll learn how you’re doing, and what you need to fix first.

*********************

Additional Marketing Resources:

Your profit and loss statement in your services business can give you important insights into the health of your business. Whether you’re a small solo business or a big global enterprise, managing your P&L is critical.

******************

******************

If you run a business, you need to have a monthly profit and loss statement (P&L).

Big global companies have robust P&Ls. But it’s not just something that benefits big enterprises or companies that produce physical products.

Companies that provide services, whether you’re a big shop or a solo part-time entrepreneur, need a P&L too.

Why do you need a P&L as a small business? It tells you important facts about the health of your business.

And it will help you ensure your business can survive seasonal swings or big economic downturns too.

So what does a P&L for a services business contain? It can be difficult to figure out, since you’re not moving tangible products. But it’s not any less important for your services business.

And what insights does it hold for your overall business?

That’s what John Arnott will cover in this video as part of the Business Mastery series.

You must manage and monitor your business finances – find out how in this video using your P&L.

You’ll learn how you’re doing, and what you need to fix first.

*********************

Additional Marketing Resources:

Комментарии

0:11:57

0:11:57

0:05:09

0:05:09

0:15:34

0:15:34

0:03:34

0:03:34

0:06:31

0:06:31

0:00:32

0:00:32

0:00:54

0:00:54

0:11:26

0:11:26

2:58:49

2:58:49

0:09:06

0:09:06

0:10:06

0:10:06

0:00:34

0:00:34

0:00:20

0:00:20

0:16:17

0:16:17

0:06:59

0:06:59

0:11:24

0:11:24

0:11:09

0:11:09

0:02:08

0:02:08

0:12:09

0:12:09

0:01:00

0:01:00

0:09:34

0:09:34

0:01:19

0:01:19

0:20:21

0:20:21

0:04:54

0:04:54