filmov

tv

TDS on Salary Calculator | Calculation of TDS on Salary | Tax Deduction at Source

Показать описание

TDS on Salary Calculator | Calculation of TDS on Salary | Tax Deduction at Source

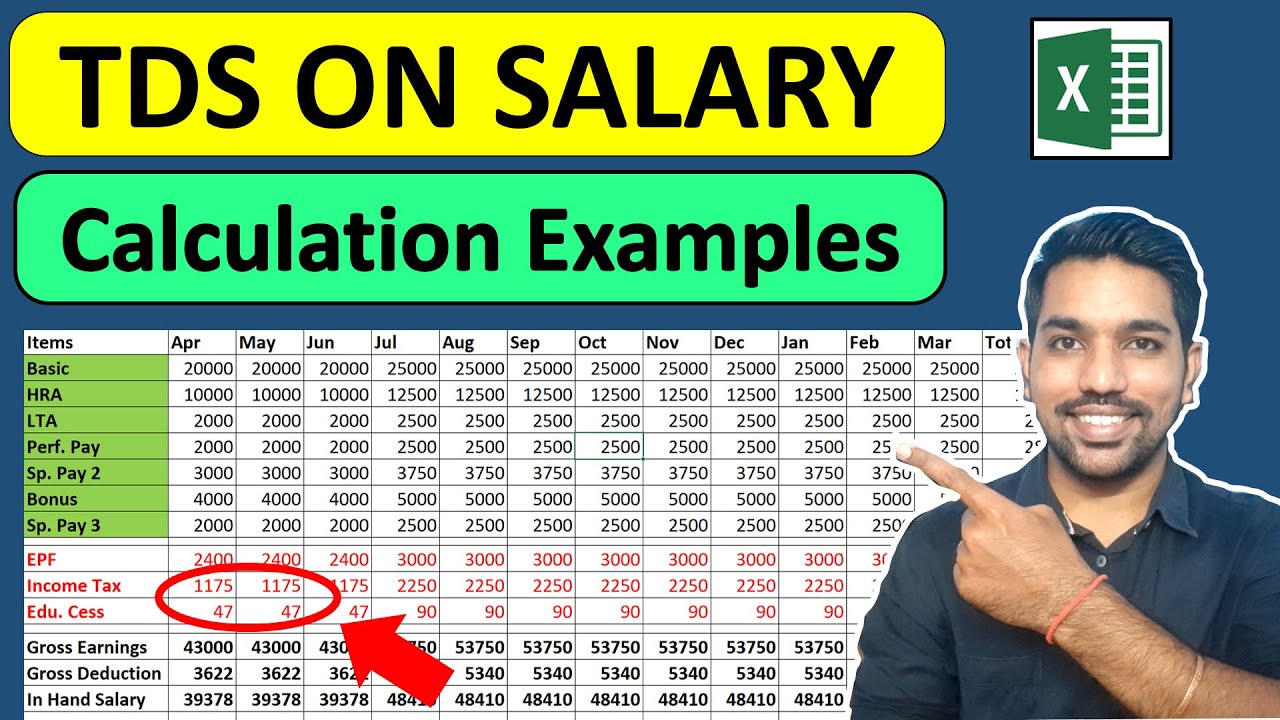

In this video by FinCalC TV we will see how to calculate TDS on salary on monthly basis in hindi. After watching this video you'll be able to understand how much income tax or TDS will be deducted from your monthly salary. TDS full form is Tax Deduction at source.

Tax Deducted at Source or TDS is the amount which is deducted from the income of an individual by an authorised deductor and deposited to the IT department. Calculation of TDS on Salary can be easily done using the excel calculator explained in this video.

Income Tax Calculator Online:

Income Tax Excel Calculator:

Website Blog:

All Excel calculators videos:

DOWNLOAD ANDROID APP "FinCalC":

CHAPTERS:

00:14 TDS on Salary Intro

01:30 Salary Slip components

03:30 Calculating Gross Earnings

03:50 Calculating Gross Deductions

04:15 How to Calculate in hand Salary

07:10 Income Tax Calculation on Gross Earnings

11:15 Calculating Income Tax in Excel

14:29 Example 1 Calculation of TDS on Salary

17:25 Example 2 TDS on Salary Increment

23:55 More excel calculators

25:13 TDS on Salary Conclusion

Income Tax Calculation Video:

All Deductions Video:

Choose between Old Tax Regime or New Tax Regime Video:

What is TDS on Salary?

TDS on salary means that tax has been deducted by the employer at the time of depositing the salary into the employee's account. The amount deducted from the employee’s account is deposited with the government by the employer.

How to calculate TDS on Salary every month?

TDS on salary is deducted based on the total income tax you are liable to pay in a financial year. Income tax is calculated based on your taxable income which is calculated by deducting your all deductions from gross earnings. Watch full video to understand step by step process of TDS on Salary calculation with excel calculator.

While the basic salary is fully taxable according to respective tax bracket, some exemptions are available for payments made as allowances and perks. You can calculate TDS on your income by following the below steps.

1. Calculate gross monthly income as a sum of basic income, allowances and perquisites.

2. Calculate available exemptions under Section 10 of the Income Tax Act (ITA). Exemptions are applicable on allowances such as medical, HRA, travel.

3. Reduce exemptions according to step (2) for the gross monthly income calculated in step (1).

4. As TDS is calculated on yearly income, multiply the corresponding figure from above calculation by 12. This is your yearly taxable income from salary.

5. If you have any other income source such as income from house rent or have incurred losses from paying housing loan interests, add/subtract this amount from the figure in step (4).

6. Next, calculate your investments for the year which fall under Chapter VI-A of ITA, and deduct this amount from the gross income calculated in step (5). An example of this would be exemption of up to Rs.1.5 lakh under Section 80C, which includes investment avenues such as PPF, life insurance premiums, mutual funds, home loan repayment, ELSS, NSC, Sukanya Samriddhi account and so on.

7. Now, reduce the maximum allowable income tax exemptions on a salary. Currently, income up to Rs.2.5 lakhs is fully exempt from paying taxes, while income from Rs.2.5 lakhs to Rs.5 lakhs is taxed at 5%, and Rs.5 lakhs to Rs.10 lakhs income bracket is taxed at 20%. All income above this amount is taxed at 30% according to Old Tax Regime.

8. Do note that senior citizen have different tax slabs and receive higher exemptions than those discussed above.

#TDSonSalary #Calculator #TDSCalculation #FinCalC #Excel

============================

LIKE | SHARE | COMMENT | SUBSCRIBE

Mujhe Social Media par FOLLOW kare:

====

MORE VIDEOS:

====

DISCLAIMER:

Examples and demo used are for Illustration purpose only and might not cover every detail of examples shown. It is advised to seek professional help before taking any financial decisions. The owner of this channel shall not be liable in any way.

In this video by FinCalC TV we will see how to calculate TDS on salary on monthly basis in hindi. After watching this video you'll be able to understand how much income tax or TDS will be deducted from your monthly salary. TDS full form is Tax Deduction at source.

Tax Deducted at Source or TDS is the amount which is deducted from the income of an individual by an authorised deductor and deposited to the IT department. Calculation of TDS on Salary can be easily done using the excel calculator explained in this video.

Income Tax Calculator Online:

Income Tax Excel Calculator:

Website Blog:

All Excel calculators videos:

DOWNLOAD ANDROID APP "FinCalC":

CHAPTERS:

00:14 TDS on Salary Intro

01:30 Salary Slip components

03:30 Calculating Gross Earnings

03:50 Calculating Gross Deductions

04:15 How to Calculate in hand Salary

07:10 Income Tax Calculation on Gross Earnings

11:15 Calculating Income Tax in Excel

14:29 Example 1 Calculation of TDS on Salary

17:25 Example 2 TDS on Salary Increment

23:55 More excel calculators

25:13 TDS on Salary Conclusion

Income Tax Calculation Video:

All Deductions Video:

Choose between Old Tax Regime or New Tax Regime Video:

What is TDS on Salary?

TDS on salary means that tax has been deducted by the employer at the time of depositing the salary into the employee's account. The amount deducted from the employee’s account is deposited with the government by the employer.

How to calculate TDS on Salary every month?

TDS on salary is deducted based on the total income tax you are liable to pay in a financial year. Income tax is calculated based on your taxable income which is calculated by deducting your all deductions from gross earnings. Watch full video to understand step by step process of TDS on Salary calculation with excel calculator.

While the basic salary is fully taxable according to respective tax bracket, some exemptions are available for payments made as allowances and perks. You can calculate TDS on your income by following the below steps.

1. Calculate gross monthly income as a sum of basic income, allowances and perquisites.

2. Calculate available exemptions under Section 10 of the Income Tax Act (ITA). Exemptions are applicable on allowances such as medical, HRA, travel.

3. Reduce exemptions according to step (2) for the gross monthly income calculated in step (1).

4. As TDS is calculated on yearly income, multiply the corresponding figure from above calculation by 12. This is your yearly taxable income from salary.

5. If you have any other income source such as income from house rent or have incurred losses from paying housing loan interests, add/subtract this amount from the figure in step (4).

6. Next, calculate your investments for the year which fall under Chapter VI-A of ITA, and deduct this amount from the gross income calculated in step (5). An example of this would be exemption of up to Rs.1.5 lakh under Section 80C, which includes investment avenues such as PPF, life insurance premiums, mutual funds, home loan repayment, ELSS, NSC, Sukanya Samriddhi account and so on.

7. Now, reduce the maximum allowable income tax exemptions on a salary. Currently, income up to Rs.2.5 lakhs is fully exempt from paying taxes, while income from Rs.2.5 lakhs to Rs.5 lakhs is taxed at 5%, and Rs.5 lakhs to Rs.10 lakhs income bracket is taxed at 20%. All income above this amount is taxed at 30% according to Old Tax Regime.

8. Do note that senior citizen have different tax slabs and receive higher exemptions than those discussed above.

#TDSonSalary #Calculator #TDSCalculation #FinCalC #Excel

============================

LIKE | SHARE | COMMENT | SUBSCRIBE

Mujhe Social Media par FOLLOW kare:

====

MORE VIDEOS:

====

DISCLAIMER:

Examples and demo used are for Illustration purpose only and might not cover every detail of examples shown. It is advised to seek professional help before taking any financial decisions. The owner of this channel shall not be liable in any way.

Комментарии

0:09:41

0:09:41

0:04:37

0:04:37

0:09:14

0:09:14

0:40:22

0:40:22

0:26:10

0:26:10

0:01:27

0:01:27

0:14:11

0:14:11

0:05:01

0:05:01

0:04:21

0:04:21

0:11:44

0:11:44

0:08:45

0:08:45

0:34:38

0:34:38

0:03:24

0:03:24

0:01:25

0:01:25

0:04:49

0:04:49

0:05:32

0:05:32

0:24:26

0:24:26

0:17:34

0:17:34

0:01:09

0:01:09

0:11:20

0:11:20

0:08:40

0:08:40

0:19:11

0:19:11

0:01:26

0:01:26

0:13:33

0:13:33