filmov

tv

How Forex Brokers Make Money? ☝

Показать описание

🔴 Trading is Risky! 74 to 89% of retail investors lose money when CFD trading/spread betting!

✅ Please like, subscribe & comment if you enjoyed - it helps a lot!

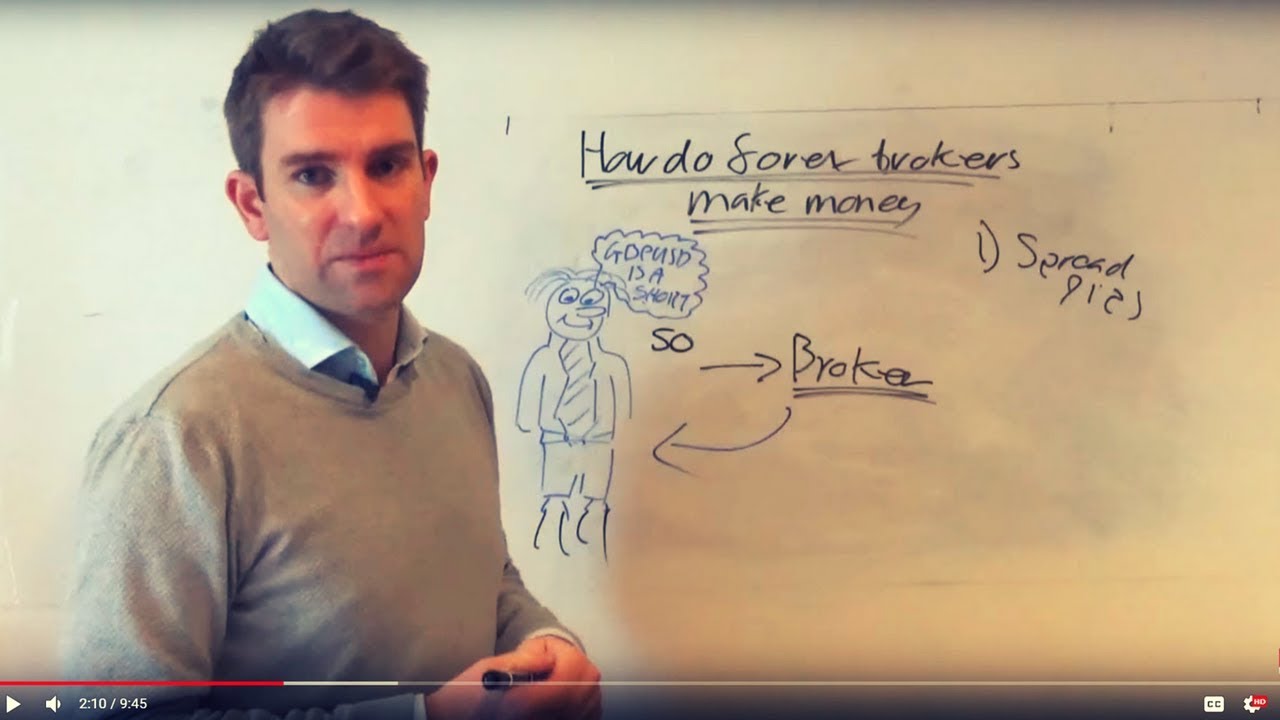

How do forex brokers make money? Have you ever wondered how your CFD broker or spread betting provider makes money?

These brokers typically have big infrastructure costs, technology costs, staff costs, marketing costs..etc yet they still seem to make decent profits. How do they do it?

The first one is the spread - this will be in pips if we're talking forex. With major pairs the bid-offer spread will be quite tight but spreads will widen for the more exotic pairs.

Number 2 is overnight financing that the broker will charge you for holding positions overnight. You will be charged a small fee for each day that you hold onto the trade. The longer you hold an open trade, the more you will be charged.

⛓️ 🔗 Channel Sponsor 🔗 ⛓️

✅ Our channel sponsor for this month are TradeNation meaning these guys are covering our costs of operation. We only accept reputable and properly regulated providers as sponsors. Please support us by trading with this provider. TradeNation offer both MT4 as well as an exclusive web-based platform, CoreTrader.

📜 Disclaimer 📜

69.9% of retail investors lose money when trading CFDs and spread betting with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Related Videos

TRADER vs DEALER vs BROKER 💡

DO MARKET MAKERS TRADE AGAINST YOU!? 🤔

Bid vs Ask: How Buying and Selling Work

How Forex Brokers Make Money? ☝

How to Avoid Bad Forex Brokers: Requotes/Skewed Spreads/Gone to Dealer Scam 😠

The Difference Between A Book and B Book Brokers ☝

✅ Please like, subscribe & comment if you enjoyed - it helps a lot!

How do forex brokers make money? Have you ever wondered how your CFD broker or spread betting provider makes money?

These brokers typically have big infrastructure costs, technology costs, staff costs, marketing costs..etc yet they still seem to make decent profits. How do they do it?

The first one is the spread - this will be in pips if we're talking forex. With major pairs the bid-offer spread will be quite tight but spreads will widen for the more exotic pairs.

Number 2 is overnight financing that the broker will charge you for holding positions overnight. You will be charged a small fee for each day that you hold onto the trade. The longer you hold an open trade, the more you will be charged.

⛓️ 🔗 Channel Sponsor 🔗 ⛓️

✅ Our channel sponsor for this month are TradeNation meaning these guys are covering our costs of operation. We only accept reputable and properly regulated providers as sponsors. Please support us by trading with this provider. TradeNation offer both MT4 as well as an exclusive web-based platform, CoreTrader.

📜 Disclaimer 📜

69.9% of retail investors lose money when trading CFDs and spread betting with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Related Videos

TRADER vs DEALER vs BROKER 💡

DO MARKET MAKERS TRADE AGAINST YOU!? 🤔

Bid vs Ask: How Buying and Selling Work

How Forex Brokers Make Money? ☝

How to Avoid Bad Forex Brokers: Requotes/Skewed Spreads/Gone to Dealer Scam 😠

The Difference Between A Book and B Book Brokers ☝

Комментарии

0:09:46

0:09:46

0:03:11

0:03:11

0:01:26

0:01:26

0:02:32

0:02:32

0:01:54

0:01:54

0:03:15

0:03:15

0:00:59

0:00:59

0:00:43

0:00:43

0:03:57

0:03:57

0:03:42

0:03:42

0:06:50

0:06:50

0:11:03

0:11:03

0:04:56

0:04:56

0:00:54

0:00:54

0:01:23

0:01:23

0:07:38

0:07:38

0:00:33

0:00:33

0:05:13

0:05:13

0:13:35

0:13:35

0:07:18

0:07:18

0:00:45

0:00:45

0:04:58

0:04:58

0:00:56

0:00:56

0:00:57

0:00:57