filmov

tv

GST FREE SAMPLES TAXABLE ? (ENGLISH)

Показать описание

This video highlights taxability of free samples and physicians' samples in the light of GST Bills passed by Parliament.

Non availability of ITC on the above is alarming. Why? Pl. watch the video and offer your valuable views on that.

Non availability of ITC on the above is alarming. Why? Pl. watch the video and offer your valuable views on that.

ITC reversals on Free Samples and Gifts | GST on Free Samples | Section 17(5)(h) | CA Vaibhav Kansal

GST FREE SAMPLES TAXABLE ? (ENGLISH)

GST On | Free | Sample | Gift | Promotional Item | Free of Cost Item

Clarification on taxability of Free Samples, Buy one Get one, Buy more Save more

Gst Treatment of Free Sample

Taxability of free samples under GST

GST on Free Sample Goods |ITC Reversal on Free Sample Goods and Gift| Donation| KSR Academy | GST

GST : Treatment of Free Samples or Gift...

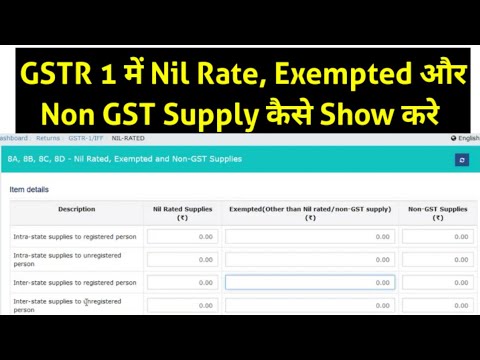

How to show Exempted,Tax Free,Nil Rated,Non GST Sales in GSTR-1

GST ON GOODS SUPPLIED AS FREE SAMPLES AND GIFTS

GST Invoice for free samples ?: GST News Part 272

GST IMPLICATIONS ON FREE SAMPLES DISTRIBUTIONS ! GIFTS ! PROMOTIONAL ITEMS !!! CA MANOJ GUPTA !!!

GST on Goods/Services given as Free Samle/Gift or as Buy 1 Get 1 Free by CA KAVITA

GST ON FREE GIFTS, GST ON FREE SAMPLES, GST ON BUY ONE GET ONE FREE, GST ON SALES PROMOTION SCHEME

GST CREDIT ON FREE SAMPLES | AD Classes | CA ASHISH DEOLASI

GST on Discount II GST on Free samples II ITC on free samples II GST Sathi

GST On Free Gifts| GST on Samples| GST on Buy More Save More | GST on Discount | GST on buy 1 get 1

E Invoice for Exempt Goods & Services I E invoice for Tax Free Goods & Services I GST I CA ...

GST Free Scheme Accounting Entries, GST Free Sample Accounting Entries in Tally, GST Accounting

FOC Supply – Taxability and input tax credit under GST

Before apply GST Refund and Export Watch this

ITC on gifts | blocked credit under GST | Impact of GST on Free sample

Sukoon❤️ My CA Intermediate result! Cleared my first group🔥 #castudentlife #resultreaction #cainter...

What are Input Tax Credits for GST?

Комментарии

0:06:02

0:06:02

0:32:48

0:32:48

0:07:49

0:07:49

0:07:27

0:07:27

0:09:47

0:09:47

0:02:41

0:02:41

0:27:07

0:27:07

0:07:07

0:07:07

0:04:36

0:04:36

0:03:20

0:03:20

0:04:17

0:04:17

0:06:24

0:06:24

0:05:59

0:05:59

0:21:49

0:21:49

0:38:03

0:38:03

0:07:32

0:07:32

0:13:31

0:13:31

0:01:44

0:01:44

0:14:27

0:14:27

0:02:01

0:02:01

0:09:01

0:09:01

0:14:39

0:14:39

0:00:11

0:00:11

0:03:50

0:03:50