filmov

tv

Top 3 Medicare Supplement Plans for 2023. No Plan G or N?

Показать описание

----------------

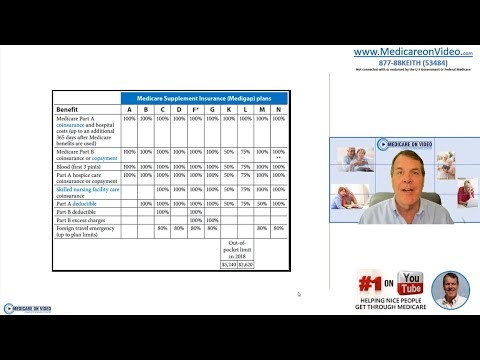

The top 3 Medicare Supplement Plans for 2023 are plan G, Plan N and Plan High deductible G. The best medigap plan in many states including Texas, California and Florida can be found in these 3 plans. If you want original medicare with a gap plan, you must attache a part d prescription plan. The Medicare supplement plan g is the most comprehensive plan but Plan N is very popular. The Supplemental Medicare plan N has gained a lot of attention.

Please watch the playlist of all Medicare videos:

Part D prescription drug plan video:

Blog Post:

Disclaimer: This video is for entertainment purposes only. If you want advice on Medicare or any of its plans, please speak to a licensed agent, whether it is me or another licensed agent. No advice should be taken from this video. If you don't speak to me about your individual concerns, I can't give you my 100% opinion. Brian Monahan and Medicare 365 are not responsible for any actions that you take without consulting with a licensed insurance agent.

Keywords:

Florida

Pennsylvania

New York

New Jersey

Illinois

California

Michigan

Colorado

South Carolina Medicare supplement plans

#medicare #medigap #medicareadvantage #medigapplang #medicarepartd #medicarepartb #medicaresupplement #medicaresupplements #medigapplans #medicareexplained #brianmedicare #medicare365

The top 3 Medicare Supplement Plans for 2023 are plan G, Plan N and Plan High deductible G. The best medigap plan in many states including Texas, California and Florida can be found in these 3 plans. If you want original medicare with a gap plan, you must attache a part d prescription plan. The Medicare supplement plan g is the most comprehensive plan but Plan N is very popular. The Supplemental Medicare plan N has gained a lot of attention.

Please watch the playlist of all Medicare videos:

Part D prescription drug plan video:

Blog Post:

Disclaimer: This video is for entertainment purposes only. If you want advice on Medicare or any of its plans, please speak to a licensed agent, whether it is me or another licensed agent. No advice should be taken from this video. If you don't speak to me about your individual concerns, I can't give you my 100% opinion. Brian Monahan and Medicare 365 are not responsible for any actions that you take without consulting with a licensed insurance agent.

Keywords:

Florida

Pennsylvania

New York

New Jersey

Illinois

California

Michigan

Colorado

South Carolina Medicare supplement plans

#medicare #medigap #medicareadvantage #medigapplang #medicarepartd #medicarepartb #medicaresupplement #medicaresupplements #medigapplans #medicareexplained #brianmedicare #medicare365

Комментарии

0:12:53

0:12:53

0:17:06

0:17:06

0:20:35

0:20:35

0:10:22

0:10:22

0:08:07

0:08:07

0:05:30

0:05:30

0:05:02

0:05:02

0:05:02

0:05:02

0:05:27

0:05:27

0:05:24

0:05:24

0:05:00

0:05:00

0:12:14

0:12:14

0:33:25

0:33:25

0:22:39

0:22:39

0:20:19

0:20:19

0:07:46

0:07:46

0:23:29

0:23:29

0:26:33

0:26:33

0:06:15

0:06:15

0:11:47

0:11:47

0:16:37

0:16:37

0:09:57

0:09:57

0:15:58

0:15:58

0:05:06

0:05:06